Once the market order to sell my shares of MMM executes, I will deploy those proceeds to purchase 256 additional shares of LEG via a limit order for no more than $13.95 per share. Any shortfall of the MMM sale proceeds will easily be covered by the $148.09 in uninvested income in the portfolio. The purchase of 256 shares will bring the LEG position total to 300 shares – the perfect amount required for selling 3 covered call contracts:

Selling to Open: 3 December 20, 2024 $15.00 Call Options [Symbol: LEG241220C15]

Limit Order Price: Credit of $1.50 per share

Rational for Trade

See if this makes sense:

- LEG reduced their dividend by nearly 90%.

- Due to #1, LEG is no longer a Dividend King and no longer in the Empire.

- The position in LEG should be closed out because of #2.

- Only profitable positions should be closed out (ideally).

- LEG is down over 50% and is at odds with #4 and prevents taking the action in #3.

- The position in LEG is much smaller than the other positions because of #5.

- LEG is the only position eligible (position imbalance) for investment because of #6.

- LEG will never again make the Top 10 because of #2 and is at odds with #7.

- The position will become profitable only with significant capital appreciation, due to #1.

- #9 is unlikely as LEG is only moderately undervalued.

- Addressing #9 and #10, means increasing the position at the lower cost implied by #5.

- Increasing the position can only come from funds within the portfolio because of #8.

- By some miracle, #1, #2, #3 AND #4 applied to MMM this week making #12 possible.

- Selling MMM affords an 8-fold increase in the LEG position.

- The increase from taking action #14 allows covered calls to be sold on LEG.

- The option premiums from taking action #15 addresses the lost income of #1.

- If the calls are assigned, the profit on the position will satisfy #4 by mere pennies(!).

- If #17 doesn’t happen, premium replaces lost dividends as if #1 NEVER happened.

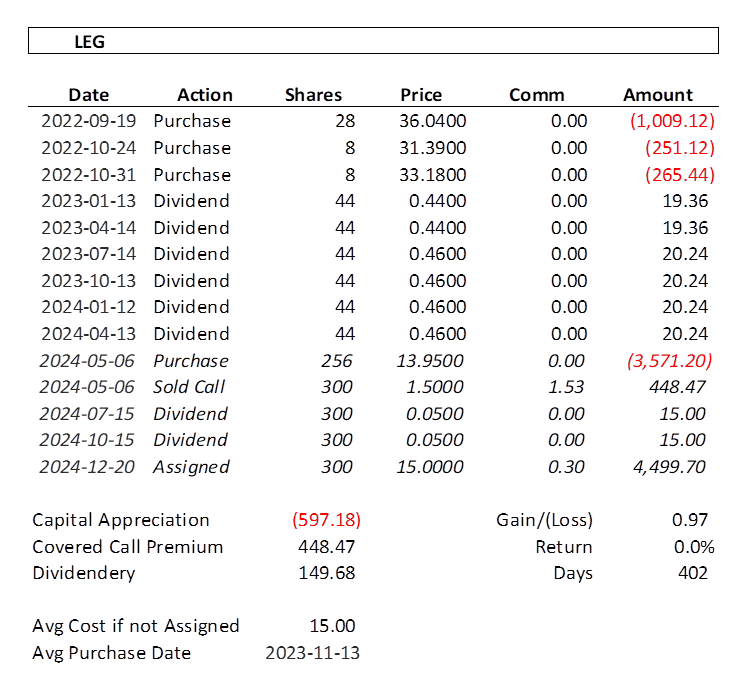

Here is how this additional share purchase and selling of covered calls should play out. Lines in italics are in the future.

One of the luxuries of having a significant number of shares is the ability to write covered calls. By simply rolling our position of MMM into LEG, now trading below $14.00, we can amass 300 shares. Selling calls just once, will bring in nearly $450 of cold, hard cash. Yes, it gives up the right to gains above the strike price, but the upside potential in the short term is not great.

Today, the LEG position is down $792.20. And yet, LEG need only rise $1.05 or 7.5% in 230 days, and Royal Dividends can be on the positive side of break even. This is preferable to realizing a nearly $800.00 loss and dealing with the mental anguish and soul destruction that comes with that.

Hopping on to Another Train

We’re simply moving money from one position to another. We’re jumping off the MMM train as we believe it to be slowing down, and hopping on the LEG train that looks like it should pick up a little steam. We’re not trying to go too much further.

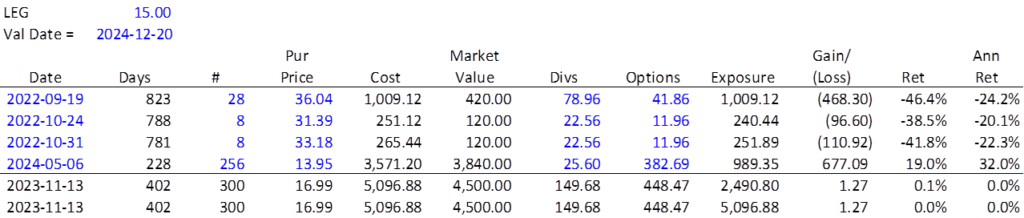

It may be that you’re wondering why it makes sense to dump $3,500 or more into a company that’s already dropped 50%. The idea is simple: LEG has been in a steady 3-year price decline, losing 75%, but they’re still making money and their fair value is probably about $17.00 at these earnings levels. And the opportunity is more visible when we look at the following table.

I use this calculation to come up with the hypothetical date on which all 300 shares would have to have been purchased to generate the same gain and annualized return as what really happened. With that one date, 2023-11-13, I can assign an age (in days) to the entirety of a position with multiple purchase dates. The gain of $1.27 does not reflect the final anticipated commission of $0.30 when the stock gets assigned.

What you want to walk away with here is to note that nothing can really save the atrocious performance of the past. But the relatively large acquisition on this coming Monday could prove very fruitful, climbing 19% in just 228 days. And note that over half that performance would be coming from the option premium allocated to those 256 shares. This is the train we want to get on.