This week, three of the portfolio holdings ranked in the Top Ten: FMCB, PPG, and SJW.

| Ticker | Account Value |

| FMCB | 2,970.15 |

| PPG | 3,063.25 |

| SJW | 2,904.40 |

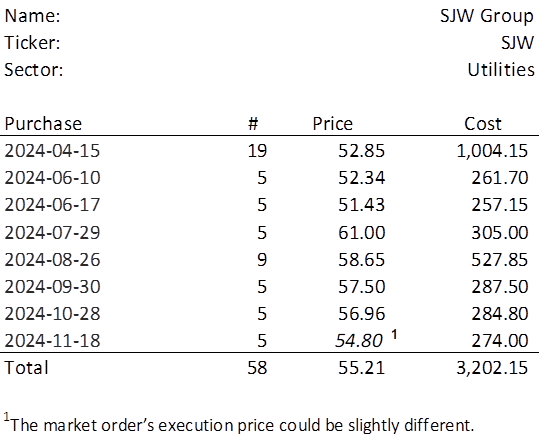

The lowest amount belongs to SJW which last traded at $54.80. Therefore, I will acquire 5 shares of SJW on Monday. Below, is the purchase history and average cost calculation.

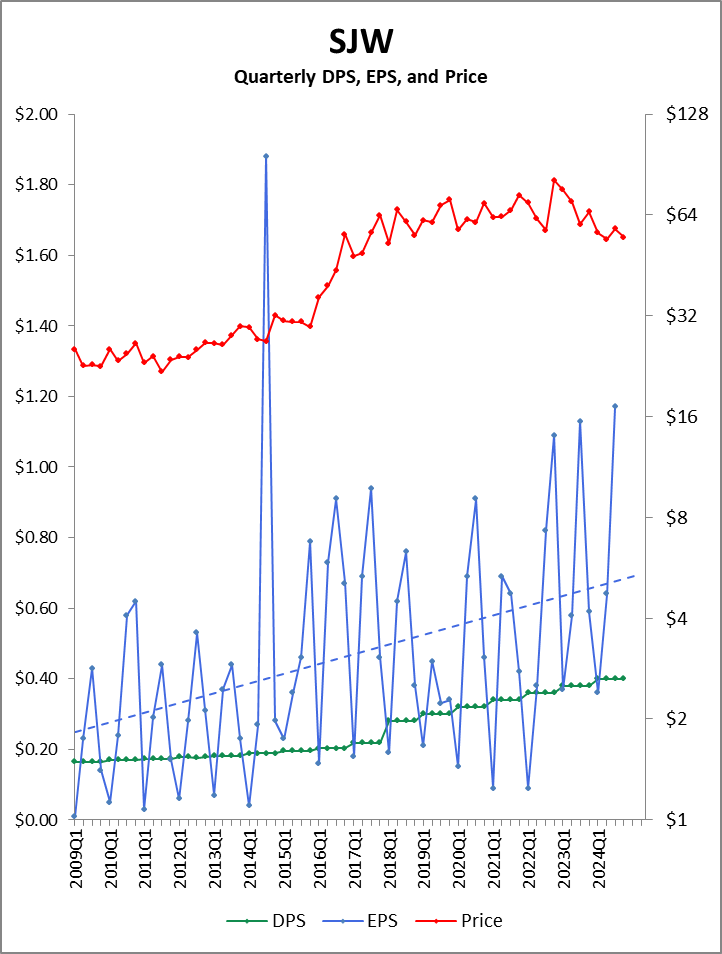

Let’s take a quick look below at the most recent performance in the context of the last 16 years.

Observations

- SJW earnings exhibit strong seasonality. A typical year sees a very low first quarter (7%), a significantly higher second quarter (27%), a massive third quarter (41%), and finally a fourth quarter that is perhaps on par with the second quarter or perhaps a little lower (25%).

- The last three quarters have been the second best start to a calendar year in SJW’s history. The absolute best year (2014) included the $1.88 Q3 spike, the result of one-time gains on the sale of real estate assets. In the absence of the sale of that real estate, this year is off to the best start and has every chance of being the best year ever from an earnings perspective.

- The current price of $54.80 is lower than where it ended CY2016 at $55.98. Yet, the low point of SJW’s CY2024 earnings guidance of $2.68 would be 8.5% higher than CY2016 earnings.

- It would appear that SJW’s price has remained flat even though EPS growth has really begun to move. Note that the Q1s of the last two years are visibly higher than in years past. Further, the last three Q3s have been markedly higher than those of the past and they have been increasing as well.

- Note the steady climb of dividends and their relative safety. Now, even the lowest quarters are nearly clear of the dividend level.

So long as water remains popular, SJW has more upward price potential.