Dividend King of the Week [SJW][5]

In addition to the usual $250+ weekly investment, there is over $250 ($282.09 to be exact) of uninvested income in the account and one lucky position will be the recipient of all that cold, hard cash. This week, four of the portfolio holdings ranked in the Top Ten: FMCB, PPG, SJW, and VZ.

| Ticker | Account Value |

| FMCB | 2,877.00 |

| PPG | 2,325.60 |

| SJW | 2,020.28 |

| VZ | 7,187.97 |

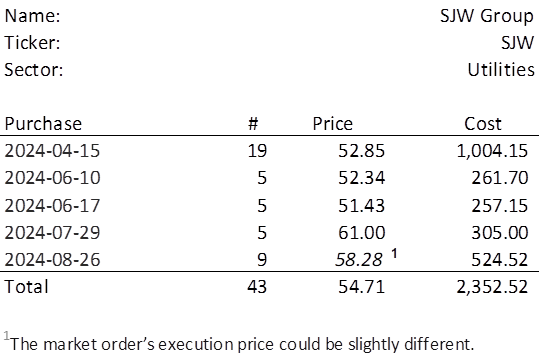

The lowest amount belongs to SJW which last traded at $58.28. I will acquire 9 shares of SJW on Monday. See my post on 2024-07-27 for a slightly deeper dive into SJW’s historical performance. Below, is the purchase history and average cost calculation.