This week, six of the portfolio holdings ranked in the Top 10: BKH, FMCB, MDT, PPG, SJW, and TGT.

| Ticker | Account Value |

| BKH | 2,708.10 |

| FMCB | 2,928.60 |

| MDT | 1,714.44 |

| PPG | 2,443.21 |

| SJW | 1,517.86 |

| TGT | 1,461.30 |

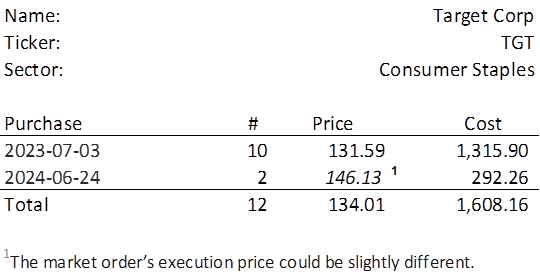

There are no restrictions on this week’s investment. The lowest amount belongs to TGT which last traded at $146.13. Therefore, in order to invest a minimum of $250 in TGT, I need to purchase 2 shares on Monday. Below, is the purchase history and average cost calculation.

Nearly a year has passed since I first opened a position in TGT on 2023-07-03. It is a good time to examine TGT’s recent performance in the context of a much longer time period, in this case 15 years.

Earnings have become much more volatile over the last 11 years or so and with the exception of 2015Q1 at ($4.14) always positive. I suspect this negative outlier was due to the recognition of a one-time event such as a goodwill write-off, but I’m not bored enough to do the frustrating research required to confirm my hunch. Earnings have been trending upward over the past 15 years (dotted blue line).

Dividends have been trending upward as well and should be well covered for the foreseeable future.

The stock price has stalled since mid-2020, perhaps because EPS have come down from an all-time high of $13.58 for CY2021. But 2023 finished at a second best of $7.84 and the first half of 2024 is $1.08 ahead of the first half of 2023, so things are looking good. The fact of the matter is TGT is still undervalued.

Picking up a few shares of an undervalued stock that has already done fairly well for the portfolio (14.4% return over 355 days) seems like a good idea; there’s still room for growth.