I am going to set up a Limit Order on a Good Until Cancelled (GTC) basis1. There are 215 shares of TDS in the portfolio and therefore, I can sell 2 contracts this time.

Selling to Open: 2 August 18, 2023 $17.50 Call Option [Symbol: TDS230818C17.5]

Limit Order Price: Credit of $0.56 per share

With the specifics of the trade behind us, let’s discuss the investment in TDS to date.

A Quick Look Back

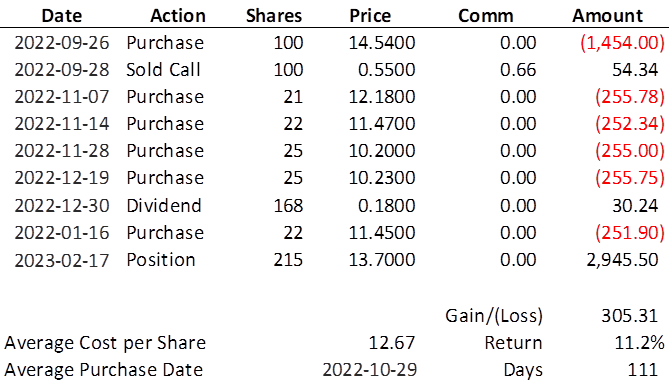

Below I present the ‘events’ of my investment in TDS.

Averaging down with five additional investments after the initial installment, has brought the average cost per share to $12.67 from $14.54. So even though the stock price has dropped 5.8% from $14.54 at entry to $13.70, I have seen a gain of 8.1% in price appreciation. But that’s not all. I collected one dividend on a large subset of the shares I now own and also collected option premium equal to three times the quarterly dividend on the first 100 shares acquired. This brings the total, largely unrealized gain to $305.31, or 11.2% on the amount invested!

The investment in TDS has proven to be advantageous so far and it is the second-best performer by return percentage (ABBV is 11.7%) and highest in absolute dollars due to its heavier weighting.

News

The decision to sell the first covered call was done as a way of hedging against the potential for a dividend reduction, suspension, or elimination. After all, it was given an ‘F’ score for dividend safety by Sure Dividend. I absolutely understand that concern, however, I believe that a 48-year dividend increase streak in the highly competitive Communications Services sector speaks to a greater level of safety. Wait. Did I write 48 years? They just announced an increase to their quarterly dividend and thus begins their 49th year of increasing dividends. They also spoke to their dividend commitment on the quarterly earnings call as well. They are proud of this streak.

In addition to the small increase in their dividend, they announced that they spent $83 million on share repurchases in 2022. This should also add a slight boost to shareholder returns.

TDS popped up a whopping 23% on Friday after an earnings announcement that came in as expected, a loss of $0.38 per share! Of course, the market inexplicably tanked the share price a little over a week ago.

It is hard to explain the day-to-day price action, so why bother trying? What I can say is that TDS deployed a large amount of capital in 2022 into building out their various networks in new communities and in existing territories. This capital expenditure will continue, though to a slightly lower degree in 2023. The return on this investment won’t be seen immediately; there is a lag to the revenue stream that should increase gradually. Essentially, TDS has gone into growth company mode, sacrificing current earnings for a chance at greater size and profits going forward. By a host of other performance metrics, their plan is off to a promising start and so, we simply have to wait and see.

However, if we put potential future earnings aside, there is still a substantial disconnect between the current share price and estimates of fair value simply based on where they are today. The lowest estimate of fair value I am seeing is $16.00. I think it is higher, maybe as high as $19.00.

Looking Ahead

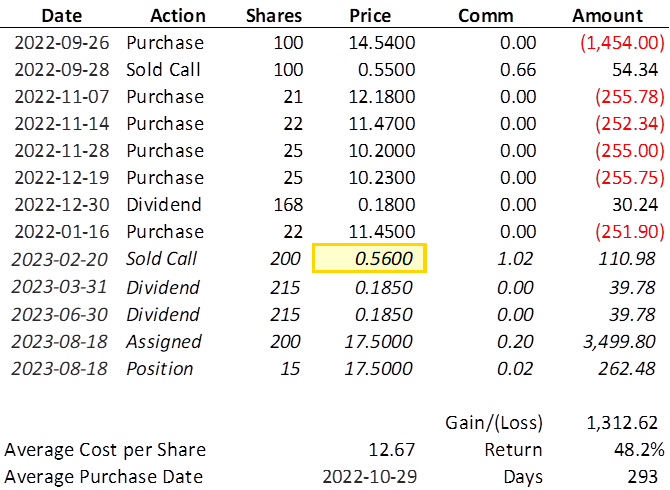

I’ve extended the table of events to see how the investment in TDS were to play out if the following three things happen:

- the desired price of $0.56 per share is achieved on the written call

- the dividends are paid as planned

- the share price climbs to at least $17.50

The current bid/ask spread on the August 18th call is $0.10 / $0.85, with the midpoint at $0.475. This is a very wide spread and the result of low volume on a small company. I am hoping for a little more upside on this bounce, recalling that the share price hit $14.33 just two weeks ago. At $0.56 per share, I would be bringing in three quarters worth of dividends in this 180-day call period. That would be optimal, however, I may watch the trade closely and if the stock is coming back down and/or this option sells for less, I will lower my price to perhaps $0.37 which is twice the quarterly dividend.

I really don’t want to let go of TDS, so I have set the strike well above where it is currently trading. This ensures that if the stock does get assigned, my return will be almost 50% in 293 days or 63% annualized2, possibly more if the 15 uncovered shares were to be sold at an even higher price. If the stock fails to move higher or even declines, I am ensuring income far greater than just the dividend yield on cost of 5.8% [(4 x 0.185) / 12.67].

The best-case scenario: TDS gradually moves higher, but stays under $17.50, allowing another covered call to be sold for more income in half a year. There also exists the possibility of rolling the covered call out or even up and out depending on how the price moves over the next 6 months. As always, I will post about any action I am taking.

1When trading options, it is never a good idea to use a market order.

2This calculation uses the number of days between the Average Purchase Date of the shares and the expiration date of the call. What is the Average Purchase Date? It is a mathematically derived date that, had all the shares been purchased on this hypothetical date, would have produced the exact same return. It takes into account which dividends and option premiums are associated with which shares. Though the calculation is a bit heavy for this footnote, suffice it to say that it is a date that produces an investment period that is appropriate. For instance, if one invests $1,000 into a stock on March 31st and another $1,000 on September 30th of the same year, it wouldn’t necessarily be fair to base annualized return calculations on the first purchase date or the last purchase date. The date in the middle, June 30th or July 1st, will produce a more accurate and credible number.