This week is the second of three consecutive ‘off’ weeks intended to restore the $250+ per week pace of investment. Read on to find out which position would have been most worthy of new money.

This week, five of the portfolio holdings ranked in the Top Ten: BKH, FMCB, MDT, PPG, and SJW.

| Ticker | Account Value |

| BKH | 2,746.86 |

| FMCB | 2,970.75 |

| MDT | 1,674.54 |

| PPG | 2,473.04 |

| SJW | 1,016.50 |

Once again, there is no surprise here, the lowest amount belongs to SJW and there is nothing that would preclude additional investment into that position, other than that of it being an off week. SJW announced earnings on Friday and the stock sold off enough to negate the gains over the previous four days. Why?

There is no reason.

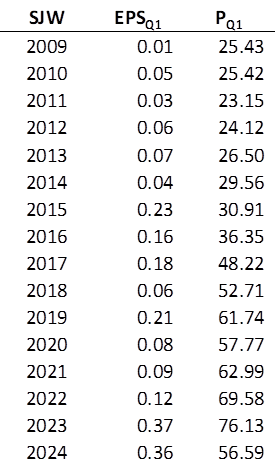

2024Q1 EPS came in at $0.36, one penny less than 2023Q1 EPS. SJW maintained its guidance range for CY2024 EPS of $2.68 to $2.78, the midpoint of which is $2.73, a slight increase over the CY2023 EPS of $2.68. Sure, the year over year trend in first quarter earnings is slightly negative, or generously, flat. But let’s look a little closer at the history of first quarters.

This past quarter was the second-best start to a calendar year ever, but the market was not impressed. The 2024-04-26 closing price of $53.50 is even lower than where the stock traded at the end of the quarter before earnings were known. The last time SJW traded at this level when the first quarter earnings were the last reported, was 2018. Of course, the EPS is six times higher than they were in that year, but whatev.

Apparently, the market is as impressionable as a young Ricky Bobby – if you ain’t first, you’re last. However, Royal Dividends is a sober institution, and investing in SJW at this time is a wise decision.