This week, three of the portfolio holdings ranked in the Top 10: MMM, MO, and TDS.

| Ticker | Account Value |

| MMM | 2,358.19 |

| MO | 2,357.16 |

| TDS | 1,670.40 |

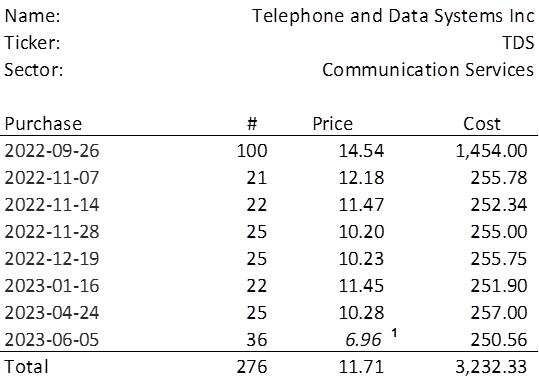

The lowest amount belongs to TDS. In order to invest a minimum of $250.00 in TDS, I need to purchase 36 shares this Monday. Below, is the purchase history and average cost calculation.

The average purchase price per share will be around $11.71 and a perfect strike price for a covered call would be $12.50. However, with Friday’s closing price just under $7.00, there are no bids for calls above the $7.50 strike price that aren’t too far into the future. It would be possible to sell a call at $7.50 for a decent premium, but TDS could easily hit $7.50 in a matter of days, and I do not wish to have my shares called away at a loss.

Therefore, I will refrain from writing a call at this time. Another good reason to hold off on covering the position at this time is the activist letter sent from GAMCO to the CEO of TDS Friday afternoon.

Shareholder Activism to the Rescue

For the record, I don’t think Telephone Data & Systems, Inc is on its way out. But I do think they’re at a critical point where their recent decisions on how to move forward need to be successful. They do not have deep enough pockets to fail at their chosen strategy this time and then try a different strategy later. So, either they will make incremental improvements each quarter, and hit their earnings targets for the whole of 2023, in which case 2024 would likely be a return to profitability and ample coverage of their dividend, or the dividend is eliminated, and TDS becomes a different animal going forward. That could mean they’re purchased outright, or perhaps they disinvest in US Cellular [USM].

I think their plan is a good one. We’re talking about several quarters in a row of rather large capital expenditures to increase their fiber footprint, and from that, an increase in their subscriber base with less churn moving forward. In other words, those expenditures are hitting the books now, and the revenue (and profits) born out of this process, will come later. Those sitting on thousands in unrealized losses with TDS, due to their blind, unquestioning, near cult-like faith in Royal Dividends, would love to see this plan play out perfectly. So would GAMCO Asset Management.

They own 4.3% of the outstanding shares of TDS. That’s 4.5 million shares tied up in their funds held by their clients. Rather than just bow out and realize what has to be millions in losses for their clients, they believe that there is a lot of value locked up in TDS. And they’re not going to sit idly by anymore. From the letter:

We are considering the probability of nominating Directors at the next Shareholder meeting.

Now, would I have written ‘possibility’ instead of ‘probability’? Yes. Regardless, the meaning is clear – they want some representation on the board. TDS just had its annual shareholder meeting on May 18th, and I don’t think there will be another until next May. Thus, if GAMCO decides to fight for a couple of seats at the table and whether they’re successful at those efforts is unknown and a long way off. Even further out, would be whether or not their presence on the board is influential and in a good way.

However, two things can be said: (1) there are many examples2 of the positive effects on shareholder returns from the actions of activist shareholders, and (2) I believe there has already been an effect on price, the very instant the letter was published.

The tallest green bar in the last five days is the 15-minute interval on Friday 12:30pm – 12:45pm. The letter is dated June 1st, but the time at which it went public was right in that time period. I don’t think the positive price reaction is coincidental, though I have to say, did the people just clamoring to buy TDS at any price even have time to digest the letter? Did they even ask why it is addressed to a guy named Leroy but starts with a casual ‘Dear Ted’? Did they catch that part about some third party offering of $100 per share3 and promptly bought all the shares they could afford in an effort to ride the lightning? Some investors, even institutional investors, are just insane. Let’s hope that adjective doesn’t apply to those sinking even more money into TDS, all for the glorification of Royal Dividends.

Suffice it to say, the family-controlled TDS could benefit from some pressure from stakeholders. Royal Dividends will continue to add shares in a measured, disciplined manner until the share price approaches its fair value, which I believe is no less than $12.50 right now. However, if they manage to get off the ground again, a price in the higher teens is within reach within the next couple of years. Whenever the next covered call opportunity presents itself, I will recommend purchasing enough additional shares to make writing another contract4 possible.

1The market order’s execution price could be slightly different.

2You probably expected this footnote to include some examples. That’s a lot of work, work already done by people with less time, but more passion. I will say I read an entire book on some famous examples: Dear Chairman: Boardroom Battles and the Rise of Shareholder Activism by Jeff Gramm. It is well-written and very well-researched, but it will not entertain the disinterested.

3This is a reference to some very old news, but it’s fair to say certain parties have regrets today – even if they don’t admit it.

4An option contract represents 100 shares. The portfolio should have 276 shares of TDS by June 5, 2023. In the event a lucrative covered call opportunity presents itself, it would make sense to acquire another 24 shares and sell three call contracts to maximize the option premium on the position.