This week, five of the portfolio holdings ranked in the Top 10: FMCB, PPG, SJW, TGT, and VZ.

| Ticker | Account Value |

| FMCB | 2,880.00 |

| PPG | 2,464.87 |

| SJW | 2,536.57 |

| TGT | 2,457.92 |

| VZ | 7,395.06 |

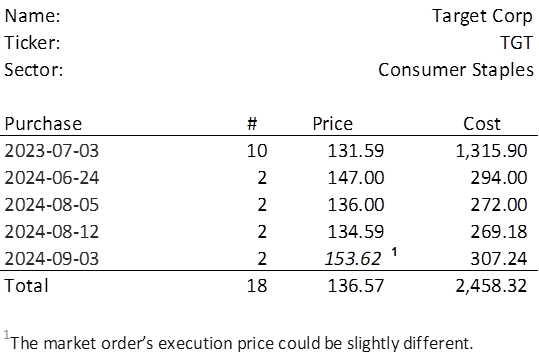

There are no restrictions on this week’s investment. The lowest amount belongs to TGT which last traded at $153.62. Therefore, in order to invest a minimum of $250 in TGT, I need to purchase 2 shares on Tuesday (the markets are closed on Monday in recognition of Labor Day). Below, is the purchase history and average cost calculation.

TGT announced earnings on 2024-08-21 so it is time to take an admittedly superficial look at how those results and TGT’s performance fit into a more historical context. For in depth analysis and detail of any earnings report, I highly encourage reading the corporate press releases and listening to the earnings conference calls. I practice what I preach and have read many press releases and listened to recorded versions of conference calls (no way am I getting up at 8am for that kind of boredom). However, I do not wish to regurgitate duplicative content here at Royal D; I would rather present something that I myself can never find or am unwilling to pay for.

As a reminder, the price is charted against the log scale axis on the right, DPS and EPS are using the linear scale axis on the left. Earnings have become much more volatile over the last 11 years or so and, with the exception of 2015Q1 at ($4.14), always positive. I suspect this negative outlier was due to the recognition of a one-time event such as a goodwill write-off, but I’m not bored enough to do the frustrating research required to confirm my hunch. Earnings have been trending upward over the past 15 years (dotted blue line).

Dividends have been trending upward as well and should be well covered for the foreseeable future.

As you can see from the Royal Dividends purchase history, this upcoming 2-share acquisition will very likely be at the highest price yet. This is a sign that TGT has begun to move with what has turned out to be a very good year from an earnings perspective. This past quarter’s EPS of $2.57 came in $0.39 higher than expectations, but I don’t really care about expectations. Of most importance is how EPS are trending over time and if they’re sufficient to cover DPS. The dividend payout ratio is just under 50%. There is no reason to doubt that annual increases will continue.

Earnings over the last three quarters are 32% higher than the equivalent period from the prior year ($7.59 vs $5.74). The price is not even 8% higher than where it ended 2023. I find it interesting that TGT reached $167.40 right after the earnings announcement on the 21st but fell from there. I think it can get back there with another strong EPS announcement in Q4.

Picking up a couple of shares while it is still a bit undervalued seems like the right thing to do.