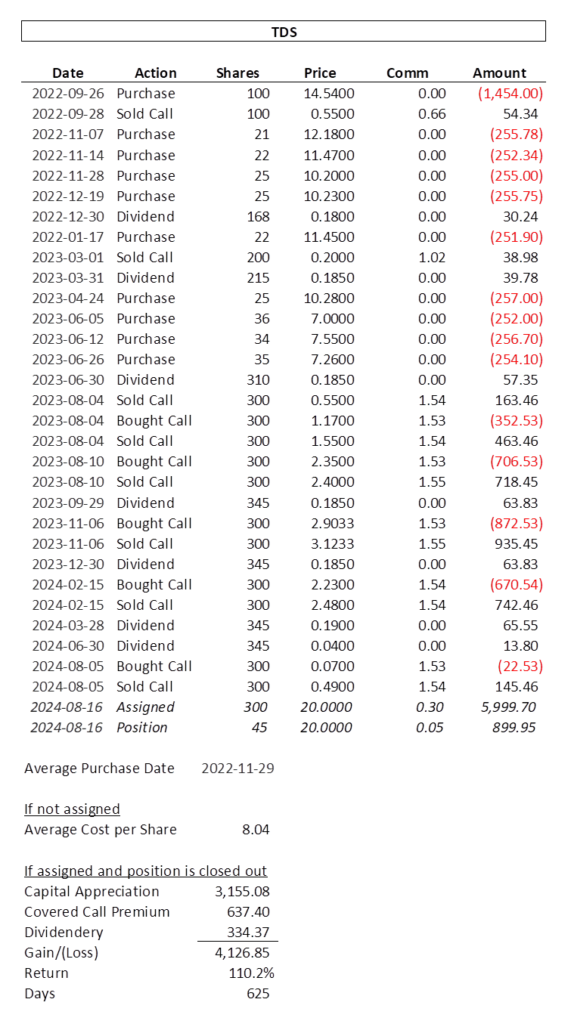

TDS announced earnings on 2024-08-02 and while they beat pessimistic estimates slightly, the needle really didn’t move. This was really the last chance for a large upward move prior to the August 16th expiry date of the 3 covered call contracts on it. Apparently, in response to this rather lackluster earnings report or perhaps a less than stellar unemployment report here in the states, markets all over the world tanked. The carnage continues today, and I have taken the opportunity to roll down the outstanding calls.

In the same, two-legged, GTC option order:

Buy to Close: (3) August 16, 2024 $25.00 Call Options [Symbol: TDS240816C25]

Sell to Open: (3) August 16, 2024 $20.00 Call Options [Symbol: TDS240816C20]

Limit Order Price: Credit of $0.42 per share

I was lucky enough to get a $0.42 credit, but even $0.40 would be acceptable. After commissions, this resulted in a $122.93 credit. That’s a nice roll credit in exchange for capping any gains at the lower, $20 level. Recall that the quarterly dividend prior to the cut was $0.19. We’re collecting another two quarters of that dividend as we count down the last 11 days of these outstanding call contracts. And with TDS trading at $19.10, the $20 strike still provides for growth of 4.7% before it gets called away and as much as 6.9% growth before we would regret collecting only $0.42 in premium or rolling down on the strike price altogether.

Let me be clear, TDS could very well be trading in the very low 20s as soon as tomorrow. However, trading above $22.50 is not at all likely as it has really only touched that level a handful of times since the agreement with T-Mobile [TMUS] was announced on 2024-05-09. And perhaps more importantly, TDS traded under $18 just a matter of hours ago. The market is fragile, volatile, irrational. In other words, let us be happy to see shares called away at $20 in a few days. Do not forget that there are 45 uncovered shares of TDS; should the stock price take off on a wave of irrational and untimely exuberance, we can at least get a taste1.

- Because we cannot know how much of a ‘taste’ could be had, the table shows a conservative exit price of $20 even on the uncovered shares. However, the calls would only be exercised and the shares assigned in the event TDS is trading above $20 on or before expiry, in which case the uncovered shares would likely be sold for higher on the following Monday. ↩︎