There are 45 Dividend Kings. Collectively, they provide exposure to ten of the eleven Global Industry Classification Standard (GICS) sectors. However, later this fall, Computer Services Inc [CSVI] is expected to complete its merger with the Centerbridge and Bridgeport partnerships and go private. With the loss of CSVI, the Kings lose exposure to the Information Technology sector. In anticipation of that change, we acquired Qualcomm Inc [QCOM], a company with a 20-year dividend increase streak with promising growth within the semiconductor industry. The Portfolio for the Ages now has exposure to all but one sector: Communication Services. The Dividend Kings can’t help us, and the Queen is dead.

The Communication Services sector has been destroyed so far this year with a return of -37.5%. However, there is one stock that has done slightly better (-28.75% YTD) with a 48-year dividend streak. This Monday is their lucky day.

That’s right, 17 months early and even before Charles III enjoys his coronation, Telephone and Data Systems Inc [TDS] becomes royalty.

Telephone and Data Systems Inc

TDS started in 1969 as the collection of ten rural phone companies in Wisconsin. In 5 years, they grew to 39 companies with operations in 17 states. That same year, they started paying a dividend and they have increased it annually until today. In mid-February of 2024, I expect they’ll announce a dividend increase that will be their 50th. At that point, just two annual increases from now, they’ll officially be called a Dividend King.

Here’s the problem. The Communication Services sector in general, and more specifically, the wireless telecommunication services industry, are highly competitive arenas. There is no guarantee that TDS gets to increase #50. After all, no other company from this sector ever has. Worse, TDS isn’t exactly thriving. But I think they’ll get there. More than that, I think they’re worthy of investment and right now seems like a great time. Let’s take a closer look.

Here is the profile from TD Ameritrade:

Telephone and Data Systems, Inc. is a diversified telecommunications company. It provides wireless, cable and wireline broadband, video, and voice, and hosted and managed services through its businesses, U.S. Cellular, TDS Telecom, BendBroadband and OneNeck IT Solutions. Its segments include U.S. Cellular and TDS Telecom. The TDS segment provides wireless telecommunications services. U.S. Cellular segment offers a range of devices, such as smartphones and other handsets, tablets, wearables, mobile hotspots, routers, and Internet of Things (IoT) devices. In addition, U.S. Cellular also offers a range of accessories, including wireless essentials such as cases, screen protectors, chargers, memory cards and consumer electronics such as audio, home automation and networking products. TDS Telecom owns, operates and invests in communications services in a mix of rural and suburban communities throughout the United States. TDS Telecom provides a range of broadband, video, and voice communications.

In 1983, TDS founded U.S. Cellular [USM] and still owns an 83% stake. Make no mistake, the performance of TDS is very much anchored to USM, and their stock prices move in lockstep.

The Details

Data as of 2022-09-24

| Name | Telephone and Data Systems Inc |

| Ticker | TDS |

| Website | Investor Relations |

| Sector | Communication Services |

| Dividend Streak | 48 years |

| Last Price | $14.67 |

| Div Amt (quarterly) | $0.18 |

| Ann Dividend | $0.72 |

| Last Ann Div Inc | 2.9% |

| Dividend Yield | 4.9% |

| Payout Ratio (ttm) | 81.6% |

| Beta (5-yr, mon) | 1.01 |

| P/E Ratio (ttm) | 16.86 |

| Margin of Safety | 29.5% |

Troubles

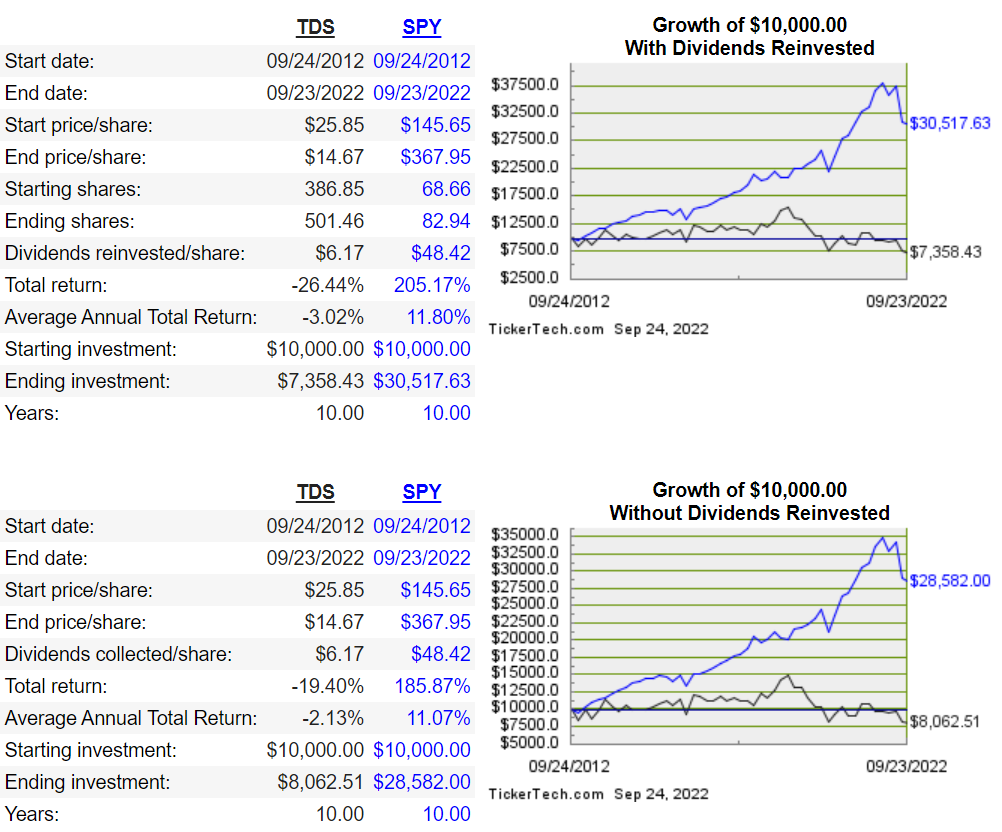

TDS has grossly underperformed the S&P 500 for a decade.

The gap is widening too. However, until TD Ameritrade allows one to chart total return (including dividends paid), we don’t have the full picture. Below is a total return comparison.

Still atrocious. Hey, I tried. Let’s throw more gas on the fire. The company’s earnings guidance for the year is $0.42 EPS. This would imply -$0.10 EPS over the next six months and a calendar year Payout Ratio of 171%, more than double what it has been over the previous 4 quarters. This super-elevated ratio earns them a dividend risk score of ‘F’ as assigned by Sure Dividend.

Reasons to Invest

We cannot use historical P/E Ratio to estimate a fair value for TDS; the earnings are too volatile. Some have used the historical price to book value ratio, P/B Ratio. From 2012 through 2019, the average P/B Ratio was 0.71 with unremarkable variance. However, the ratio has dropped each year since, and stands at 0.35 today. Now, it would be easy to say that reversion to the mean would basically mean a fair value of $30.

Unfortunately, closer inspection of the assets shows that the Goodwill and Intangible Assets component of book value, once quite consistent, has also significantly ramped up in the last three years. Stripping this number out of book value produces absurd values in 2021 and 2022; examining the historical trend in price to tangible book value is pointless.

We cannot rely on typical metrics. Instead, I am choosing to focus on a very strong dividend history with a very high current yield. In the calendar years, 2013-2015, TDS had EPS of ($1.29, -$1.26, $1.98). They have not had negative earnings for a whole year since then. And obviously, their dividend increase streak was unfazed during that time period. I think even if 2022 finishes poorly, and 2023 is a rough go, TDS will bounce back and continue to increase their dividend ever so slightly. Their balance sheet is strong enough to weather a temporary blow to profitability.

First quarter EPS of $0.37 significantly beat the collective analyst estimate of $0.26. Second quarter EPS of $0.15 destroyed the $0.04 estimate. TDS has very likely chosen to keep their guidance for CY2022 unchanged, because they wish to stay conservative and beat expectations. It is the prudent thing to do, and no different than thousands of other companies.

I can say that two different analysts have lowered their target prices to $22. Another, places it at $19. They all believe that future growth is limited, but that it is undervalued today. I agree. To summarize, there are three reasons for my investing in TDS at this time:

- It gives exposure to the Communication Services sector.

- The current dividend yield is excellent and double the 10-year historical average yield.

- There is agreement among analysts that TDS is significantly undervalued but disagreement on just how much.

Covering My Ace

What if TDS drops further? What if it the dividend is unsustainable? Is there something I can do to provide some protection against poor performance? Yes. I can sell a covered call. This post is not the best place to explain what a covered call is. But I will give you the specifics of the trades I will execute and explain my thought process. One quick comment: though the covered call is the single most conservative way to trade options, you need permission from a broker to do so. As it is a great way to augment one’s income, I would go ahead and get that permission even if you’re not considering trading options just yet.

First, I have been investing $1,000 into each portfolio position to date. At $14.67, I would normally purchase 68 shares. However, I need 100 shares in order to sell a one contract call on my shares. This requires that I invest nearly $1,500. This would mean TDS would have the highest weighting in my portfolio. It will be 50% greater than the other positions and about 13% of the whole portfolio. This is okay. And really, this is only possible with TDS because it trades at such a low price, lower than any of the Dividend Kings. Buying 100 shares of FMCB at $955 per share would require an additional investment of $95,000 and it would represent about 90% of the portfolio1. You get the idea.

Now, you might ask why I would choose to weight what might be seen as the riskiest stock in the portfolio, more than the others. The answer is simply that the additional risk is not substantial, and it affords me the opportunity to increase my income and hedge the position slightly. Let me explain.

In committing to 100 shares, I will be able to augment the dividend income by selling 1 call contract with a certain expiration date and strike price. Ordinarily, I would do both steps in a single order called a ‘buy/write’ or ‘covered call’ order, but options on TDS are not liquid enough for me to have confidence that a limit order with my desired, combined price parameters would ever execute. Thus, I will first acquire the 100 shares at market price on Monday morning and then sell a call afterwards.

The Covered Call

I need to decide three parameters for the call I intend to sell: the expiration date, the strike price, and how much premium I want to collect.

- The sweet spot in call expirations are 3 to 6 months out. Shorter expirations mean lower premiums. And too much can change about the company or environment in longer time periods.

- I want a strike price higher than what we paid for the stock, such that if our shares are assigned at this strike price, my annualized return would be at least 30%. I really don’t want to lose the shares, but if I do, we want to be compensated rather nicely.

- Premium and strike price go hand in hand, so I want to strike a balance. Lowering the strike price brings more premium but increases the likelihood the stock gets called away. Raising the strike price will compensate me more in the unlikely event the stock takes off, but the lower premium leaves money on the table. I think a premium that produces the same income as the dividend would be welcome here. That means I want at least $0.72 per share annually.

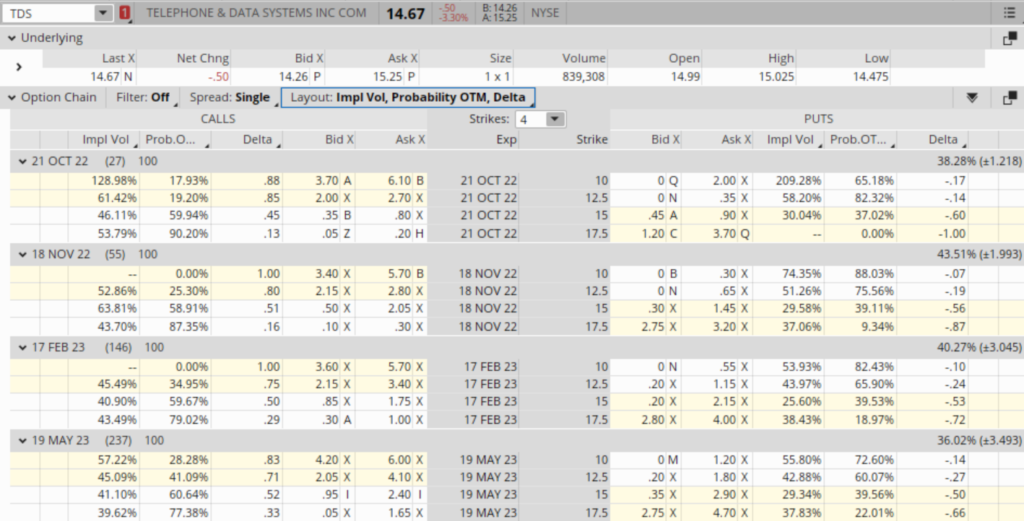

Below is the option chain for TDS.

The option chain for TDS has 4 different expirations, but the February 17, 2023 expiry is 146 days out and is in the sweet spot. So, let’s go with that.

For an option that is out 146 days, I am looking for at least (146/365) x 0.72 = 0.29 in premium per share, or $30 for 1 contract. Further, I am only considering strikes above my entry price and so $15.00 and $17.50 are really the only viable ones here. I have chosen not to display the strikes beyond $17.50. There is little to no option interest at those levels, because it is highly unlikely TDS will trade at those levels anytime soon.

Unfortunately, the bid/ask spreads are very wide for TDS. Getting my shares called away at $17.50 would produce an annualized return (ignoring dividend and call premium) of (17.50/14.67)^(365/146) – 1 = .554 or 55.4%. The midpoint of the bid/ask spread is $0.65. That would be a nice premium, but midpoints are more easily acquired as premium when spreads are narrow. Now, if you look at the same strike level in November, you’ll see that the midpoint of the relatively narrow bid/ask spread is $0.20. So, the bid of $0.30 is good in that it is higher and because it satisfies the premium requirement of $0.29, but I could be leaving money on the table if I ask for only $0.30. I think a little less than midpoint might be a good idea. I’ll shoot for three dividends worth (rounding up a penny).

I am going to set up a Limit Order on a GTC basis, that’s Good Until Cancelled. Never set up a market order with options.

Sell to Open: 1 February 17, 2023 $17.50 Call Option [Symbol: TDS230217C17.5]

Limit Order Price: Credit of $0.55 per share

Outcomes

Let’s assume I get 100 shares for the last traded price of $14.67 and the option order executes at my limit price within a few days. I will post a confirmation if it does. Let’s look at three different outcomes on February 17, 2023. Because the stock was purchased after the September ex-dividend date, I miss the next dividend; I will only receive the December dividend prior to the option expiration.

TDS is trading at $16.50

The person or entity who purchased the call for $55 is pissed. Why would they exercise their right to purchase TDS for $17.50, when they can buy it for $16.50 on the market? The option expires worthless to the purchaser. That’s $55 down the tubes for them. And the $55 was always mine to keep regardless of the outcome.

- Unrealized gain/(loss): ($16.50 – $14.67) x 100 = $183

- Dividends received: 1 at $0.18 * 100 = $18

- Option premium received: 1 contract for $0.55 x 100 = $55

Up $256 on an investment of $1,467 in 146 days is a very nice return (mostly unrealized of course) and I get to keep my shares and write (sell) another covered call. If I can do this for an average of $20 per quarter or $40 every six months, I am doubling the dividend yield for income.

TDS is trading at $21.00

My shares would get called away (automatically sold) for $17.50. But at least I already own them! If I didn’t already have this call ‘covered’, I’d have to acquire the shares (done automatically by the broker) at market value ($21.00) and sell them (again, automatically) to some unknown jerk for $17.50. That’s a loss of $295 ($350 minus the original $55 premium I received). This is why I would never sell a ‘naked’ call; one can never be sure how much a stock can take off in 146 days and frankly, just out of spite. Now instead of losing $295 on a naked call, the following are the results of this venture into TDS.

- Realized gain on assignment: ($17.50 – $14.67) x 100 = $283

- Dividends received: 1 at $0.18 * 100 = $18

- Option premium received: 1 contract for $0.55 x 100 = $55

A realized gain of $356 on an investment of $1,467 in 146 days. That’s 24% unannualized!. The shares are gone, but perhaps there are other opportunities in the communications services sector now. Am I upset that I only received $55 up front for a call that ended up screwing me out of $350 = ($21.00 – $17.50) x 100 in capital appreciation? No! Well, yes, but I shouldn’t be. The odds that TDS would be above the $17.50 strike back when I sold the call were, from the table above, (100% – 79.02%) = 20.98%. And above $20, the odds were even less at about 11%. Hey, TDS has really shown us something here. They’re probably in a stronger position now, perhaps having had a really good earnings announcement at some point in the last 146 days. Perhaps there will be another good buy opportunity in the future.

TDS is trading at $13.00

This is why we sold the call in the first place. The outcome is no different than in the first scenario.

- Unrealized gain/(loss): ($13.00 – $14.67) x 100 = $(167)

- Dividends received: 1 at $0.18 * 100 = $18

- Option premium received: 1 contract for $0.55 x 100 = $55

I have an unrealized loss of $(94) or -6.4%. But had I not sold the call, I would be down -11.4%. Now that my net cost is $1,467 – $18 – $55 = $1,394, I can write another call option with a $15 strike a few months out, and likely collect a decent premium again. Ideally, I would keep selling calls at a strike price that guarantees a profit in the event the option is assigned. So, even though this is the worst-case scenario, the option premium I receive from just one call (that has expired worthless to the sucker that bought it), affords me the opportunity to sell another at a strike that is now below my original cost and still guarantees a profit if I end up losing the shares.

Having an appropriate covered call in place, means my results are better than a strict buy-and-hold in two of the three scenarios above. And in the middle scenario, where I do worse, I do awesome! This strategy isn’t for everybody. And in this portfolio, it really isn’t warranted or even possible for the other positions right now. But for TDS, it isn’t a bad way to hedge the position and the risk inherent in the dividend.

Monday morning, TDS becomes the second Elected Monarch to make the Portfolio for the Ages.

1I have chosen FMCB as an example because its share price is the highest in the Empire. However, option contracts do not exist for FMCB. Thus, selling a covered call on FMCB within this portfolio would be both impractical and impossible. But as I say, you get the idea.