This week, five of the portfolio holdings ranked in the Top Ten: BDX, GRC, PII, PPG, and TGT.

| Ticker | Account Value |

| BDX | 2,341.08 |

| GRC | 3,332.16 |

| PII | 2,291.31 |

| PPG | 3,064.32 |

| TGT | 2,795.60 |

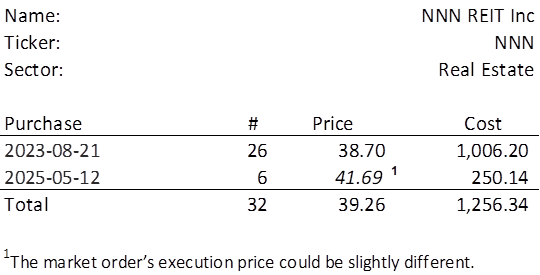

The lowest amount belongs to PII. Unfortunately, there exists a sector imbalance and the only sector worthy of additional investment at this time is real estate. None of the companies above are in the real estate sector, and none appeared in the Top Ten. However, 30 of the 79 stocks in the Royal Dividends Empire met the criteria from which the Top Ten is skimmed. I had to expand all the way to a ‘Top 25’ to get the first real estate company and, lo and behold, it is NNN from our current portfolio. It last traded at $41.69 and I will acquire 6 shares on Monday. Below, is the purchase history and average cost calculation.

I should note that coming in at #27 was Universal Health Realty Income Trust [UHT]. As expected, total returns are a function of current price, had the market battered UHT just a bit more, we might have welcomed a brand-new stock into the Portfolio for Ages. That’s how close it came to earning its place among greatness.

Such is the reality of discipline—sticking to a system, even when we acknowledge its inherent imperfections. The distinction that makes one stock slightly more attractive than another is largely arbitrary, as each stock’s fair value and future prospects are shaped by a web of assumptions, all carrying an inherent margin of error.

While there’s undeniable excitement in adding a new stock to the portfolio, we do so only when truly warranted (or at least algorithmically warranted). There is wisdom—and, dare I say, artistry—in maintaining a well-pruned portfolio, much like the delicate craftsmanship of a bonsai tree.

It has been nearly two years since opening a position in NNN and thus a perfect time to assess its recent performance in the context of the last 16 years.

Observations

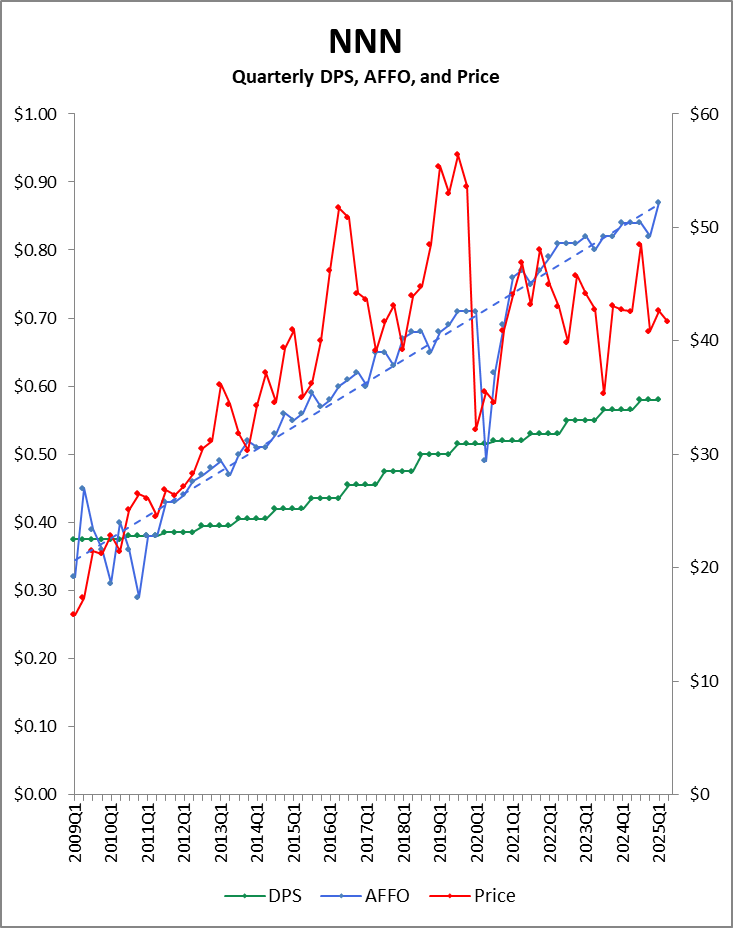

Stock Price

The chart above makes it clear that NNN is trading at 2016 levels. But it is actually worse than that. The prices above are quarter-ending prices. It just so happens that NNN first traded at $41.69 (and up to $41.98) in May of 2013.

NNN has traded sideways for 12 years despite steadily growing earnings.

Earnings

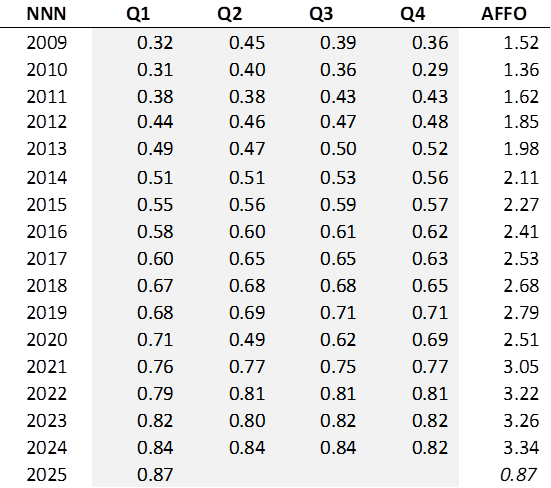

Magnitude/Trend

What’s not to like about NNN’s earnings, which because it is a REIT are really Adjusted Funds from Operations (AFFO)? AFFO has a compound annual growth rate of 5.4% over the last 15 years and, with the exception of one quarter during the pandemic, that growth has come with very little volatility.

Seasonality

There is virtually no seasonality to AFFO. Q1 is historically a shade low, averaging about 24.3% of the full year amount, with the other quarters all slightly higher than 25%.

CY2025Q1 AFFO of $0.87 is the best start to a calendar year ever.

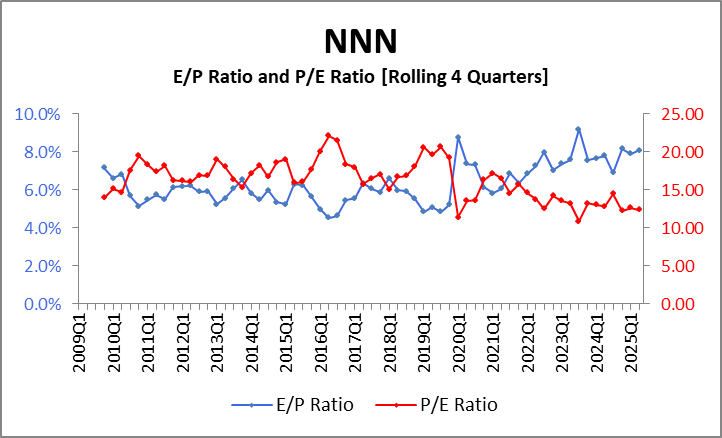

Despite the start to the year, NNN is trading at a trailing P/E Ratio of 12.37. Rarely has the P/E Ratio dropped below this level.

Dividends

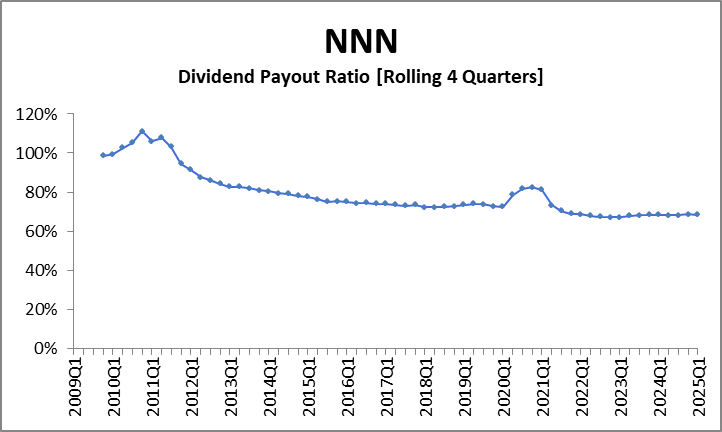

NNN is not yet a Dividend King; that distinction amongst REITs belongs solely to FRT, another Royal Dividends holding. However, it does have a 35-year streak and CY2025 dividends should be well covered with current payout levels hovering around 68%.

Thoughts on Investment

Investing in NNN right now is simply aimed at correcting a sector imbalance. That being said, it is certainly worthy of additional investment. Even though the Royal Dividends position has performed well with an average annualized return of 9.3%, it is still trading under fair value and is yielding a safe 5.6%.

It is a good time to add some shares.