This week, four of the portfolio holdings ranked in the Top 10: FMCB, MDT, MMM, and PII.

| Ticker | Account Value |

| FMCB | 2,829.00 |

| MDT | 1,348.95 |

| MMM | 2,377.51 |

| PII | 1,437.76 |

As of this writing, the portfolio no longer has a sector imbalance. However, there is currently an overexposure to the following positions (tickers in bold made the Top Ten this week): FMCB, MMM, MO, QCOM, and TDS. None of these tickers are eligible for additional investment at this time. No matter, the lowest amount belongs to MDT and it is eligible for further investment.

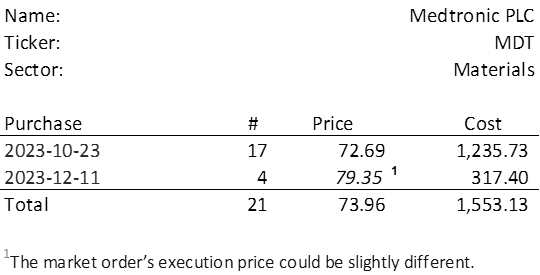

MDT last traded at $79.35. Therefore, in order to invest a minimum of $250 in MDT, I need to purchase 4 shares on Monday. Below, is the purchase history and average cost calculation.

It’s nice to pick up a few more shares before MDT goes ex-dividend on 2023-12-19. Let’s take this opportunity to examine some graphs. In the graph below, we can observe that MDT has had positive earnings in all but a couple of quarters, has been steadily but slowly increasing those earnings over time, and the steady increase in the dividend has finally reached a point where paying for those dividends is becoming a bit more challenging.

Consistent with the first graph, the dividend payout ratio is definitely elevated.

Adding shares of MDT at this time is probably getting them at a slight bargain; the earnings-to-price ratio is only slightly elevated.

Finally, the chart below shows the calendar year tallies for dividends per share (DPS) and earnings per share (EPS). DPS has grown at a rate of 9.2% annually while EPS has only grown at a rate of 3.5%. More concerning, EPS hasn’t grown at all over the last 12 years.

Though MDT has seen unrealized gains of 9.2% in the 49 days it has graced the portfolio, I am concerned. Zero growth in earnings from here will surely mean zero growth in the dividend. MDT could quickly become a company who raises its dividend a penny each year or worse end up reducing its dividend.

Or, and this might just blow your mind – it’s the holidays after all and man do I love this time of year – the earnings could spring up from a decade-long consolidation and the forthcoming dividends could be breathtaking.