After presenting five different methods for calculating beta in Excel, I used examples to demonstrate why beta should not be used to set expectations about future return. There are several reasons for this:

- Beta isn’t even reliable for estimating the historical returns on which it is based.

- Beta is a point estimate summarizing a multitude of data points.

- A stock’s beta will change in the future.

- Using beta for stock projections, relies first on a prediction of the market’s return – a futile task.

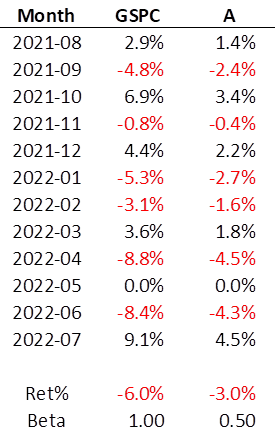

A quick dive into the point being made in #2: the table below shows a made-up company ‘A’ with a beta of .5. And by golly, its return for the year was half of that of the index. That’s because A’s return for every month was exactly half of the index return. It is perfectly correlated with the index, moving up when the market moves up, and down when the market goes down.

If there really was a company like this, AND you felt strongly that the market was about to make a big move up, you’d avoid it and instead, would purchase a stock with a much higher beta. You would have a strong, legitimate reason to believe that the point estimate of 0.5 was in fact, a great estimate for any future month, because it had been perfect for each of the previous 12 months.

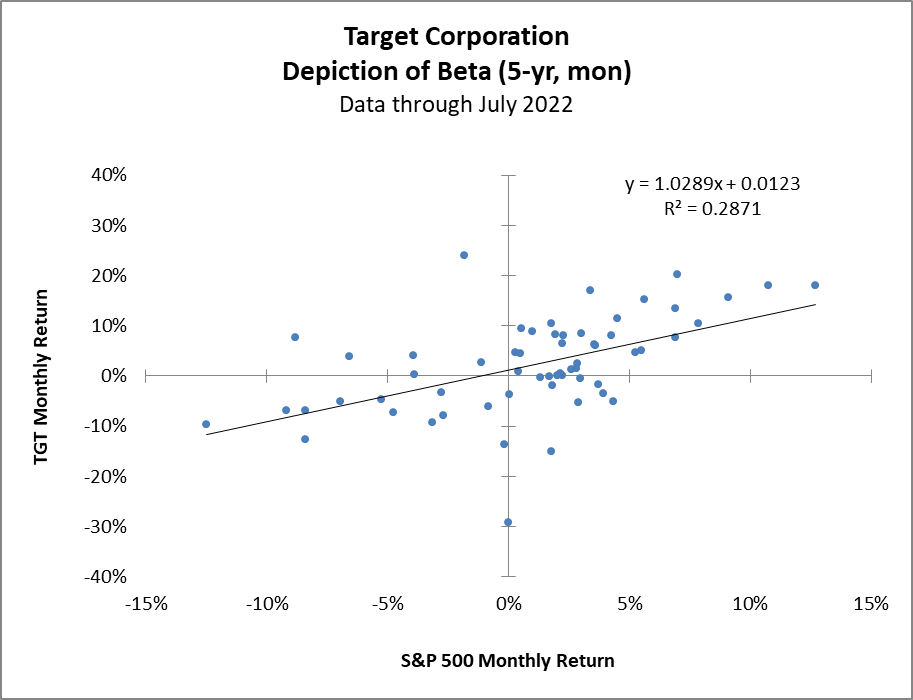

Unfortunately, real stock performance is much less correlated to that of the index. A stock with a beta of 0.5 will have returns that are wildly different in magnitude than that of the index and those returns will sometimes be in the opposite direction too. It would be very likely that no month’s return was exactly half that of the index. In other words, 0.50 might be a terrible match for any one month going back or forward in time.

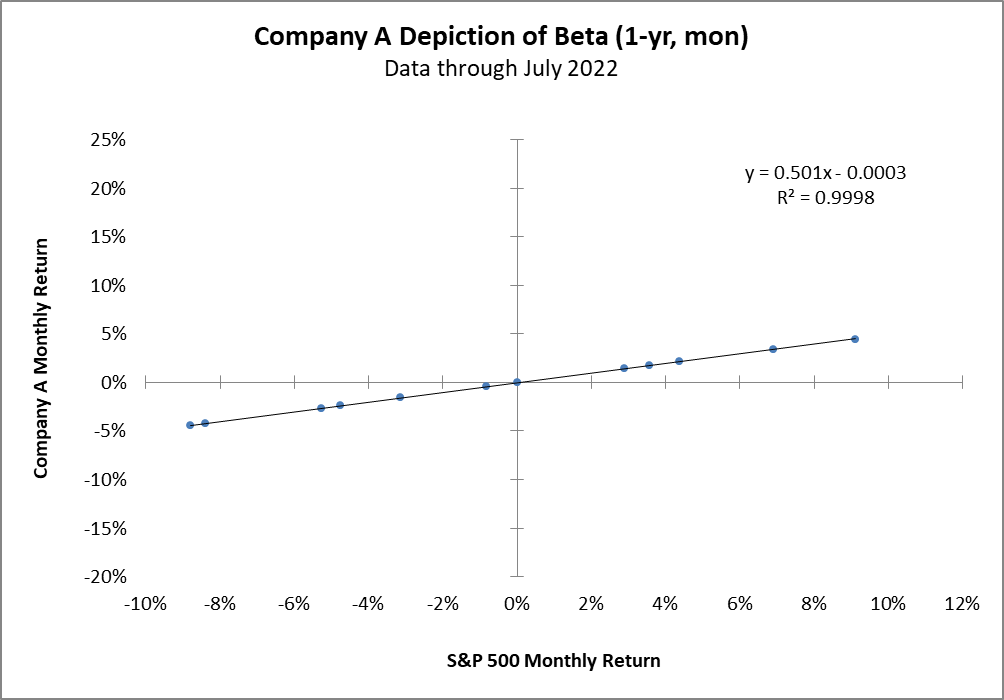

To bludgeon the horse further, Company A’s beta graph looks like this:

A real company looks like this:

Which Beta?

Let me be clear about one thing before I dive into what beta should be used for. There are quite a few variations of beta calculations out there. Investors can play around with the return period, the lookback period, and even the benchmark index to which a company is compared. One can use weekly or even daily returns and calculate beta over shorter periods such as a year. One year, with daily return comparisons, brings with it 250 data points. Weekly returns over a year uses 52. Personally, I don’t think a year is a long enough lookback; the market which goes up about two-thirds of the time, may not have enough exposure to pronounced periods of negative performance. We want to see how a stock moves in all types of market behavior.

Daily returns are interesting to look at, but the calculations slow things down in a real-time situation1. I think the combination of the 5-year lookback with monthly returns and using the S&P 500 as the benchmark is perfect for most domestic stocks; Yahoo! and TD Ameritrade have it right. It changes once a month, when the latest calendar month ends and an old month ages off. This creates a statistic that changes, but not erratically.

How to Use Beta

Beta is a measure of volatility and thus, beta is best used to assess volatility. Now, if volatility isn’t necessarily a predictor of return, why should we care? Risk aversion. Most people, certainly investors, are risk-averse. Volumes have been written about risk aversion and utility theory, but in the context of investing it boils down to this. A risk-averse investor prefers the preservation of capital over the chance at better than average returns.

Why? Because of the decreasing marginal utility of money. This concept simply means that to risk-averse individuals, each additional dollar they receive provides less usefulness. Huh? It means that sane, risk-averse people get the most use out of the ‘early’ dollars. We buy high-utility items such as food, clothing, and shelter first. It isn’t until more income comes in that we start throwing money at high-end purses, jacuzzies, or heated sidewalks. And yes, there are risk-seekers. Those individuals have a proclivity for gambling. They are likely to forego food or shelter for the chance to win it big.

It all comes down to this. Investors are risk-averse and thus, happiest when risk is low. Volatility is a proxy for risk. When we lower volatility, we lower risk. We lower volatility when we choose stocks with low beta. This is where beta can give us a fighting chance. All other things being equal, we want stocks with a beta as close to zero as possible. Practically speaking, this is extremely difficult to achieve. Thus, we aim to be less volatile than the market itself. We want a portfolio beta that is less than 1, the lower the better.

How Beta Works

The goal is to outperform the market with less volatility. Is it possible to favor capital preservation over a chance at higher returns and still actually get the higher return? It is possible. People get lucky. People get things they don’t deserve. We’ll just cross our fingers and hope we get lucky. Actually, we’ll set us up for success through stock selection from a universe of the most successful dividend companies of all time. Then we will hold those companies and use the power of compounding and expense avoidance to our advantage.

Stocks with a beta greater than 2 over an appreciable time period, get old fast. Sure, they explode when the market is doing well, but they give it all back and then some when the market turns sour. Their daily fluctuations are laughable, and they’ll give you whiplash at how much they bounce. Right now, Dividend Kings range from -.01 to 1.57 with an average of .78. No one King is wildly oversensitive to the general market and a well-chosen portfolio of Kings means your account values will fluctuate less than the S&P 500.

Let’s not forgot that while two-thirds of the time the market goes up, the other third it drops. And the drops are greater in magnitude. There are plausible market theories as to why this must always be the case. An over-priced market will never just move sideways until earnings catch up to the elevated price level; the market will always burst and decline faster than it grows. A beta of 2 is wonderful for the months when the market is slowing climbing. But in a significant bear market with a 40% decline, the 80% declines of just a few companies can put your portfolio in a hole for years.

How Important is Beta?

Considering beta when picking a single stock en route to building a portfolio of Dividend Kings is not critical. Entry price, estimate of fair value, dividend yield – these are the most important factors. Most of the Kings have a reasonable sensitivity to the market forces and have stable price reactions to economic and other impactful events. By narrowing potential stocks in such a way, you’re virtually guaranteed to end up with a portfolio beta less than 1. You’re welcome.

I’ve written a lot about beta here, strictly to educate the interested reader and to reiterate yet another benefit of staying focused on Dividend Kings. There is a world of growth stocks out there that are nearly unpredictable in the short term. Their prices fluctuate in irrational ways that in no way reflect the intrinsic value of the business. Even for the most stable companies, the current stock price spends very little time as a proxy to the fair value of a company. Market price swings like a slow pendulum, overvaluing a stock for months at a time and gradually reverting to the fair value for the briefest of moments before moving into undervalued territory, and then one day reversing yet again. Market prices for high beta stocks are a bit more like a metronome.

Investing in Dividend Kings is like having a mother who is a professional chef. You’ll come to find out, not everybody has it so good.

Tootsie Rolls Industries Inc, with a beta of -.01, closed at $34.04 at month-end July 2017. Five years later, it closed July 2022 at $35.12. That’s an average annualized price return of 0.6% versus the S&P 500’s 10.8%. If we throw in dividends, Tootsie’s total return was 1.6% annualized. That isn’t great.

Tootsie Rolls Industries Inc may have underperformed for the last 5 years, but it hasn’t lost money and its price has moved as if it lives in a world of its own. There is something appealing about that. There’s also the chance for outperformance going forward, perhaps a little reversion to the mean in a good way.

Plus, Tootsie Rolls are delicious.

1TD Ameritrade allows a person to add a customized beta calculation to real-time watchlists in its proprietary trading software, ThinkOrSwim.