This week, six of the portfolio holdings ranked in the Top 10: FMCB, MDT, PII, PPG, SJW, and TGT.

| Ticker | Account Value |

| FMCB | 2,928.60 |

| MDT | 1,714.44 |

| PII | 1,496.06 |

| PPG | 2,443.21 |

| SJW | 1,517.86 |

| TGT | 1,461.30 |

There are imbalances in the portfolio due to the strong performance of TDS and to a lesser degree, QCOM. Now, those two stocks did not make the Top 10, but had they somehow weaseled their way in, rest assured – they would not have been blessed with additional funds. Their strong performance not only rules themselves out but has also caused a sector imbalance such that only the Energy sector is eligible for investment this week. Thus, even though TGT is the stock with the lowest account value, being a consumer discretionary stock, it is not eligible for investment. Ditto, the others. In fact, because there were no energy stocks in the Top 10, I had to relax the criterion ever so slightly and grab the Top 13 in order to capture the first energy stock and it isn’t current portfolio holding NC.

Folks, it is time to add a new position to the Portfolio for the Ages!

Enterprise Products Partners L.P.

First some boilerplate. Here is the profile from Charles Schwab:

Enterprise Products Partners L.P. provides midstream energy services to producers and consumers of natural gas, natural gas liquids (NGLs), crude oil, petrochemicals, and refined products. It operates in four segments: NGL Pipelines & Services, Crude Oil Pipelines & Services, Natural Gas Pipelines & Services, and Petrochemical & Refined Products Services. The NGL Pipelines & Services segment offers natural gas processing and related NGL marketing services. It operates natural gas processing facilities located in Colorado, Louisiana, Mississippi, New Mexico, Texas, and Wyoming; NGL pipelines; NGL fractionation facilities; NGL and related product storage facilities; and NGL marine terminals. The Crude Oil Pipelines & Services segment operates crude oil pipelines; and crude oil storage and marine terminals, which include a fleet of approximately 250 tractor-trailer tank trucks that are used to transport crude oil. It also engages in crude oil marketing activities. The Natural Gas Pipelines & Services segment operates natural gas pipeline systems to gather, treat, and transport natural gas. It leases underground salt dome natural gas storage facilities in Napoleonville, Louisiana; owns an underground salt dome storage cavern in Wharton County, Texas; and markets natural gas. The Petrochemical & Refined Products Services segment operates propylene fractionation facilities, including propylene fractionation units and propane dehydrogenation facilities, and related marketing activities; butane isomerization complex and related deisobutanizer operations; and octane enhancement, isobutane dehydrogenation, and high purity isobutylene production facilities. It also operates refined products pipelines and terminals; and ethylene export terminals; and provides refined products marketing and marine transportation services. Enterprise Products Partners L.P. was founded in 1968 and is headquartered in Houston, Texas.

Enterprise Products Partners L.P. [EPD] is a large midstream energy company with a spotless reputation. It owns 50,000 miles of pipelines, possesses storage capacity for 14 billion cubic feet of natural gas, and over 300 million barrels of storage capacity for natural gas liquids (NGLs). I would be remiss if I didn’t mention that there are significant regulatory obstacles to getting new pipelines in the ground. With so many miles of pipelines already in the ground, a company like EPD possesses a massive competitive advantage.

Further, being a midstream company, a conduit for energy, EPD’s price does not fluctuate with the price of oil or natural gas like stock prices for upstream or downstream energy companies do. Don’t get me wrong, when the price of oil tanks, you’ll note EPD does the same, because the market sucks. But it recovers quickly because ultimately EPD is paid to move (or store) the product, regardless of its price.

Master Limited Partnerships

EPD is organized as a master limited partnership (MLP). In addition to regular corporations, serious income investors have to consider Real Estate Investment Trusts (REITs), Business Development Companies (BDCs), and MLPs. Why? Because each of these corporate structures are required to distribute a high percentage of earnings to shareholders, or in the case of MLPs, unitholders.

MLPs are the most tax efficient vehicle for returning money to investors. They are not taxed at the organization level and thus avoid the double taxation issues of corporations.

The quarterly payments unitholders receive are often referred to as dividends. I will certainly refer to them as dividends from time to time. However, the more accurate term is ‘distribution’. Distributions are treated differently than dividends at tax time. This is because about 80% to 100% of MLP distributions are deemed a ‘return of capital’. The unitholder does not pay taxes immediately on the return of capital portion of the distributions. Return of capital effectively reduces your cost basis in the MLP and this ultimately drives the amount you will pay in taxes when you sell your units. Let’s take a look at an example.

Suppose you buy 100 units of EPD for $30 per unit and that you hold them for 3 years. Perhaps EPD now trades for $40 per unit and it has paid out $8 in distributions, $7 of which is return of capital and $1 regular income (think dividend). You would pay taxes at your regular income tax rate on the $100 as you received it over the years. If you choose to sell, your proceeds are $4,000 and your cost is adjusted from $3,000 to $2,300. The $1,700 gain would be taxed at the long-term capital gains rate. Someone’s personal income tax rates will vary with their annual income in any given year, but ultimately, the taxes paid upon sale of the MLP should be less than if one had to pay taxes on all of the income each year.

If you’re concerned about the tax implications or that owning an MLP seems too complicated, just know that: (1) purchasing and selling an MLP is no different than with a regular stock, and (2) the MLP will provide each unitholder a Schedule K-1 each year at tax time. It contains all the information you need to complete your income taxes.

One should not avoid MLPs because of the small inconvenience of dealing with an extra schedule at tax time.

One last comment1 on MLPs: it is perfectly fine to hold them in a non-taxable account like an IRA or Roth IRA, but one only gets the full effect of the tax advantages when they’re in a taxable account.

The Details

Data as of 2024-06-29

| Name | Enterprise Products Partners L.P. |

| Ticker | EPD |

| Website | Investor Relations |

| Sector | Energy |

| Dividend Streak | 26 years |

| Last Price | $28.98 |

| Div Amt (quarterly) | $0.515 |

| Ann Dividend | $2.06 |

| Last Ann Div Inc | 5.2% |

| Dividend Yield | 7.1% |

| Payout Ratio2 (ttm) | 57.7% |

| Beta (5-yr, mon) | 1.094 |

| P/E Ratio3 (ttm) | 8.1 |

| Margin of Safety | 0% |

Reasons to Invest

There are perhaps 60 publicly traded MLPs, and EPD is the largest and best of them. I have never read an article or analysis about EPD that wasn’t glowing.

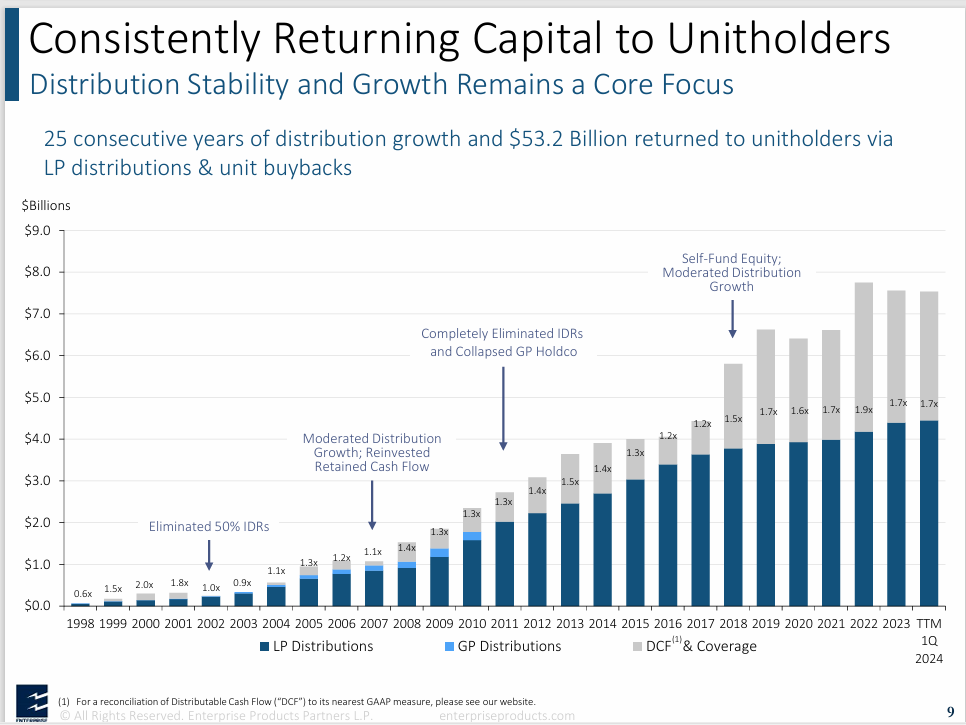

It has the longest dividend streak of any MLP and it consistently pays a yield north of 7%.

The day-to-day stock price volatility is almost nonexistent. It has taken 4 years for EPD to trade back to where they were pre-pandemic. However, the earnings and the DCF never really suffered at all. It would have been great to grab EPD in March of 2020, but that opportunity is gone. That being said, it is not an awful thing to purchase a great company at a fair price.

I will be opening a position by acquiring 35 shares on Monday.

- Okay, two more comments, but only for the truly bored:

First, MLPs may generate taxable income in a retirement account if they obtain income that is unrelated to their core business. As an example, the MLP could loan out drilling equipment or the use of their pipelines to another company, thereby producing rental income. Another example would be if the MLP borrowed money to finance operations or the acquisition of certain assets. The income generated from that activity would be considered ‘debt-financed income’ and would not have been possible had the money not been borrowed. The income in these situations is considered Unrelated Business Taxable Income (UBTI) and is subject to taxation in retirement accounts when total UBTI across all applicable investments held in such accounts equals $1,000 or more. When that happens, Form 990-T must be filed by the account holder. How likely is it you would ever have to file a Form 990-T? Let’s take a look at an example: suppose the only MLP you own is EPD and ALL of EPD’s $2.06 annual distribution per unit is UBTI. You would have to own 486 shares in a tax advantaged account to produce $1,000 of UBTI. That’s a $14,000 investment. Possible? Absolutely. But is it possible that all of EPD’s distribution could be unrelated to its core business. No. In fact, recent distributions have been 100% return of capital and 0% qualifying for UBTI. This means the number of shares of EPD or some combination of other MLPs would have to be much larger to flirt with the $1,000 threshold. Suffice it to say that it is not at all common for an individual to have to file a Form 990-T. If you end up being one of those people, be proud of your wealthy self.

Second, one can get around the Schedule K-1 and UBIT issues by investing in MLPs via an ETF. However, show me an ETF of MLPs that doesn’t include a considerable amount of garbage. Royal Dividends will very likely never own a second MLP let alone many. ↩︎ - For MLPs, dividend safety is more appropriately assessed by a Payout Ratio looking at the ratio of distributions paid to distributable cash flow (DCF), instead of earnings, over the past twelve months. In fact, the industry likes to look at ‘Coverage Ratio’ which is nothing more than the ratio of DCF to distributions paid or the inverse of the Payout Ratio. ↩︎

- The P/E Ratio gets the same treatment as with the Payout Ratio; earnings are replaced by DCF. ↩︎