This week, five of the portfolio holdings ranked in the Top Ten: FMCB, MDT, PPG, SJW, and TGT.

| Ticker | Account Value |

| FMCB | 2,910.00 |

| MDT | 2,118.24 |

| PPG | 2,442.83 |

| SJW | 2,793.12 |

| TGT | 2,751.84 |

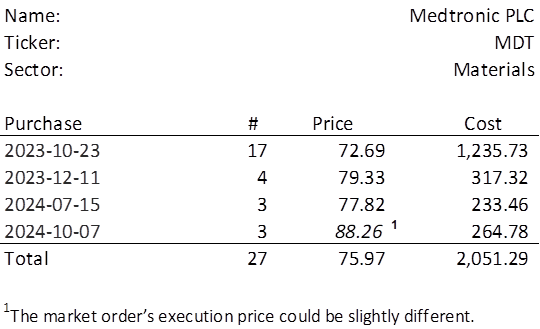

There is overweighting problems at this time. The lowest amount belongs to MDT which last traded at $88.26. Therefore, I will acquire 3 shares of MDT on Monday. Below, is the purchase history and average cost calculation.

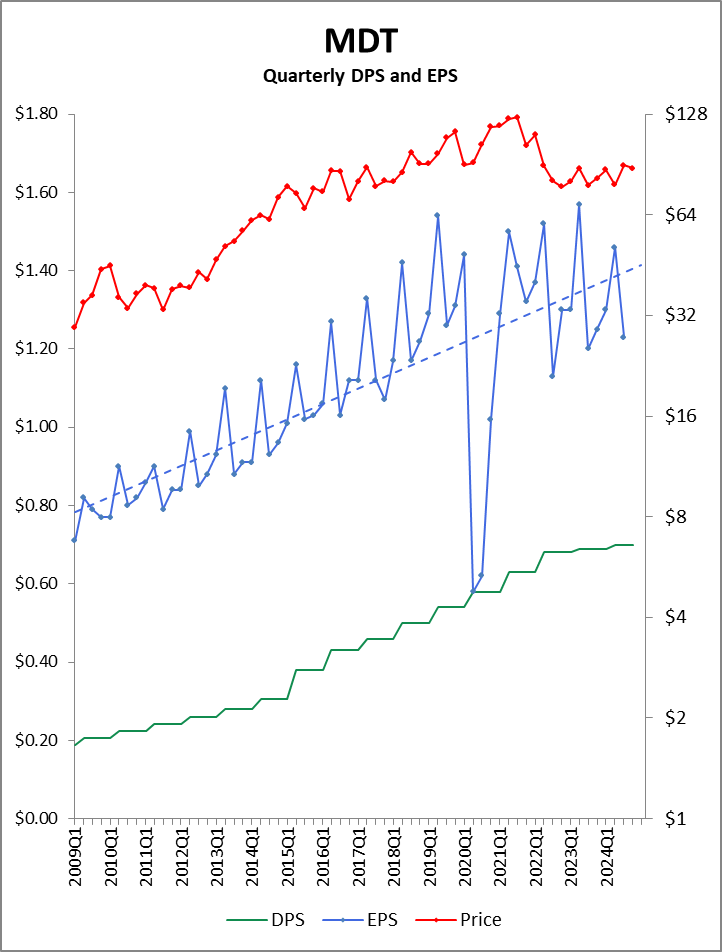

There has been an earnings announcement since I last added to the MDT position, so let’s take a quick look below at the most recent performance in the context of the last 16 years.

Observations:

- EPS exhibit a very prominent seasonal effect where the second calendar quarter (the fourth quarter of MDT’s fiscal year) typically marks the high point of the year.

- With the exception of EPS bottoming out in early 2020 as a result of the pandemic, there is a rather strong positive trend.

- The last reported EPS of $1.23 was $0.03 greater than the same quarter a year ago.

- EPS have become a bit more volatile and do appear to be in a flatter channel over the previous six years.

- Dividend increases have slowed, quite possibly due to the channeling of the EPS. The $0.70 quarterly dividend is well-covered.

The price has climbed since the last investment by Royal Dividends and trades at a P/E Ratio of 16.8. There is nothing wrong with picking up a few shares here as the stock price consolidates just shy of a fair value estimate of $93.00.