This week will count as the second of three ‘off’ weeks intended to restore the $250+ per week pace of investment due to the acquisition of EPD. However, there is over $250 ($263.24 to be exact) of uninvested income in the account and I am going to deploy it.

This week, five of the portfolio holdings ranked in the Top Ten: FMCB, MDT, PPG, SJW, and TGT.

| Ticker | Account Value |

| FMCB | 2,903.25 |

| MDT | 1,636.95 |

| PPG | 2,481.78 |

| SJW | 1,691.57 |

| TGT | 1,834.20 |

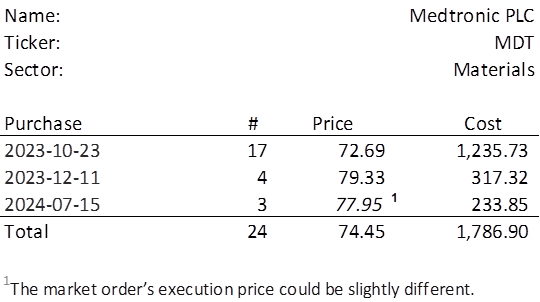

While there is no sector imbalance at this time, there is a position imbalance. QCOM and TDS are off limits for additional investment, but they’re not in the Top 10 so there is no concern. The lowest amount belongs to MDT which last traded at $77.95. Therefore, being careful not to go over the $263.24 available, I will acquire 3 shares of MDT on Monday. Below, is the purchase history and average cost calculation.

It has been over 6 months since I last invested in MDT so let’s take a quick look below at the most recent performance in the context of the last 15 years1.

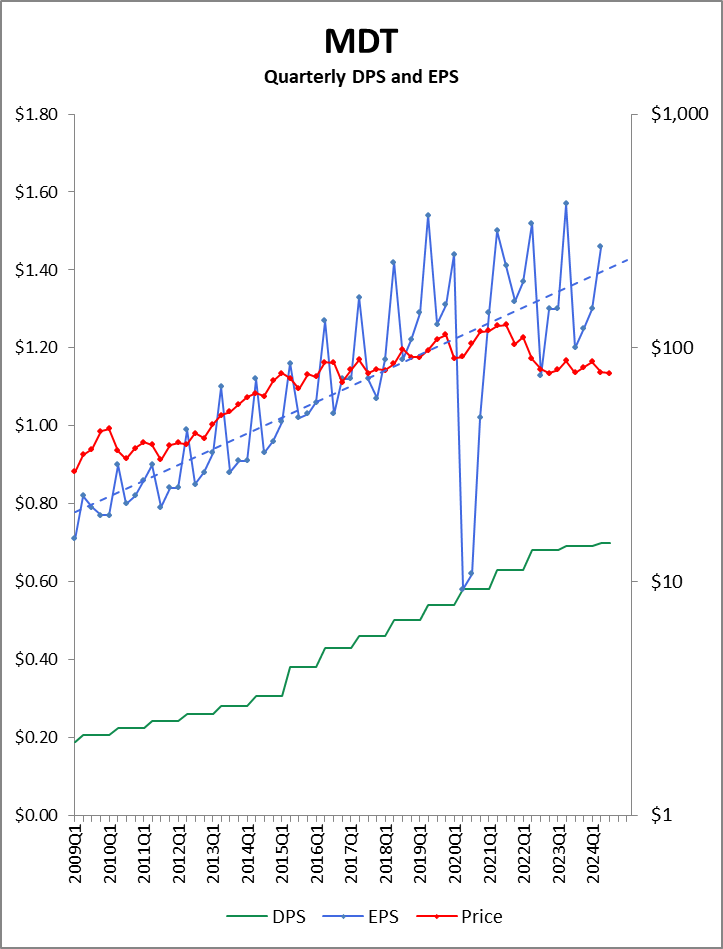

Observations:

- EPS exhibit a very prominent seasonal effect where the second calendar quarter (the fourth quarter of MDT’s fiscal year) typically marks the high point of the year.

- With the exception of EPS bottoming out in early 2020 as a result of the pandemic, there is a rather strong positive trend.

- The last reported EPS fell $0.11 short of the all-time high of $1.57 from the same quarter a year ago.

- EPS have become a bit more volatile and do appear to be in a flatter channel over the previous five years.

- Dividend increases have slowed, quite possibly due to the channeling of the EPS. The $0.70 quarterly dividend is well-covered.

The price has dropped off such that the stock is now trading at a P/E Ratio of 15. This is uncharacteristically low, and one can see that the price seems to have fallen a bit too far. Or seen another way, the price suggests Wall Street anticipates further decline from here. I do not share that view. I think picking up a few shares under $80 is a perfectly sane thing to do.

- The EPS numbers that come from macrotrends.com were found to be diluted and therefore, markedly lower than those reported as unadjusted earnings at Sure Dividend and Charles Schwab. The non-diluted numbers are more appropriate for evaluating the adequacy of the dividend and so I chose to search for a source that had these numbers going back to 2009. The source: tradingeconomics.com. ↩︎