This week, five of the portfolio holdings ranked in the Top 10: BDX, HTO, PPG, QCOM, and TGT.

| Ticker | Account Value |

| BDX | 2,913.46 |

| HTO | 3,303.72 |

| PPG | 3,082.24 |

| QCOM | 3,343.74 |

| TGT | 2,734.41 |

The lowest amount belongs to TGT. Unfortunately, investing $250+ into TGT will create a portfolio imbalance where technically only 1 stock would be eligible for further investment and that stock is FRT. Unfortunately, FRT did not make the Top Ten. That can only mean one thing:

It is time to add a new position to the Portfolio for the Ages!

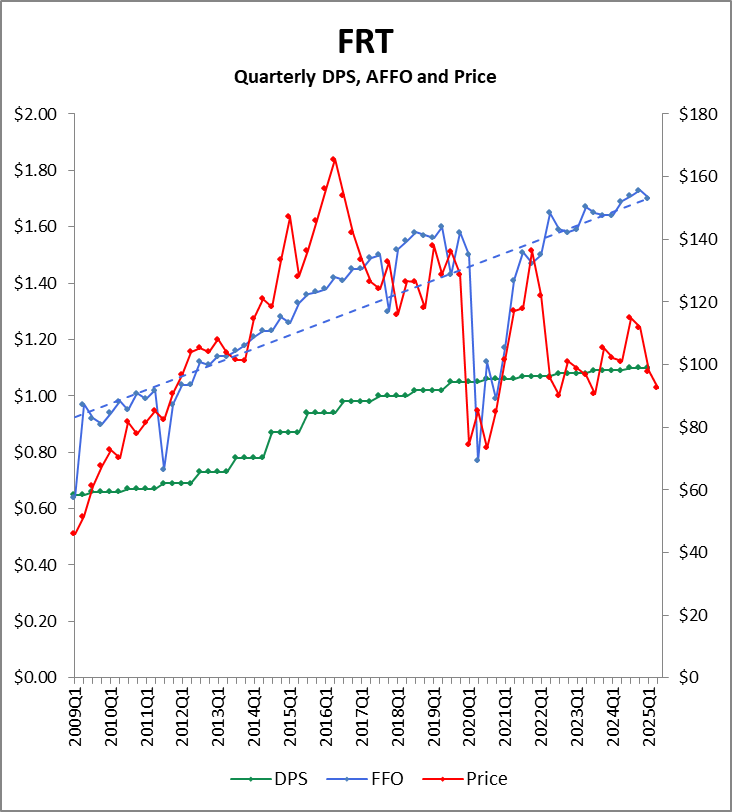

FRT is not performing poorly as an investment; there is a $17.10 profit after 1,034 days. If that is performing poorly, oh Dear Reader, you have not been investing long enough. Further, FRT is not performing poorly as a going concern either. They just announced FFO that were the highest ever for a first quarter. In fact, that’s nine straight quarters where the FFO were the highest ever for that respective quarter. Here’s what that looks like and how much that performance diverges from the stock price.

The reason FRT hasn’t been making the Top Ten is rather simple – the valuation multiple has been coming down and is anticipated to be even lower in the future. Using the valuation multiples at which it used to trade, one could easily see the fair value north of $150. Apparently, the market does not wish to pay that kind of money for a well-managed, profitable REIT anymore1. The fair value is estimated to be around P/FFO = 12 or $86 per share.

Now you might argue vociferously that this estimate is far too conservative, but Sure Dividend takes a measured approach to valuation and this is no mistake. And, it does explain the poor price performance over the last few years. If it proves too conservative, then sure, we missed an opportunity to add more funds to the position, but we won’t complain because ultimately, we’ll be happy to see the position produce the returns we would have expected from the beginning. Regardless, it is the fair value estimate, and the current price’s relation to it, that keeps FRT out of the Top Ten. For now.

There is no current sector imbalance, nor will there be one when $1,000 is used to open a new position in the Materials stock that came in at #1 in this week’s Top Ten.

Stepan Co.

Here is the profile from Schwab:

Stepan Company, together with its subsidiaries, produces and sells specialty and intermediate chemicals to other manufacturers for use in various end products worldwide. It operates through three segments: Surfactants, Polymers, and Specialty Products. The Surfactants segment offers surfactants that are used in consumer and industrial cleaning and disinfection products, including detergents for washing clothes, dishes, carpets, and floors and walls, as well as shampoos and body washes; and other applications, such as fabric softeners, germicidal quaternary compounds, disinfectants, lubricating ingredients; emulsifiers for spreading agricultural products; and industrial applications comprising latex systems, plastics, and composites. The Polymers segment provides polyurethane polyols that are used in the manufacture of rigid foam for thermal insulation in the construction industry, as well as a base raw material for coatings, adhesives, sealants, and elastomers (CASE); polyester resins used in coating applications; specialty polyols, such as CASE and powdered polyester resins; and phthalic anhydride that is used in unsaturated polyester resins, alkyd resins, and plasticizers for applications in construction materials, as well as components of automotive, boating, and other consumer products. The Specialty Products segment offers flavors, emulsifiers, and solubilizers for use in food, flavoring, nutritional supplement, and pharmaceutical applications. Stepan Company was founded in 1932 and is headquartered in Northbrook, Illinois.

Bottom line: this company manufactures all sorts of chemical concoctions that other companies need for their products. They have 2,200+ employees including some 230 scientists at their disposal. They have a worldwide footprint and tons of clients and business partners. They’re the type of company that finds its way into every household but is anything but a household name. Their products go into the products you know by name.

The Details

Data as of 2025-05-25

| Name | Stepan Co. |

| Ticker | SCL |

| Website | Investor Relations |

| Sector | Materials |

| Dividend Streak | 57 years |

| Last Price | $54.43 |

| Div Amt (quarterly) | $0.385 |

| Ann Dividend | $1.54 |

| Last Ann Div Inc | 2.7% |

| Dividend Yield | 2.8% |

| Payout Ratio (ttm) | 63.3% |

| Beta (5-yr, mon) | 1.02 |

| P/E Ratio (ttm) | 22.68 |

| Margin of Safety | 23.1% |

Reasons to Invest

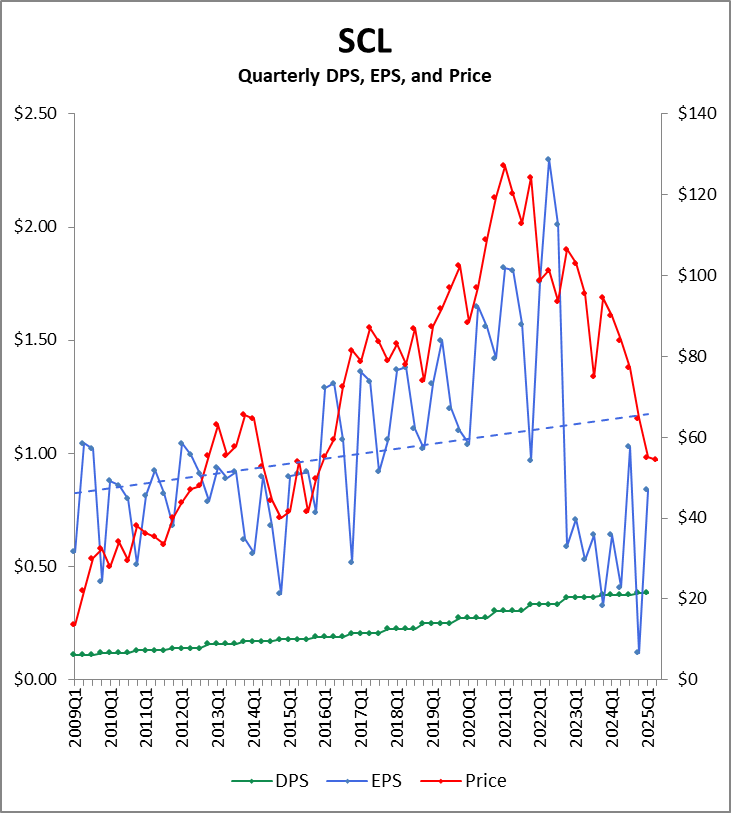

A company doesn’t come in at #1 in the Top Ten unless they are distressed in some way. After achieving record EPS several years in a row, SCL has had disappointing earnings for the last two calendar years. They are by no means immune to the recessionary economies all over the world. Revenue has fallen off a bit, gross margins have come down, and free cash flow is suffering because of increases to working capital. The interested reader can find plenty of material on their recent disappointing performance.

But I’m here to say that I think 2025Q1 marks a return to a more ‘typical’ year for EPS and with that a stabilization in share price. Subsequent positive EPS results should elevate the share price over the next few quarters.

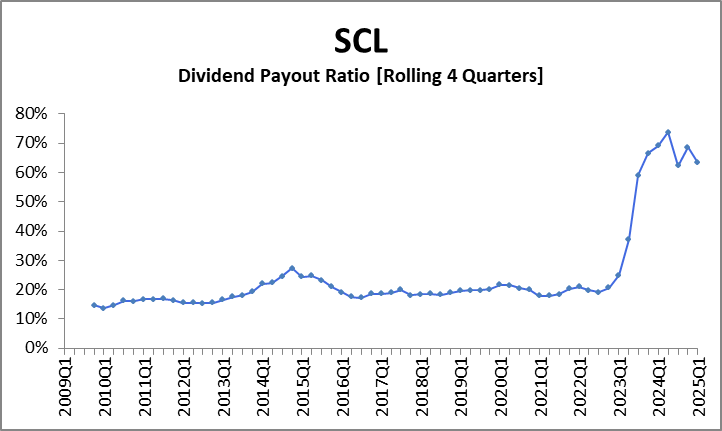

Despite being three times higher than the historical payout ratio, 63% is still very safe. I do not expect the 57-year dividend streak to come to an end any time soon.

SCL yielding 2.8% is essentially unheard of. Lock it in, people!

SCL last traded at $54.43 per share. I am placing a market order to buy 18 shares on Tuseday as the markets are closed Monday in recognition of Memorial Day.

- For every grossly over-valued stock like Tesla, Inc [TSLA] there are many under-valued, shareholder friendly stocks with proven histories and far more promise for the future. ↩︎