This week, six of the portfolio holdings ranked in the Top 10: BKH, FMCB, MDT, MMM, NFG, and PII.

| Ticker | Account Value |

| BKH | 1,420.12 |

| FMCB | 2,970.00 |

| MDT | 1,734.81 |

| MMM | 2,460.54 |

| NFG | 708.40 |

| PII | 1,470.24 |

There is currently an overexposure to the following positions (tickers in bold made the Top 10 this week): FMCB, QCOM, and TDS. These tickers are not eligible for additional investment at this time. There is one clear loser, however, NFG! It has dropped well below the $1,000 I started the position with, and it is eligible for further investment.

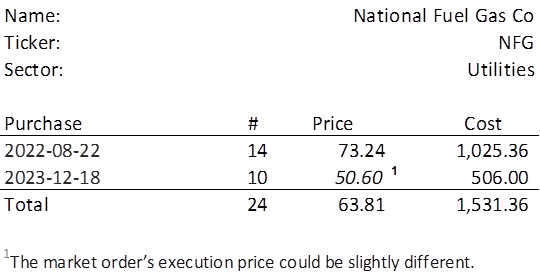

NFG last traded at $50.60. Therefore, in order to invest a minimum of $250 in NFG, I need to purchase 5 shares on Monday. However, in addition to the typical weekly investment, the accumulated dividend total has crossed over the $250 threshold yet again. Lucky for NFG, there is an additional $260.08 available for investment. Now, I don’t want to go over on this number, so I’ll just use this amount to acquire 5 more for a total of 10 shares. Below, is the purchase history and average cost calculation.

NFG entered the portfolio on 2022-08-22 and despite selling off all the way down to $48.60 on 2023-11-02, it has not received an additional investment. This is because their earnings have dropped off as well. The first three quarters of 2023 are 30% lower than the first three quarters of 2022. But, lo and behold, it made the Top 10 this week. Why? The stock market has increased seven straight weeks and most of the Royal Dividends positions have been along for the ride, but NFG hasn’t budged. It is out of favor. That’s how you make the Top 10.

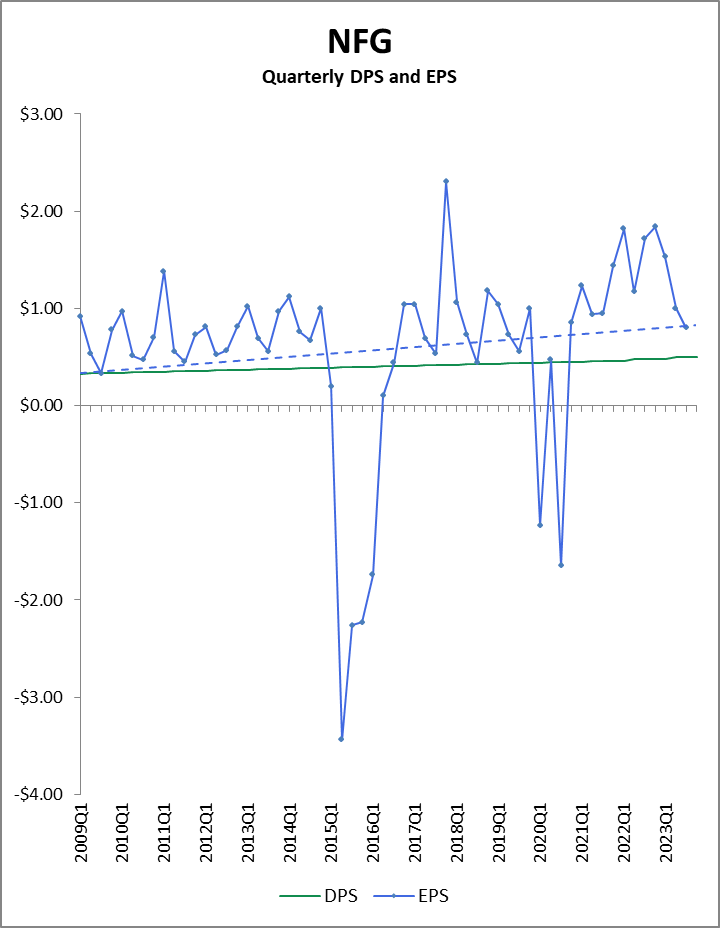

Since we haven’t added to NFG in forever, let’s take a quick look at two graphs. In this first graph, you’ll find that NFG has significant seasonality to their earnings per share (EPS), and that those earnings have trended upward over time (dotted blue line). The dividends per share (DPS) are well supported and have been climbing at a slower pace.

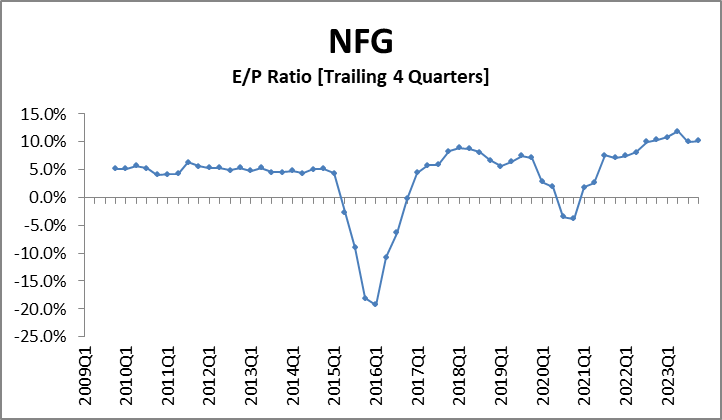

Relatively speaking, this is a great time to purchase NFG; the earnings-to-price (E/P) ratio is at an elevated level (10.2%).

NFG had record EPS of $6.55 in CY 2022. The first three quarters of 2023 may be way down over the same period from last year, but the $3.33 EPS just happens to be the second best start to a year ever, or so I assume. I can’t speak for their more remote history, and it isn’t like I have reached out to them asking. I do ask companies questions from time to time, but few return my calls1.

1I’m joking, I resist calling strangers. I just felt it was easier to write than the real explanation – but now I present that here in a footnote because it isn’t like I don’t have time. Most companies have not replied via email to the auto-generated message that a busy investor relations professional likely receives as a result of my having filled out an online form that typically prompts one for non-relevant personal information before limiting any written questions or comments to a certain inadequate number of characters.

Notably, many years ago, I reached out to Infracap Funds who manage several ETFs. I had lost a few thousand dollars in AMZA and was both incredulous and distraught. The individual who reached out to me via phone (and I actually answered!) turned out to be the Founder and CEO, Jay Hatfield. Jay Hatfield is intelligent and understands his business. He shared my incredulity at the market performance of the MLPs on which AMZA’s portfolio is built and explained a few things and answered some questions. Ultimately, it proved to be too risky an instrument for me and that investment taught me a few things about investing that I too easily dismissed beforehand. That could be a post for another day.