In addition to the usual $250+ weekly investment, there is an additional $261.52 of uninvested income in the account. Which portfolio holding will be the recipient of this bunce? Let’s find out.

This week, five of the portfolio holdings ranked in the Top Ten: FMCB, PPG, SJW, TGT, and VZ.

| Ticker | Account Value |

| FMCB | 2,911.50 |

| PPG | 2,436.75 |

| SJW | 2,757.60 |

| TGT | 2,852.28 |

| VZ | 7,611.00 |

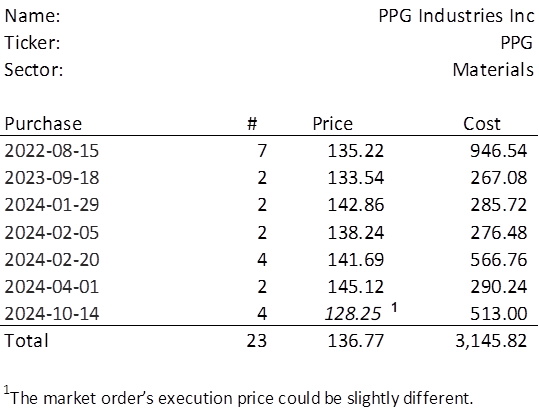

The lowest amount belongs to PPG which last traded at $128.25. Therefore, I will acquire 4 shares of PPG on Monday. Below, is the purchase history and average cost calculation.

There have been two earnings announcements since I last added to the PPG position. In fact, there will be an announcement for 2024Q3 earnings in just a few days. Let’s take a quick look below at the most recent performance1 in the context of the last 16 years.

Observations

- PPG earnings exhibit strong seasonality. A typical year sees a low first quarter, a high point in the second quarter, a third quarter with a slight drop off, and finally a fourth quarter that is perhaps on par with the start of the calendar year or perhaps a little lower.

- The last two quarters are the very best start to a calendar year in PPG’s history. If not easily seen in the chart above, it is very clear in the table below. Look how markedly different the first halves of 2023 and 2024 have been relative to the flatness of the seven previous years.

- The current price of $128.25 is lower than where it ended CY2019 at $133.49. Yet, the low point of PPG’s CY2024 earnings guidance of $8.15 would be 30%+ higher than the earnings of 2019.

- It would appear that PPG’s price has remained flat even though EPS growth has really begun to move. Sure Dividend puts a fair value of $156.00 on PPG and I cannot disagree.

- Note the steady climb of dividends and their relative safety – even the lowest quarters have the dividend easily covered.

In all likelihood, PPG will deliver its strongest year ever. Now, perhaps somehow the market knows this is the high point of a very dull future and has collectively decided to drop its price to earnings multiple accordingly OR it is just a matter of time before the market comes back around to this Dividend King. You know where I stand on the matter.

- The EPS numbers that come from Macrotrends.com were found to be diluted for PPG. I prefer to use the non-diluted figures which is consistent with PPG management’s reporting. I found an accurate source for non-diluted, adjusted EPS numbers at: https://tradingeconomics.com/ppg:us:eps and it is these historical figures from Trading Economics that are presented in the analysis that follows. ↩︎