If someone puts their money in an index fund or similarly, a target retirement date fund, they are passive investors. If someone purchases stocks and bonds directly, they’re considered active investors. But people can buy and sell stocks willy-nilly. Maybe because Jim Cramer is hyping a stock. Maybe because they like the product made by a certain company. Perhaps they have FOMO on some new fad. That’s not real investing. That’s more speculative in nature or just trading.

Someone might argue “Hey, Warren Buffett owns Coca-Cola [K], why is it investing if he does it, and speculating if I do it.” Comparing yourself to Buffett huh? Listen, I suppose it isn’t about the stock, but the person. If you bought K because Warren Buffett has it, then you just might be a speculator. Stock ideas come to us from all over and honestly, I’m not judging. Speculation has its place, as does options trading, etc. I enjoy both. There are many approaches to making money in the stock markets, but in every case, one must be a risk manager and exercise some discipline, or the approach will falter over the long haul. Discipline and risk management are a topic for another day. Back to investing: if you really want to be an active investor and feel engaged, you should do at least two things.

Real Active Investing

Before you purchase stock in a company, remember that you’re becoming a part owner of a business. You don’t want to approach this in a cavalier way. If you want to be an active investor, be active.

- Do at least some upfront research before you purchase.

- Monitor your stock after you purchase.

Today, I only want to speak to the latter; volumes have been written about the former and I will touch upon elements of research in future posts.

The Dividend Kings are public companies. This means anyone, not just shareholders, can access investor presentations, quarterly earnings reports, press releases, and certain mandatory regulatory filings. This is why I include the investors relations link in my posts featuring the latest Dividend King I am acquiring for the portfolio. If you go to the site and start digging around the quarterly reports, you’ll likely find the audio or the transcript for the most recent quarterly earnings conference call. Folks, whether or not you read them or listen to them, the quarterly conference calls are absolutely riveting!

I kid. They’re professional business meetings. But my goodness, if you want to feel like you are an owner of the business, try listening to one and follow along with the slide deck. It works. And you’ll learn a ton of stuff about what they’re doing and how they think about the business and a lot of it will be over your head.

Fly on the Wall

This morning, I brewed my Lavazza straight into my Lavazza cup, and then I live-streamed Black Hill Corporation’s 2022 Second Quarter Review conference call. It was thoroughly enjoyable. I mean, if I wanted to, I could have submitted a question and found a way to weasel myself into the records. But that isn’t professional. What I did do, was listen to the presentation and I followed along with their slides. Immediately, I felt engaged and actually felt respect for the company and the process. The questions from various individuals near the end were remarkable. These were not trivial questions, but inquisitions aimed at ascertaining information that hadn’t been addressed, coming from people who obviously knew the business well. The answers were comprehensive and not dismissive.

Now, can I report on the results and regurgitate them like everyone else? You bet. You don’t have to waste precious time on the actual call or reading the transcript later either. Hell, minutes after the earnings were announced after market close yesterday, TD Ameritrade put up the headlines:

Boom, BKH beat estimates on the top line (revenue) and the bottom line (earnings per share). They even reaffirmed their former guess at what their earnings for the year will be (guidance). In five seconds of headline skimming, you have all you need to know. Honestly, it really is convenient and useful information for monitoring your company and you should take an interest in the earnings summary headlines at a minimum.

The Intangibles

I highly recommend listening to a quarterly earnings conference call and perusing the presentation slides if they’re handy. You’ll hear the numbers. You’ll even get a sense of corporate bias and optimism. But there will also be just a little bit of color around certain decisions. You’ll learn a lot about the company and what they’re doing. You’ll be bombarded with macro and micro economic trends and factors that are affecting the business. Actively engaging in this way has a profound effect on your mentality. You’ll think twice before letting a stock go, just because its price hasn’t budged in two years. Really. You’ll be more considerate and contemplative about investing and a lot less impulsive. Imagine feeling even just a little bit of pride knowing that you have a stake in a company that sure, makes money for their shareholders, but actually provides a valuable service to people and/or businesses that need it.

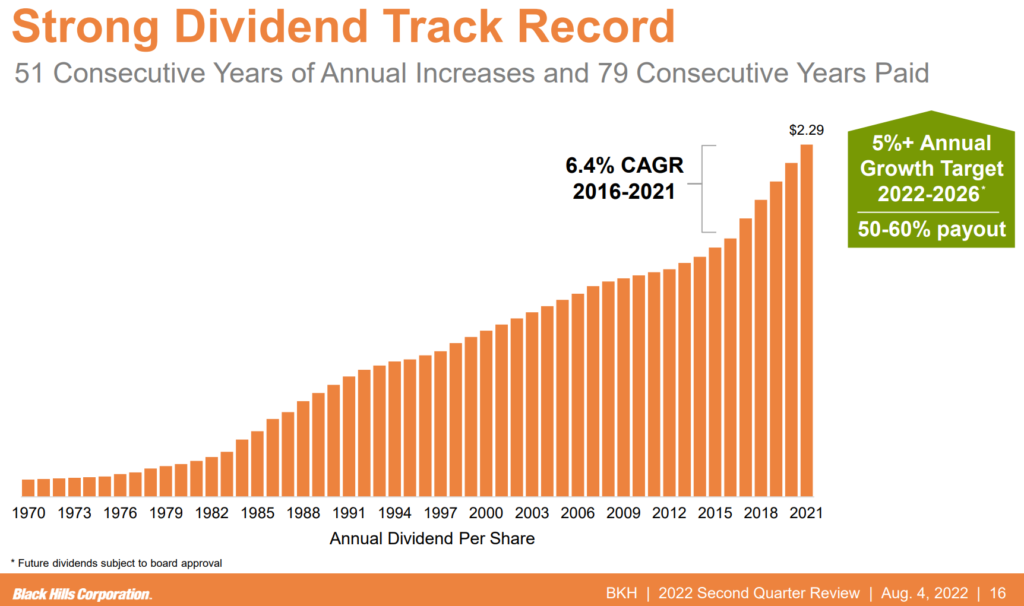

I thought I would share one last piece of info, a slide from this morning’s presentation.