Dividend King of the Week [BDX]

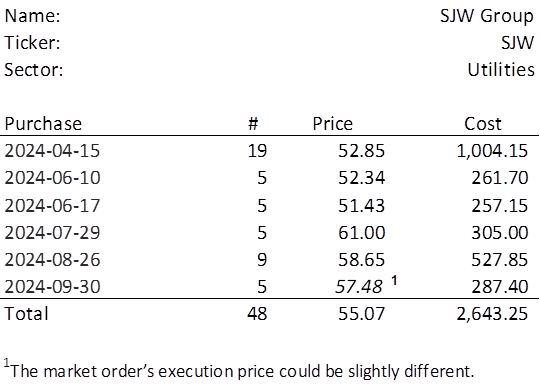

This week, three of the portfolio holdings ranked in the Top 10: FMCB, PPG, and SJW.

| Ticker | Account Value |

| FMCB | 3,195.00 |

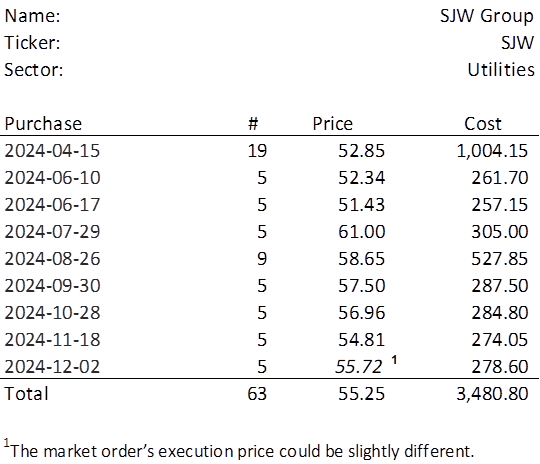

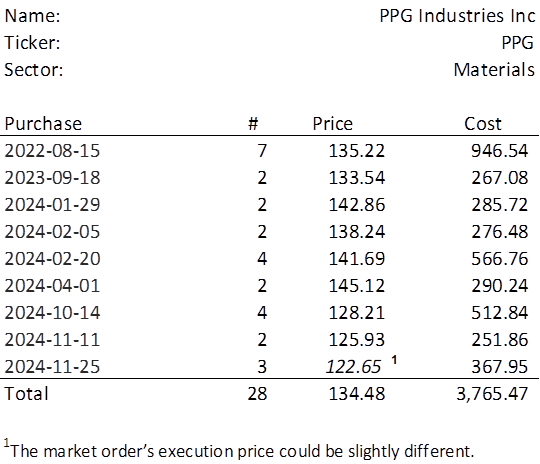

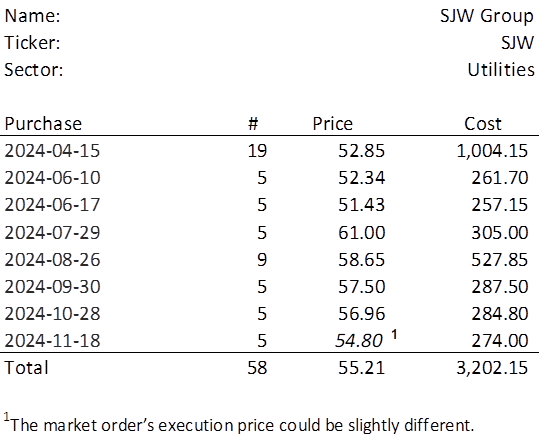

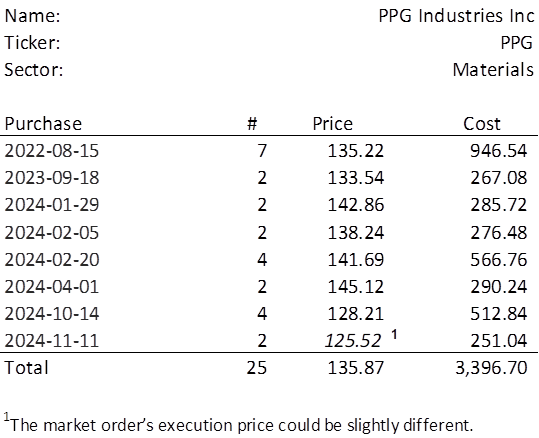

| PPG | 3,515.96 |

| SJW | 3,338.37 |

The lowest amount belongs to FMCB. Earlier this week I placed a GTC limit order to acquire another share of FMCB at $975 (see 2024-12-01 post) and that order has not executed. The truth is, acquiring one more share of FMCB at its current price of $1,065 would create a position imbalance within the portfolio, leaving only ABBV, PII, EPD, FRT, and NNN eligible for additional investment. Unfortunately, none of these positions made the Top Ten. That can only mean one thing:

It is time to add a new position to the Portfolio for the Ages!

…