This week, four of the portfolio holdings ranked in the Top 10: FMCB, MMM, MO, and TDS.

| Ticker | Account Value |

| FMCB | 1,930.00 |

| MMM | 2,302.07 |

| MO | 2,627.40 |

| TDS | 2,839.35 |

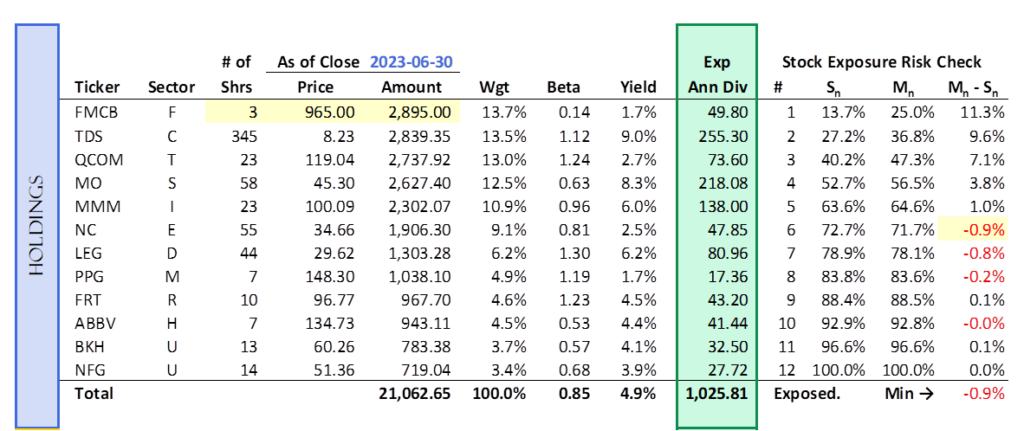

The lowest amount belongs to FMCB. However, purchasing just 1 share of FMCB would cause a breach in stock exposure within the portfolio. More specifically, the six most heavily weighted stocks would be 72.7% of the portfolio, about 1% higher than the maximum allowable weight of 71.7%.

Investing $250 into MMM, MO, or TDS would do the same. Therefore, it is time to add a new position to the Portfolio for the Ages!

For the second time, we have the opportunity to add a new position to the original 11 portfolio stocks. The highest ranked stock in the weekly Top 10, not already in the portfolio is Target Corp [TGT]. A $1,000 stake in TGT requires the purchase of 8 shares. However, because I have received another $276.07 in dividends since the last build-up of $250 in dividends, I will acquire another 2 shares of TGT.

Purchasing 10 shares of TGT will not create an exposure risk violation from either a stock or sector perspective. However, adding a 13th position does lower the maximum allowable stock weights.

Let’s crack open a Bud Light and find out a little more about this new addition.

Target Corp

After a strong earnings report on May 17th, Target proceeded to steadily drop over 20% over the next three weeks. Why? Because in anticipation of Pride Week, certain Target stores increased the visibility of a certain, ‘tuck-friendly’ adult-sized, bathing suit that might be of interest to certain individuals belonging to one of the subsets of humanity for which Pride Week exists. If this relatively unimportant corporate decision was somehow important to you, then you fell into one of two categories: (1) you have an interest in such bathing suits, or (2) you want everyone to be like you. Apparently, enough people fall into category 2 that a small subset of them chose to boycott Target and their impact has been significant. Or at least it is believed to have had a large impact, since it is the stock price that has fallen. We won’t know for sure until the next quarterly earnings update.

Target and Budweiser are probably the most visibly affected from this politically inspired, conservative backlash so far. They are not the first and they won’t be the last. It’s everyone’s right to vote with their dollars. But threatening employees? Broadcasting falsehoods? And I thought I had time on my hands.

None of this is important to me.

Here’s what I know: Target isn’t going anywhere and better yet; their stock is on sale. Why niggle? Just like Barbie, Target is so much more than a bathing suit.

Here is the profile from Yahoo! Finance:

Target Corporation operates as a general merchandise retailer in the United States. The company offers apparel for women, men, boys, girls, toddlers, and infants and newborns, as well as jewelry, accessories, and shoes; and beauty and personal care, baby gear, cleaning, paper products, and pet supplies. It also provides dry grocery, dairy, frozen food, beverages, candy, snacks, deli, bakery, meat, and food service; electronics, which includes video game hardware and software, toys, entertainment, sporting goods, and luggage; and furniture, lighting, storage, kitchenware, small appliances, home décor, bed and bath, home improvement, school/office supplies, greeting cards and party supplies, and other seasonal merchandise. In addition, the company sells merchandise through periodic design and creative partnerships, and shop-in-shop experience; and in-store amenities. Further, it sells its products through its stores; and digital channels, including Target.com. Target Corporation was incorporated in 1902 and is headquartered in Minneapolis, Minnesota.

The Details

Data as of 2023-07-03

| Name | Target Corp |

| Ticker | TGT |

| Website | Investor Relations |

| Sector | Consumer Staples |

| Dividend Streak | 52 years |

| Last Price | $131.90 |

| Div Amt (quarterly) | $1.08 |

| Ann Dividend | $4.32 |

| Last Ann Div Inc | 20.0% |

| Dividend Yield | 3.3% |

| Payout Ratio (ttm) | 73.6% |

| Beta (5-yr, mon) | 1.01 |

| P/E Ratio (ttm) | 22.47 |

| Margin of Safety | 0% |

Reasons to Invest

Target is trading at fair value. That, in and of itself, is a good reason to consider investing in Target. Like the majority of Dividend Kings, it typically trades at a premium. Royal Dividends tends to grab Kings when something in the news has caused the stock price to be oversold. This time it happens to be Target. I suspect this boycott will be short-lived and Target’s earnings will pick up where they left off in short order. After all, TGT has grown its earnings-per-share at an average annual rate of nearly 13% over the last decade. That’s the second reason. The third reason is related to their dividend. No, it is not the 52-year streak. It isn’t the higher-than-usual 3.3% yield either. Two weeks ago, they announced another increase. Now, it isn’t the massive 20% increase it was a year ago, but it is a nearly 2% increase from $1.08 to $1.10 per quarter. Nothing stops Target.

On a more personal note, I think Target is an excellent place to get your groceries. Sure, it is a massive department store, but the grocery section is not too big, not too small. There is choice, but not too much choice. Their own branded products are of good quality. My favorite frozen pizza in this world is Target’s Good & Gather Spinach & Goat Cheese. Wood-fired. Ice Box Frozen. Oven-reheated. It’s delicious.

I will be purchasing 10 shares of TGT on Monday morning.