We’re going to look at a very simple and common example of a company paying a dividend. This will lead to a more practical way of using dividends to assess risk.

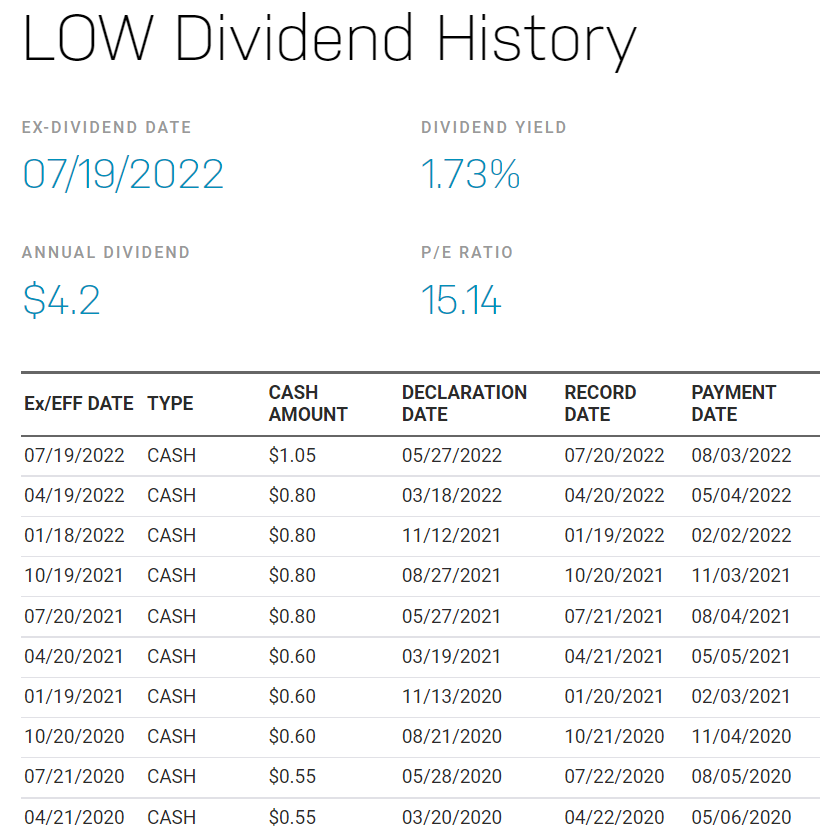

A few Dividend Kings find themselves listed on the NASDAQ exchange. But what you may not have known is that the NASDAQ has its own website. It is very useful for obtaining accurate information about a company’s dividend, and NOT just for companies listed on their exchange. Below is an excerpt from the dividend history page for Lowe’s Companies, Inc [LOW].

An Example

As you can see, from the first two columns, Lowe’s pays a quarterly cash dividend1. On May 27th (declaration date), they declared that owners as of July 20th (record date) would receive on August 3rd (payment date), a cash dividend of $1.05 for each share they own. Now, where dividends are concerned, the purchase date and the ownership date are not the same. In 2017, the settlement date for marketable securities was reduced from three days to just two. Thus, to be considered an owner on the record date, you have to purchase the shares a day before the ex-dividend date which in this example is July 19th (today!) So, don’t buy Lowe’s right now thinking you can capture that juicy $1.05 dividend a couple of weeks from now.

In theory, all else being equal, between market close on July 18th, and market open July 19th, Lowe’s is worth $1.05 less because of the commitment to pay that dividend. Accordingly, the price of Lowe’s should have dropped by approximately this amount by market open. Of course, a stock’s price fluctuates all day long for myriad reasons and it is entirely possible that a company will trade higher on its ex-dividend date – so one cannot see the decline in value created from the commitment to pay a dividend soon. Other times, a chart will show a gap down at the market open of the ex-dividend date and it will be obvious it is due to the dividend because the amount of the drop is nearly equal to that of the dividend.

1All but one Dividend King pays a quarterly dividend, choosing instead to pay a semiannual dividend. That company is Farmers & Merchants Bancorp [FMCB], my first addition to this portfolio. Their dividend history cannot be found on the NASDAQ website because FMCB is small and trades over the counter [OTC].