No Purchase This Week [27]

This week is the third and final ‘off’ week intended to restore the $250+ per week pace of investment which became necessary with the establishment of a position in EPD. Read on to find out which position would have been most worthy of new money.

This week, five of the portfolio holdings ranked in the Top Ten: FMCB, MDT, PPG, SJW, and TGT.

| Ticker | Account Value |

| FMCB | 2,910.45 |

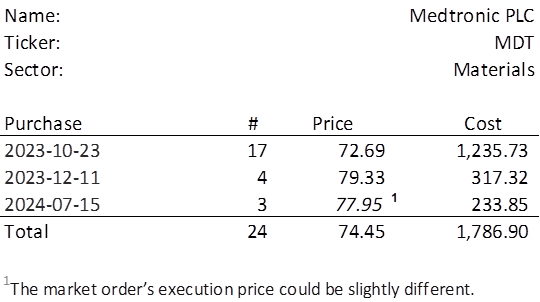

| MDT | 1,907.52 |

| PPG | 2,432.76 |

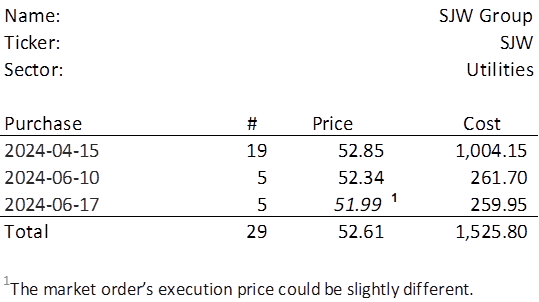

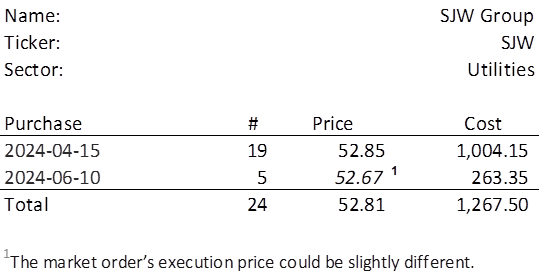

| SJW | 1,711.58 |

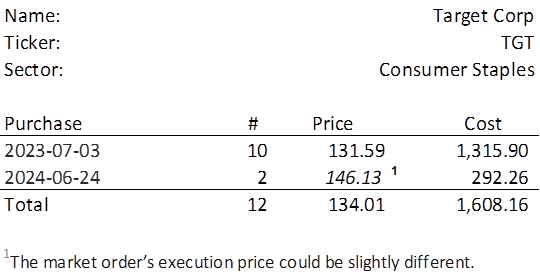

| TGT | 1,796.76 |

The lowest amount belongs to SJW. There is nothing precluding further investment in that position, other than it being an ‘off’ week.