Over the last few weeks, Royal Dividends has been alternatively adding to the SJW and PPG positions, and to a lesser degree, GRC, TGT, and MDT. However, FMCB has been in the Top Ten each week, but its price has managed to climb just enough to avoid being the portfolio stock with the lowest amount in the Top Ten. It is just a matter of time before another share of FMCB is officially recommended, so I want to be proactive.

What is There Not to Like?

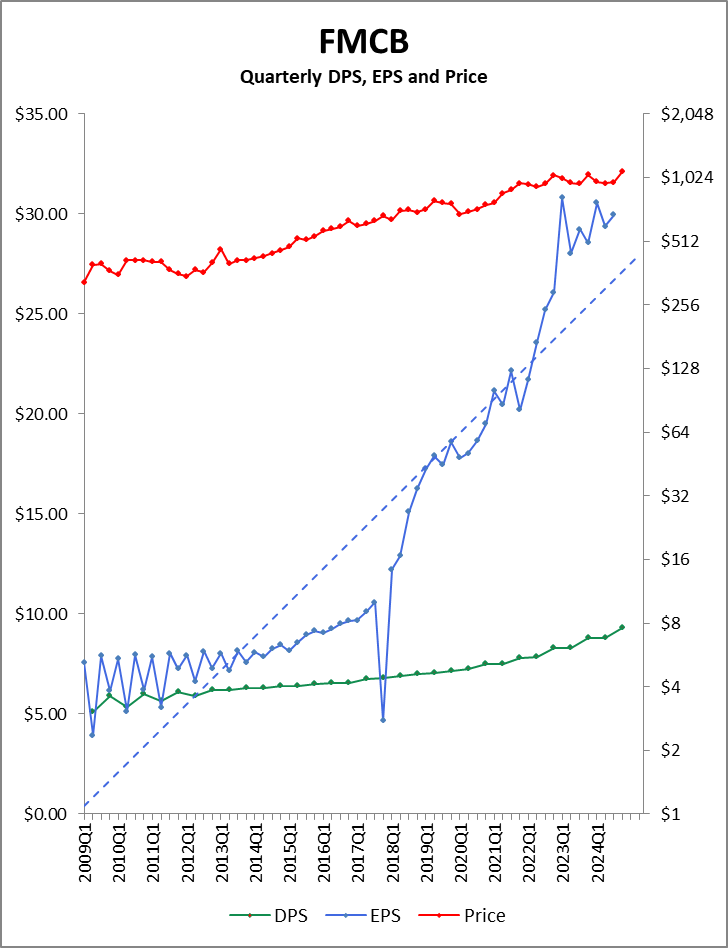

About eight years ago, FMCB became more aggressive with acquisitions and earnings have been growing at a clip of nearly 20% annually since the end of 2017. This was a marked departure from historical management and likely a proactive attempt to stave off being acquired themselves. After all, smaller community banks have been the targets of acquisition by larger regional players for years in the U.S. mainly because keeping up with the maintenance costs of regulations and technology is a game of scale. This change in direction for the bank has been very successful. Just take a look:

Now, to the dedicated follower of Royal Dividends and to the astute observer, you may recall that stock price (red) uses the right axis, and it is on a log scale, while earnings per share (blue) and dividends per share (green) use the left axis which is not on a log scale. Thus, the stock price growth is muted relative to that which is visible in earnings per share.

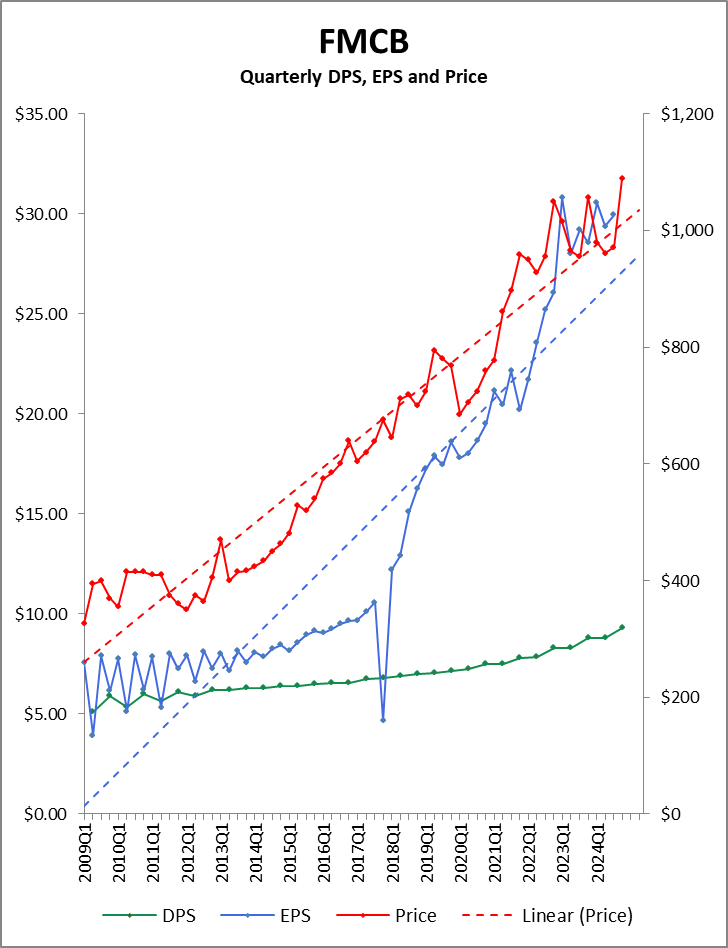

Since I really want you to focus on the earnings, I could ask you to ignore the stock price. Unfortunately, I’ve already mentioned the stock price line and thus, sabotaged my goal of illuminating just how much earnings have been moving. So, for FMCB, I will make an adjustment that changes the right axis to a linear scale.

It is still clear, that (a) EPS has accelerated since the beginning of 2018, and (b) the earnings growth has surpassed the growth in share price, which is to some degree dampened by the payment of semi-annual dividends. But I refuse to adjust for that right now!

The point is earnings have been growing very nicely.

FMCB’s dividend is very safe. That is visually evident in the graph above. There were times in the past when the semi-annual dividend would approach 50% of the relevant two-quarters worth of earnings, but the gap between EPS and DPS has expanded significantly.

The dividend has grown for 59 straight years. FMCB is, after all, a Dividend King.

Also, after announcing another increase to the dividend, a recent press release stated “the Company has further concentrated the shareholders’ ownership percentage by repurchasing and retiring 47,989 shares or $45.4 million on a year-to-date basis for 2024 through October 31, 2024 under the Company’s share repurchase program. This represents a reduction in the number of outstanding shares of 6.42% compared to December 31, 2023”.

Earnings growth. Dividend growth and safety. Significant share buybacks. A declining P/E Ratio?? Yes. This is seen in the slope differential between the red and blue dotted lines1. The price spiked 13.5% (from $960 to $1,090) in three weeks, and it is still trading below a P/E of 9. Prior to 2018, FMCB traded with a multiple in the mid-teens. Morningstar places an algorithm-based fair value estimate of $1,242 on FMCB. Sure Dividend adds another $220 on top of that.

What is There Not to Like?2

FMCB’s growth cannot continue at this pace. It is unlikely that FMCB is ever going to be mentioned in the same sentence as Nvidia [NVDA] again. In fact, it actually has begun to slow down.

FMCB is traded over-the-counter [OTC] and is illiquid; it may trade nearly every day, but there is low volume even on its most active days. FMCB is chronically undervalued, partly due to this illiquidity.

When illiquidity meets up with enthusiasm around positive news from a great company, we get spikes to the upside in the share price. Take a look at these one-sided spikes over the last five years.

After each of these spikes, there is a subsequent pull-back within a matter of a few days. And within a few weeks it is as if the spike never took place. The red horizontal lines capture the full return to a new, lower plateau despite the recent spike. Of course, these plateaus have been climbing over time. Is a return to $960 possible within a few weeks? I think so.

Action

I want to be a buyer at $975 (the green horizontal line) or even at $1,000. The $975-$1,000 range, if it is hit again, would likely happen in a week or two. Waiting for $960, could take a month or two. I don’t think it pays to be greedy.

So, in a Royal Dividends first, in anticipation that FMCB will be the official ‘Dividend King of the Week’ next weekend or the weekend after that, I am setting up a good ’til cancelled (GTC) limit order to acquire one share of FMCB for $975. If the price comes down to $1,000 or lower but doesn’t drop as far as $975 later this week, I may raise my limit in an attempt to snag the share on the rather quick drop from $1,090.

Worse-case scenario is FMCB becomes the official purchase next week and the price has remained well above $1,000. I may very well adjust the order again, but there is also the chance I let it play out for a few weeks and simply select another stock to get the weekly installment in the interim.

- One could argue that the linear trend line is a poor fit to the earnings. However, it is unlikely that earnings will continue to grow at the pace it has since the beginning of 2018 and appears to have slowed more recently. Thus, the extrapolation into the future implied by said linear trend line might not be inappropriate. ↩︎

- Yes, I have chosen to use the same heading title twice in the same article. I thought it was fun to explore both the rhetorical and literal interpretations of the question. Sundays can be boring.

The ridiculous, enormous size of the footnote number is determined by the size of the text box to which it belongs, in this case a headline. This is a feature of the Astra theme I am using in WordPress. This is what happens when you choose a free theme. Would it be possible to override this default? Most assuredly. But that would involve getting into the HTML weeds and, well, laziness and boredom are positively correlated. ↩︎