The Royal Dividends portfolio, what I refer to as the Portfolio for the Ages, is my creation. I have made every transaction as posted here since the inception of the website. I own the portfolio exactly as it appears on the Portfolio page right now.

But it is not all that I own.

I own some fixed income, some exposure to precious metals, and plenty of other dividend stocks. In fact, one can think of the Portfolio for the Ages as the most promising microcosm of this larger collection of stocks. It is a simple, refined, comprehensive, value-based selection of dividend stocks from an Empire of dividend stocks, themselves a dividendery-based distillation from a vast, less impressive universe of equities.

Royal Dividends has zero exposure to the Magnificent Seven and crypto currencies, but that is no longer true for my broader collection of investments.

Royal Dividends is a model of restraint and simplicity. I shield Royal Dividends from impulse and speculation. It will not be sullied by the refuse that can so easily find its way through the flawed stock screens that others employ. However, outside of Royal Dividends, I speculate with small amounts of money. I try impatient and complex option strategies and dabble in technical analysis. Royal Dividends lives in a world above these dalliances; I do not.

In the grittier, earthier underbelly of the stock market, there are temptations. There is the danger of going to zero on a stock and the lust of ten-bagger returns. There is hunger and greed.

There is FOMO.

That’s not a ticker symbol. The fear of missing out is ever present.

Hey Jealousy

Outside of Royal Dividends, I became frustrated with the performance of my investments and found it to be consistent with that of the silent majority, my own term for the other 493 companies in the S&P 500 Index [SPX]. It was 2024-06-17 and the equally weighted S&P 500 Index [SPXEW] was trading where it was on 2022-01-04. Meanwhile, the SPX was routinely hitting new highs. Bitcoin had recently breached $70,000. I feared I was missing out.

I finally broke down and decided I should have some exposure to the Magnificent Seven and while I was at it, Bitcoin. I decided to open a small position in Nvidia Corportation [NVDA]. Well, not quite. I couldn’t stomach the idea of a $0.01 dividend. Instead of investing directly in NVDA, I opened a position in a single-stock exchange traded fund [ETF] from YieldMax ETFs. Specifically, I bought 100 shares of YieldMax NVDA Option Income Strategy ETF [NVDY].

I chose NVDA because of its dominance. NVDA had risen 330% since 2023-05-23 and had just gone through a 10-to-1 stock split. But I didn’t stop there. I picked up 100 shares of YieldMax Magnificent 7 Fund of Option Income ETFs [YMAG] just in case the other six stocks would catch up to NVDA. Finally, I acquired 100 shares of YieldMax Bitcoin Option Income Strategy ETF [YBIT].

I read the prospectus of each. I compared the performance of each to their underlying investments, particularly over time periods when the underlying stock(s) did not do particularly well. Admittedly, there were scant few time periods of poor performance to look at because these ETFs were new instruments and had not been around very long. For most of their short lifespans, the “Magnificent Seven” and Bitcoin had been on a tear most of the time.

These YieldMax funds are actively managed funds with the primary goal of generating significant monthly income by writing call options. The strategy does allow for some participation in price gains, but these gains are capped due to the nature of writing call options. It is a clever way of producing income from underlying positions that in large part pay no dividends of their own. In fact, the small dividends that some of the Magnificent Seven companies do pay aren’t even passed on to the shareholders of the YieldMax ETFs because the ETFs don’t even hold the stock that they’re based on. How is this possible?

The ETFs essentially use what is called synthetic ownership and by extension write synthetic covered calls. So instead of owning the shares of NVDA outright, NVDY uses a combination of cash, U.S. Treasurys, and both put and call options to replicate the performance of owning NVDA stock. The reason for this complexity is capital efficiency. It requires less capital compared to buying the actual stock.

The synthetic covered call is nothing more than selling a call. It is synthetic because the ownership of the underlying is synthetic.

Results

The Magnificent Seven is overvalued. NVDA is overvalued. Bitcoin? I’m not sure it even has value. It isn’t difficult to imagine each of these being rather lackluster investments for a decade and this is why I chose to go with the covered call ETFs.

I was surprised when NVDA hit an all-time high just three days after my purchase of NVDY. Had I gotten away with it? Had I snuck into first class unnoticed?

Nope. I was caught. The market saw my interest, and everything dropped from there. I thought for sure that NVDA’s blockbuster earnings report on 2024-08-28 would turn things around, but alas not only has it sold off, but it also brought down the entire market with it. NVDA has fallen 27% from its all-time high. Sorry folks, I killed Nvidia.

Of course, the Significant Six didn’t bail me out. Perhaps Bitcoin, often touted as some sort of hedge, picked up the slack? No. Part of me knew that taking an active stake in these investments would kill the very phenomena I was witnessing – that their runaway performance wouldn’t abate until I bought in. I thought I could fly under the radar by buying these, admittedly, thinly masked ticker symbols, but the Dark Market caught on.

One saving grace is the covered call performance for NVDY.

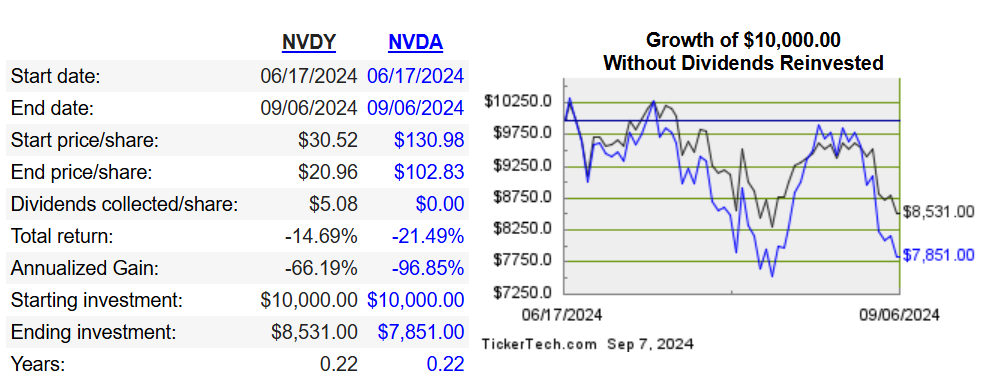

NVDY is outperforming NVDA since I bought it. I am positive the outperformance is true of YMAG and YBIT as well. So that’s something. I had hoped the outperformance would be say 11% versus 8%, but -15% versus -21% is at least a sign that the strategy is working.