Dividend King of the Week [BKH][3]

This week, five of the portfolio holdings ranked in the Top 10: BKH, MDT, MMM, PII, and TGT.

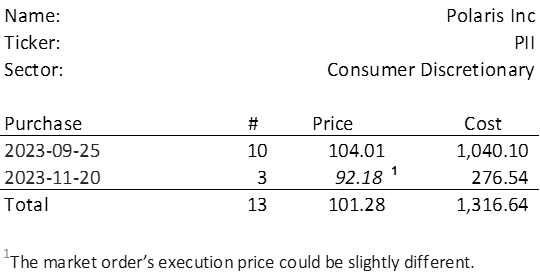

| Ticker | Account Value |

| BKH | 1,076.46 |

| MDT | 1,342.49 |

| MMM | 2,206.85 |

| PII | 1,177.41 |

| TGT | 1,314.60 |

As of this writing, the portfolio no longer has a sector imbalance. However, there is currently an overexposure to the following positions (tickers in bold made the Top Ten this week): FMCB, MDT, MMM, MO, NC, QCOM, and TDS. None of these tickers are eligible for additional investment at this time. No matter, the lowest amount belongs to BKH and it is eligible for an investment of additional funds.

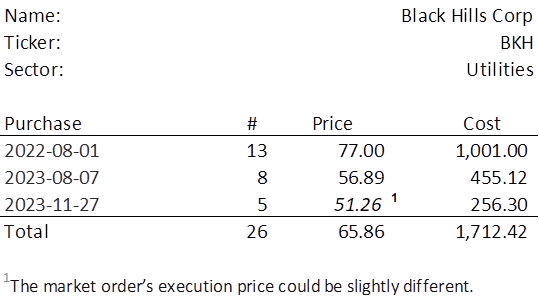

BKH last traded at $51.26. Therefore, in order to invest a minimum of $250 in BKH, I need to purchase 5 shares on Monday. Below, is the purchase history and average cost calculation.