Royal Dividends started its first position on 2022-07-18. The Portfolio for the Ages finally turned positive on 2023-01-11, showing a return of 0.9%. Since then, the broader market has moved up and the portfolio right along with it.

But today the portfolio’s total return reached a new all-time high. Let’s take a closer look.

Observations

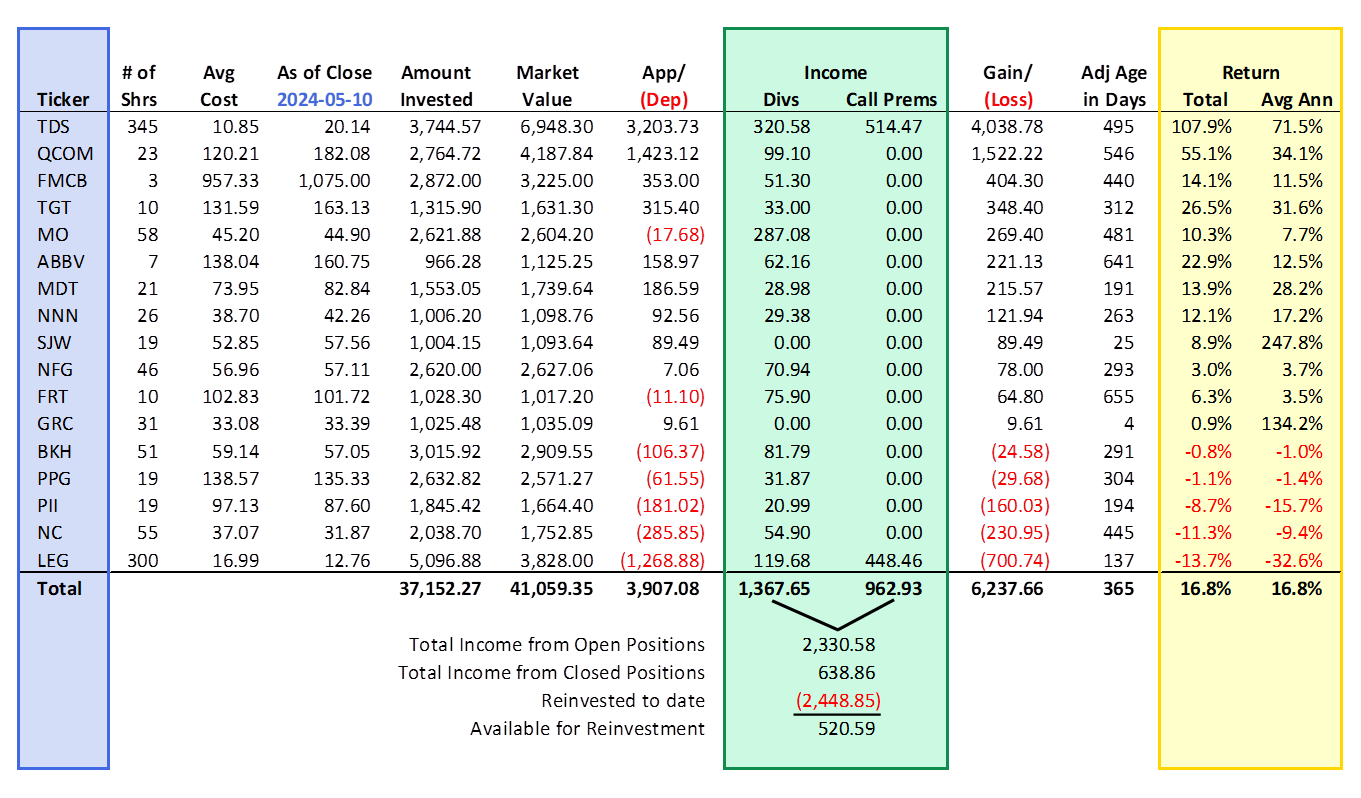

- Twelve of the 17 holdings are in the black.

- The best performing stock, TDS, has easily had the worst business performance.

- Gains are coming from price appreciation (63%), dividends (22%), and options (15%).

- The market value weighted average holding period is exactly one year.

The latest burst upward for the portfolio, from having a return of about 12% to now approaching 17%, is largely due to rumors that T-Mobile [TMUS] and Verizon [VZ] are interested in partnering to purchase USCellular [USM]. TDS has an 82% stake in USM. The stock of TDS (and USM) shot up nearly 30% on Thursday.

Royal Dividends has an active covered call position on 300 of the 345 shares of TDS in the portfolio. The strike price of those calls is $25.00 and they expire 2024-08-16. This gives us some breathing room in the case TDS continues to climb on these rumors or in the event the rumors are confirmed in an official press release.

I thought it was a good time to take a snapshot. Hopefully, things continue to improve from here.