This week, five of the portfolio holdings ranked in the Top 10: FMCB, MDT, PPG, SJW, and TGT.

| Ticker | Account Value |

| FMCB | 2,910.00 |

| MDT | 1,888.80 |

| PPG | 2,423.45 |

| SJW | 1,765.23 |

| TGT | 1,788.00 |

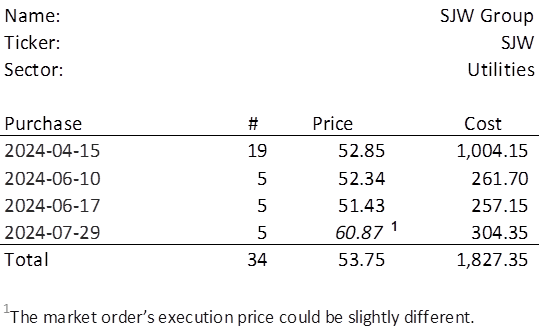

The lowest amount belongs to SJW which last traded at $60.87. Therefore, in order to invest a minimum of $250 in SJW, I need to purchase 5 shares on Monday. Below, is the purchase history and average cost calculation.

Below, I present some graphs that provide a glimpse at the last 15 years in SJW’s long history.

2024Q2 EPS of $0.64 is $0.06 higher than the prior year’s second quarter. 2024H1 EPS of $1.00 is $0.05 or 5.3% higher than 2023H1 EPS. It is also the second-best first half of a calendar year ever (the best first half was 2017H1 EPS of $1.08).

Dividends continue to increase each year and should be well covered for the foreseeable future.

SJW is trading at levels first seen in 2017Q4, but the stock price has been trending upward since 2024-06-13. I wouldn’t be surprised if this is the last time SJW qualifies for an additional installment; it will cease being a bargain when the stock price approaches $70.00.