I’d like to think Blaze Bayley came up with the title I chose for this post, but there are historians who would beg to differ. In his song ‘The Brave‘, we have the lines:

Fortune favours1 the brave

Risking it all again and again

Fortune favours the brave

Fall after fall they climb up again

Was he singing about the stock market?

All Summer in a Day2

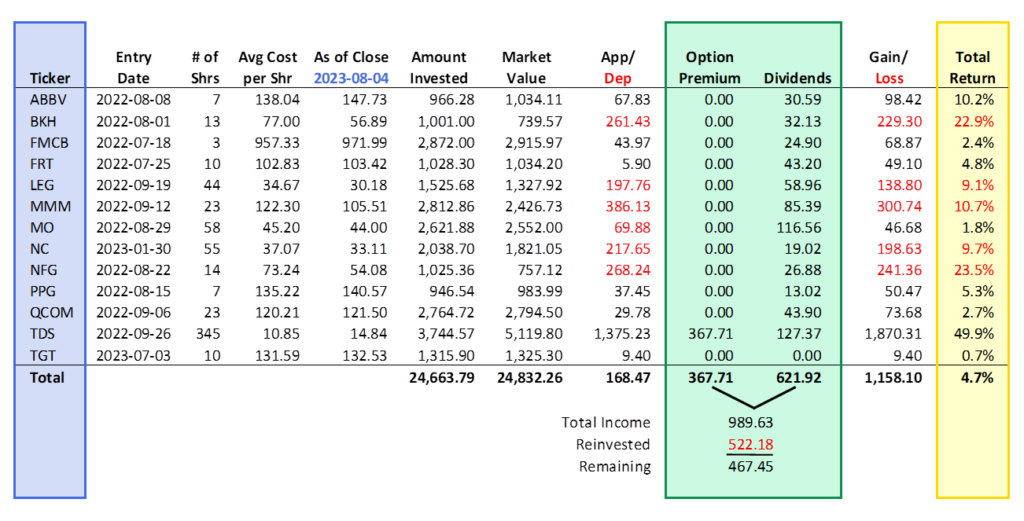

TDS closed Friday, August 4, 2023, at $14.84 up $6.94 or 87.85% from the previous day! Miraculously, I did not have this position covered by a call. This one-day performance propelled the Portfolio for the Ages into the black for the first time in quite some time.

I mentioned how this came to be on the second of my two posts on Friday. It is worth mentioning again, that a) TDS did not have a particularly good earnings report, and b) their announcement to explore ‘strategic alternatives’ for UScellular [USM] may never come to fruition. So, while TDS has approached what may be considered a fair value of $15, plenty of risk remains. I hope they become a Dividend King next year and continue to grow, with or without the presence of USM. But in the meantime, I think it makes sense to continue writing calls to supplement the dividend income.

How We Got Here

First, let us reminisce about all the times TDS was the Stock of the Week.

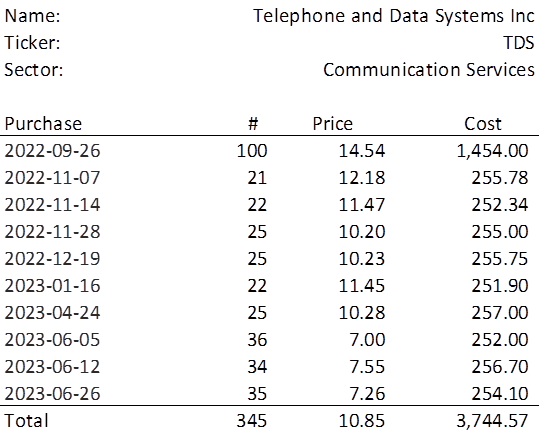

Not only did I initiate a larger than typical position in order to support call writing, but there have been nine other occasions where I added to this position. TDS had fallen to price levels not seen in 35 years and I began to wonder whether this stock was a dead duck. I read what I could get my hands on and listened to presentations their leaders made in recent months. I felt that their instrinsic value was probably around $15, quite a bit lower than when I first initiated a position, but quite a bit higher than where it had been trading. I stuck it out. Now, things look a lot better. Nothing has really changed, just that management is open to the idea of selling their substantial stake in UScellular. If it sells, TDS will be much smaller. Thus, it still makes sense to maximize income by writing covered calls on it. Here’s how things will play out.

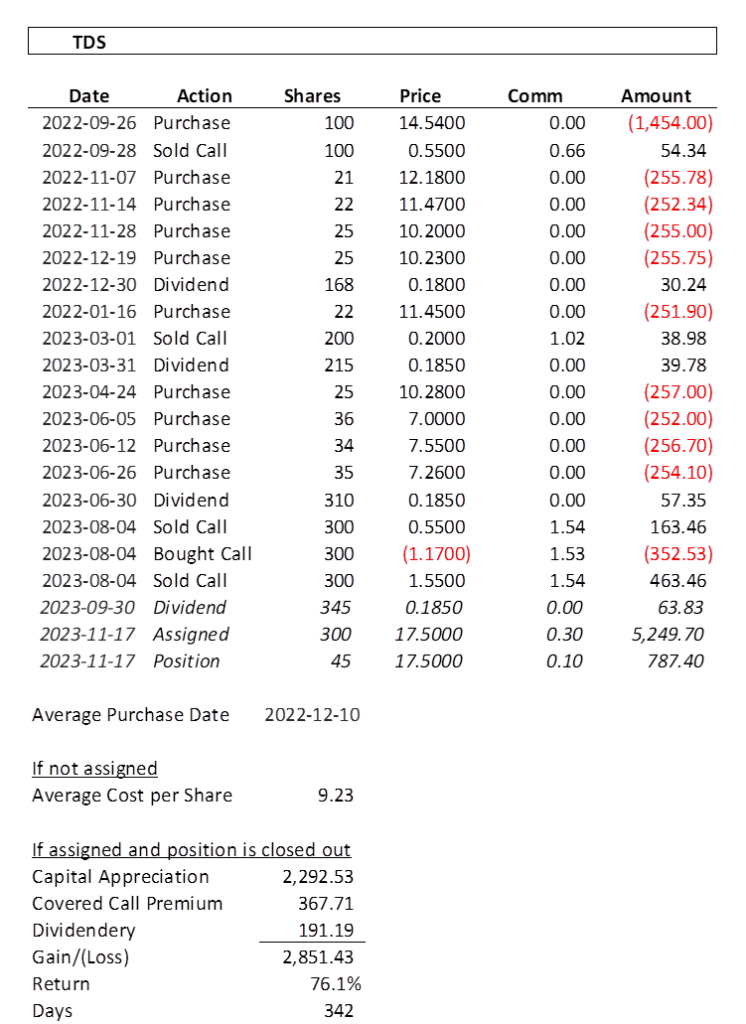

The Average Purchase Date is a hypothetical date that essentially reproduces the same annualized return as the more detailed exposure method which incorporates every purchase date. Likewise, the Average Cost per Share in the same display is not the average purchase price but is net of all dividends and option premium.

Was I thrilled that I pulled the trigger on selling a covered call too early on Friday? No. But I was able to right the wrong to a degree that likely brought in the same premium as would have been available had I never written the first call. Maybe. Either way, it is extra income with a relatively conservative strike price and not a particularly lengthy time period. Rolling the call a second time might not be nearly as lucrative, and I may have to let go of TDS at $17.50. A 76% return on a stock that has been falling for 5 years and struggling for 20 is alright by me.

1I left the British spelling here as it is clearly Blaze’s voice you should be hearing in your head when you read it. If you’re unfamiliar with his impressive catalog, I first direct you to his two albums fronting Iron Maiden: ‘X Factor’ and ‘Virtual XI’. Both are highly underrated and a great way to get acquainted with the man. From there, I would delve into his impressive and still growing catalog as a solo artist.

2This is a short story by Ray Bradbury. At 865 words, it is perhaps the shortest, great story.