No Purchase This Week [6]

This week is the third of four weeks in which I will be abstaining from the usual $250+ investment into the portfolio. This maintains the $250+ per week average. However, for anyone curious as to what I would have invested in, I present the usual material below.

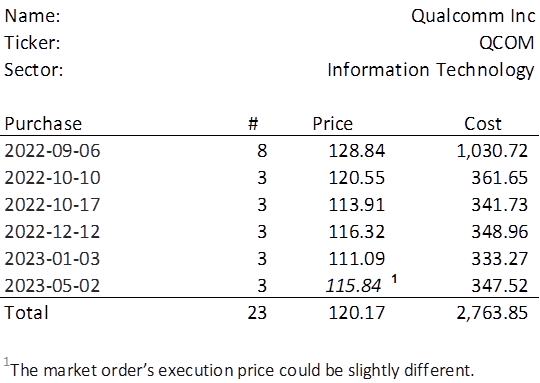

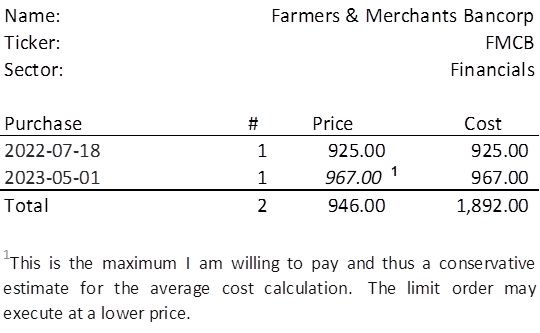

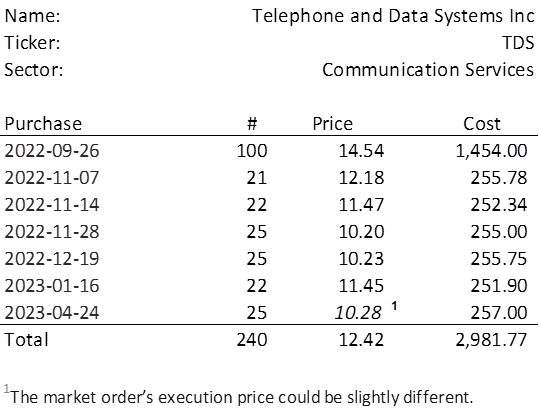

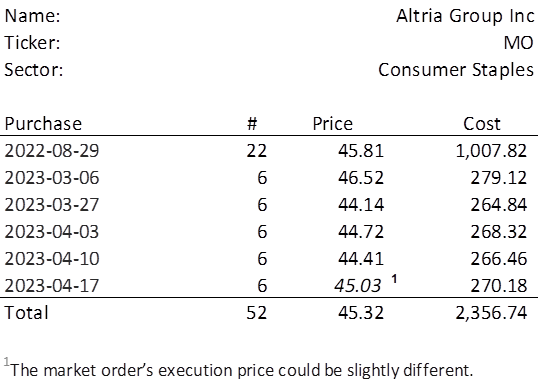

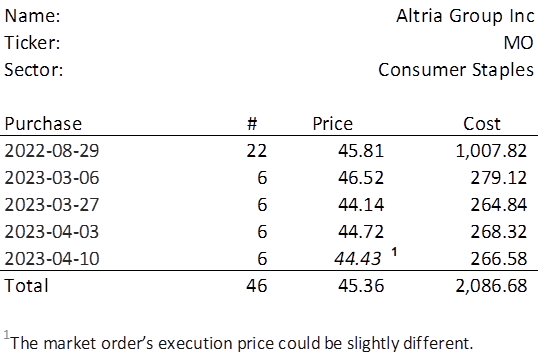

This week, four of the portfolio holdings ranked in the Top Ten: MMM, MO, QCOM, and TDS.

| Ticker | Account Value |

| MMM | 2,277.69 |

| MO | 2,355.60 |

| QCOM | 2,434.78 |

| TDS | 1,668.00 |

The lowest amount belongs to TDS.

The covered call on TDS expired worthless on Friday. The $38.98 I collected in premium after commissions was nice and all, but hardly a protection in the face of such massive declines in the share price. The portfolio is now down 11.7%, a record low! TDS has played a large role in this performance. Further, the dividend won’t be safe until their earnings turn sufficiently positive. The option premium is supposed to be a hedge against a potential cut in the dividend, but now that the share price is under $7, there are no strike prices above my cost level – even for the last available expiration date of November 17, 2023. Even if I were to purchase another 60 shares at say $7, bringing the average cost per share down further, there are no good choices for writing a call.

So, I will wait; a lot can happen in two weeks. Don’t get me wrong, I have zero expectation that the TDS stock price will reverse course, presenting me with only wonderful options. However, it could go out of business after 49 consecutive years of dividend increases. In fact, what if they just decided to have one last big blow out?

- Sell all the assets.

- Pay a massive, irresponsible dividend.

- Put tumbleweed in the cubicles.

- Scratch TELECOAN into the glass window in the lobby.