This week, four of the portfolio holdings ranked in the Top 10: BKH, MMM, NFG, and PPG.

| Ticker | Account Value |

| BKH | 1,858.32 |

| MMM | 2,136.70 |

| NFG | 1,621.12 |

| PPG | 1,814.54 |

As of this writing, the portfolio no longer has a sector imbalance; there is only a slight overexposure to QCOM and TDS. Had either of those tickers made this week’s Top 10, they would not have been eligible for additional investment.

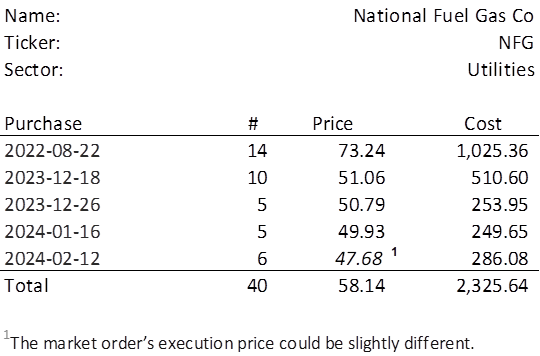

Of the current holdings that made the Top 10, the lowest amount belongs to NFG. It last traded at $47.68. Therefore, in order to invest a minimum of $250 in NFG, I need to purchase 6 shares on Monday. Below, is the purchase history and average cost calculation.

On February 7, 2024, NFG reported their earnings from the first quarter of their 2024 fiscal year. It turns out that CY2023 was the second-best year ever, second only to CY2022. The market responded positively sending the stock up nearly $3 or 6.5% the very next day. And yet, Royal Dividends gets to add 6 more shares at what will very likely be the lowest acquisition price yet.

The graph below displays the quarterly movement of the stock price, earnings per share (EPS) and dividends per share (DPS). The DPS and EPS use the axis on the left and stock price uses the axis on the right. A log scale has been chosen for the stock price as it is more appropriate for long timelines, say over a decade. The price axis is not very detailed and that is either due to the limitations of Excel 2010 or the user. But it isn’t important. What is important is that it is very easy to see that the price has had a level to downward trend since the start of 2011. Over the same time, the earnings, though markedly more volatile, have grown.

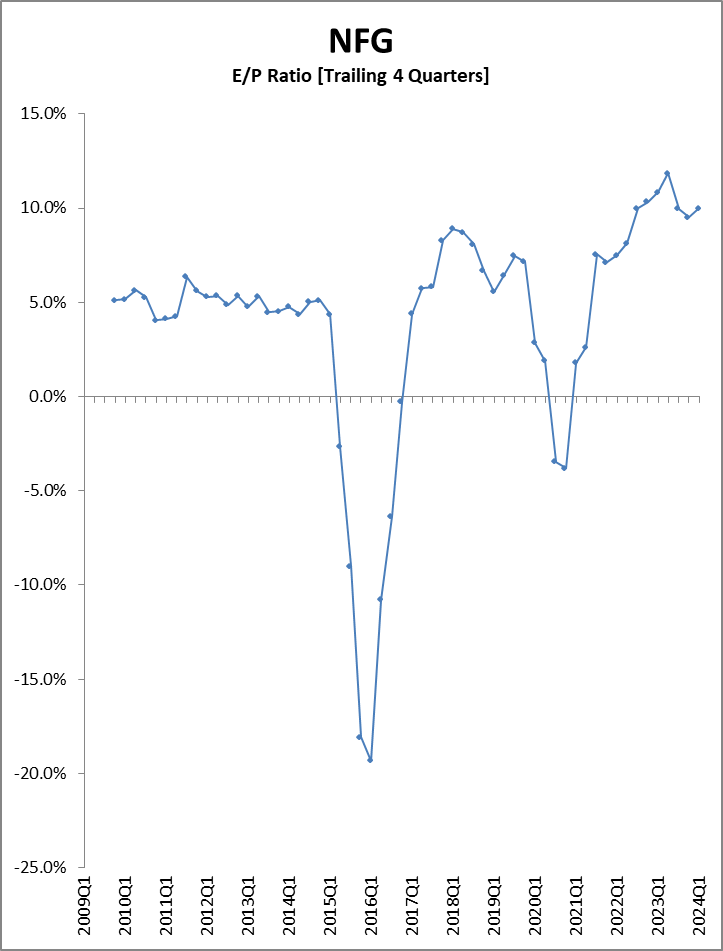

But should we care about the fact that the price seems to be lagging? Not too much. After all, NFG has been paying shareholders a dividend that represents a chunk of their earnings each quarter. If it didn’t, then we might have seen some climb in the stock price. CY2023 EPS of $4.77 is 10% of the current share price. Relatively speaking, this is a very good time to acquire NFG.

In the end, we trust that the market will one day get bored with the Magnificent 7 and move on to companies like NFG. Until then we’ll continue to enjoy the steady progression of the dividend. How safe is the dividend? Very safe. The payout ratio for CY2023 was 41%, well within NFG’s acceptable range.