This week, six of the portfolio holdings ranked in the Top 10: BKH, FMCB, PII, PPG, SJW, and TGT.

| Ticker | Account Value |

| BKH | 2,734.11 |

| FMCB | 2,955.00 |

| PII | 1,478.01 |

| PPG | 2,439.79 |

| SJW | 1,000.73 |

| TGT | 1,460.00 |

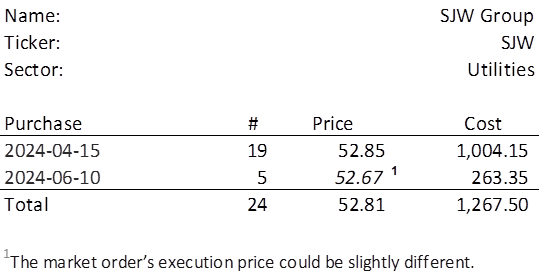

While there is no sector imbalance at this time, there is a position imbalance. LEG, QCOM, and TDS are off limits for additional investment. The lowest amount belongs to SJW which last traded at $52.67. Therefore, in order to invest a minimum of $250 in SJW, I need to purchase 5 shares on Monday. Below, is the purchase history and average cost calculation.

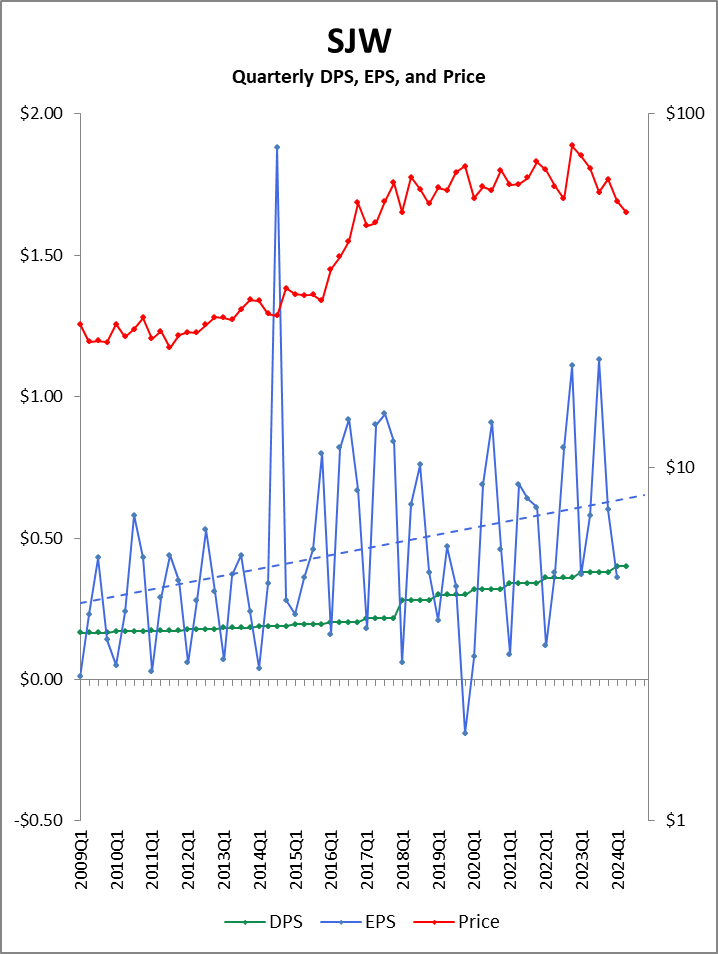

When I add to a position, I like to check on the company’s performance since the last time I invested in it. It hasn’t been very long since the position in SJW was created, but I chose not to present the historical views that follow at the time. However, for this post, I present some graphs that provide a glimpse at the last 15 years in SJW’s long history. At a quick glance, one should very quickly see how SJW came to be in the Top 10 and why Royal Dividends initiated a position.

Earnings have become more volatile as SJW has grown through acquisitions. However, the EPS has always been positive save 2019Q4 when earnings came in at $(0.19). I suspect this was due to the recognition of a one-time event more than ‘water’ being a product in poor demand. There is a prominent seasonality to the earnings. And while the first quarter is usually the lowest of the year, 2024Q1 EPS of $0.36 is the second-best start to a year ever. Earnings have been trending upward over this time frame (dotted blue line).

Dividends have been trending upward as well and should be well covered for the foreseeable future.

One thing that is not trending upward is the share price. It hasn’t budged since late 2016. Now the earnings have become increasingly more volatile, but the lows are increasing and the highs are increasing. It is only a matter of time before the stock price drifts upward again.

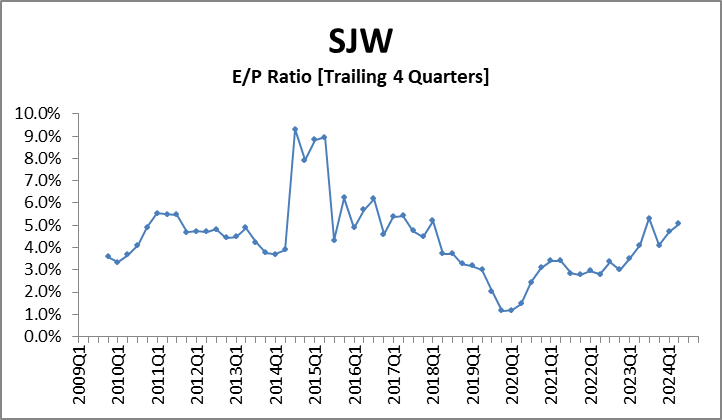

The Earnings-to-Price Ratio or Earnings Yield is the most attractive it has been in the last few years.

Certainly, if the price were to drop from $52.67 today and perhaps fall into the $40s, SJW would be extremely attractive, but right now is certainly a good time to be adding shares to this position.