Small Matters

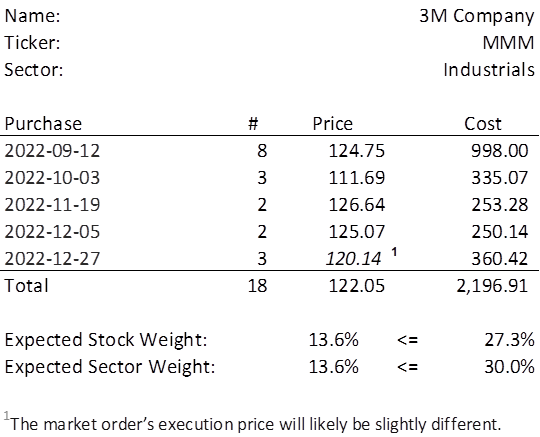

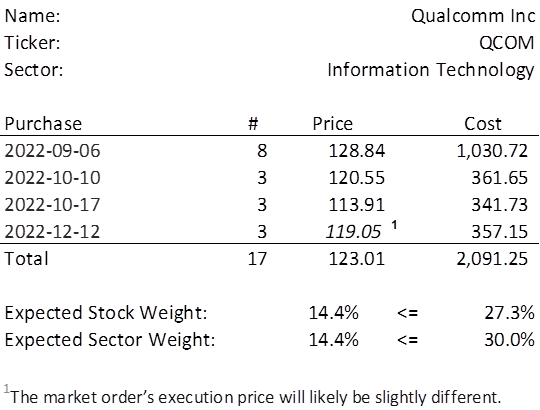

Below is an example of the table I had been including with my weekly investment.

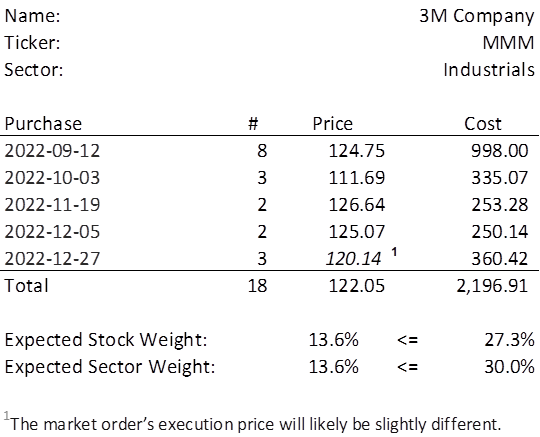

There are three things I felt like changing with this table, starting with the one I published earlier today (below).

Did you notice the changes?

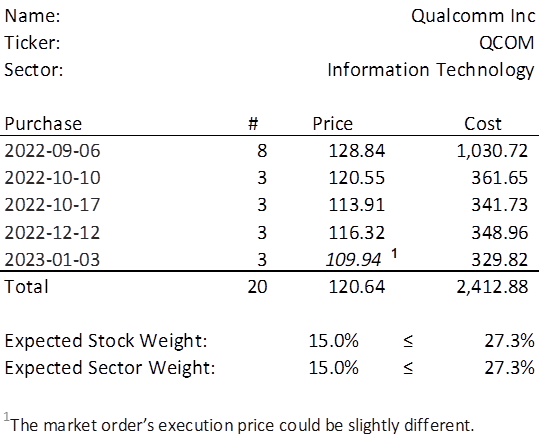

…Below is an example of the table I had been including with my weekly investment.

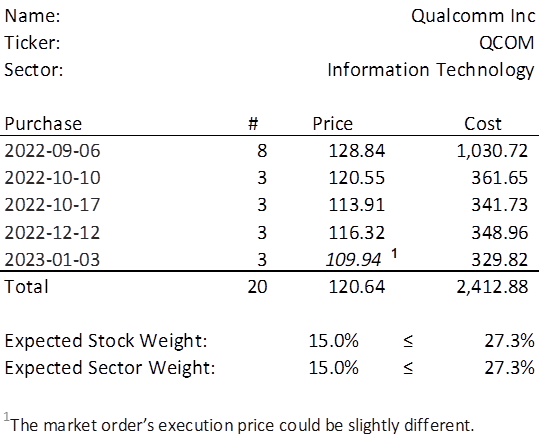

There are three things I felt like changing with this table, starting with the one I published earlier today (below).

Did you notice the changes?

…This week, three of the portfolio holdings ranked in the Top 10, MMM, QCOM, and TDS.

| Ticker | Account Value |

| MMM | 2,158.56 |

| QCOM | 1,868.98 |

| TDS | 2,024.57 |

The lowest amount belongs to QCOM. In order to invest a minimum of $250 in QCOM, I need to purchase 3 shares this Tuesday as Christmas will be recognized on Monday. Below, I present the purchase history, average cost calculation (subject to change), and expected weights.

Position sizing within a portfolio is an important component of managing risk. In order to avoid excessive exposure to the performance of any one stock, investors will limit the weight of stocks within the portfolio. It is not uncommon to invest, at least initially, equal amounts into each stock of a portfolio. Thereafter, the portfolio might be rebalanced periodically.

Suppose an investor has placed 2% of his nest egg into each of 50 stocks. If one company goes completely out of business and the stock drops to zero, the portfolio has only lost 2%. However, for more active investors who wish to purchase additional shares of only those stocks with the highest expected returns, maintaining an equally weighted portfolio becomes impractical; every time he wishes to add to one position, the same amount (give or take) must be added to the others.

This is undesirable, imperfect, unfortunate, indiscriminate.

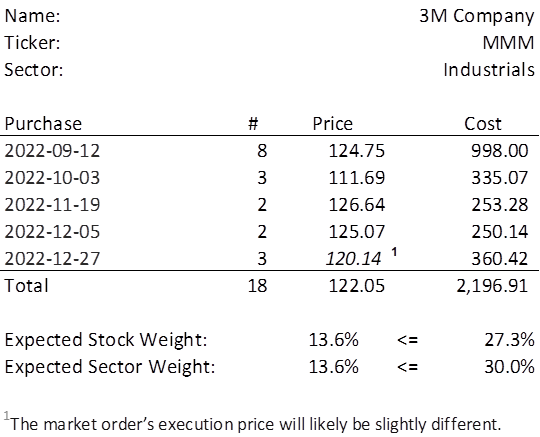

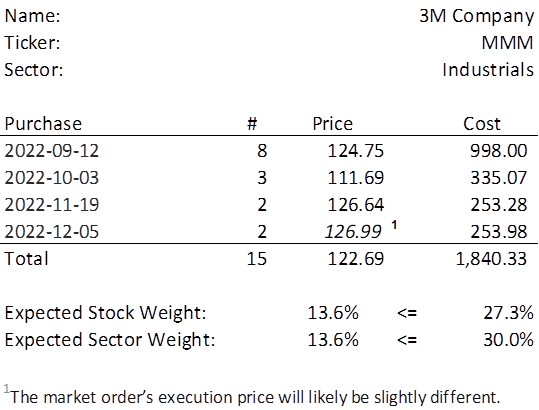

…This week, three of the portfolio holdings rank in the Top 10: MMM, QCOM, and TDS.

| Ticker | Account Value |

| MMM | 1,802.10 |

| QCOM | 1,884.28 |

| TDS | 2,040.01 |

The lowest amount belongs to MMM. In order to invest a minimum of $250 in MMM, I need to purchase 3 shares this coming Tuesday as Christmas will be recognized on Monday. Below, I present the purchase history, average cost calculation (subject to change), and expected weights.

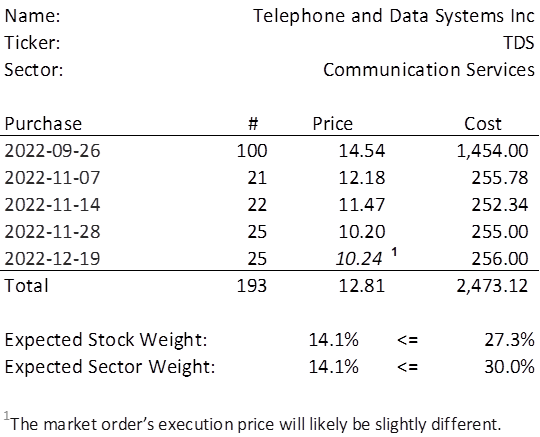

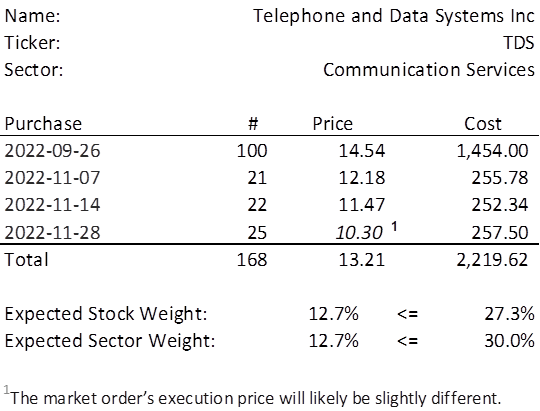

This week, three of the portfolio holdings rank in the Top 10: MMM, QCOM, and TDS.

| Ticker | Account Value |

| MMM | 1,825.35 |

| QCOM | 1,947.01 |

| TDS | 1,720.32 |

The lowest amount belongs to TDS. In order to invest a minimum of $250 in TDS, I need to purchase 25 shares this Monday. Below, I present the purchase history, average cost calculation (subject to change), and expected weights.

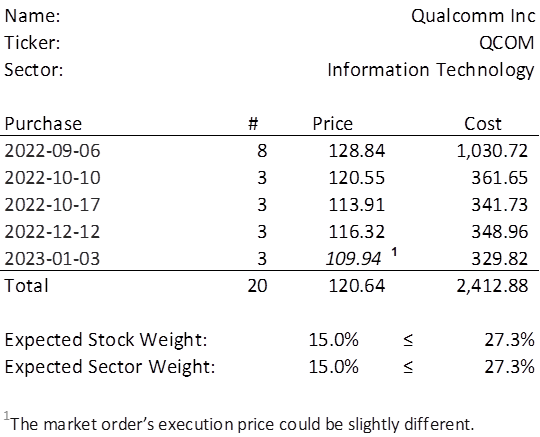

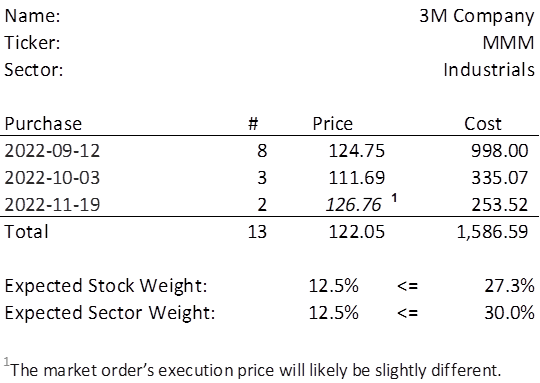

This week, three of the portfolio holdings ranked in the Top 10, MMM, QCOM, and TDS.

| Ticker | Account Value |

| MMM | 1,886.40 |

| QCOM | 1,666.70 |

| TDS | 1,683.36 |

The lowest amount belongs to QCOM. In order to invest a minimum of $250 in QCOM, I need to purchase 3 shares this Monday. Unless the market price on Monday is vastly different from Friday’s close, doing so will not violate the stock weight or sector weight constraints.

This week, three of the portfolio holdings rank in the Top 10: MMM, QCOM, and TDS.

| Ticker | Account Value |

| MMM | 1,650.87 |

| QCOM | 1,759.24 |

| TDS | 1,750.56 |

The lowest amount belongs to MMM. In order to invest a minimum of $250 in MMM, I need to purchase two shares this Monday. Below, I present the purchase history, average cost calculation (subject to change), and expected weights.

This week, three of the portfolio holdings rank in the Top 10: MMM, QCOM, and TDS.

| Ticker | Account Value |

| MMM | 1,677.52 |

| QCOM | 1,728.30 |

| TDS | 1,472.90 |

The lowest amount belongs to TDS. In order to invest a minimum of $250 in TDS, I need to purchase 25 shares this Monday. Below, I present the purchase history, average cost calculation (subject to change), and expected weights.

This week, four of the portfolio holdings ranked in the Top 10: LEG, MMM, QCOM, and TDS.

| Ticker | Account Value |

| LEG | 1,527.24 |

| MMM | 1,394.36 |

| QCOM | 1,733.90 |

| TDS | 1,487.20 |

The lowest amount belongs to MMM. In order to invest a minimum of $250 in MMM, I need to purchase two shares this Monday. Below, I present the purchase history, average cost calculation (subject to change), and expected weights.

In 1899, John Barbey and a group of investors established the Reading Glove and Mitten Manufacturing Company. In 1920, the company is renamed Vanity Fair Silk Mills, Inc. and they begin selling silk lingerie. Some 20+ years after that, there is an embargo on silk during World War II and so ‘silk’ is dropped from the name. In 1951, the company goes public on the NYSE. In 1969, the name is changed yet again to simply VF Corporation and the company expands into denim. Then, just three years later they begin what is now a 50-year streak of annually increasing their dividend. And this is why we gather today.

All hail VF Corporation!

…