Do you remember what you were doing on June 15, 2022? We should all remember. On that day, a company from Williamsville, New York, founded in 1902, announced an increase to their dividend. They have paid a dividend for 120 consecutive years and this increase is the 52nd consecutive annual increase in the dividend. Think about that. When they began paying a dividend, the U.S. was still minting the Indian Head penny.

This week’s Dividend King operates in four business segments, one of which is Utilities. I think this might be why they’ve been misclassified as a Utility stock on TD Ameritrade. Yahoo! Finance has them correctly labeled as an Energy company. Energy companies are notorious for inconsistent earnings, because their performance is sensitive to a host of economic factors that are out of their control. It very likely explains why there is only one Energy company in the list of Dividend Kings. Only one.

Monday morning, National Fuel Gas Company [NFG] joins the Dividend King portfolio.

National Fuel Gas Company

Here is the profile from TD Ameritrade:

National Fuel Gas Company is a holding company. The Company is an energy company engaged principally in the production, gathering, transportation, distribution, and marketing of natural gas. The Company’s segments include Exploration and Production Segment, Pipeline and Storage Segment, Gathering Segment, and Utility Segment. The Exploration and Production segment seeks to discover and produce raw materials, including natural gas, oil, and hydrocarbon liquids. The Pipeline and Storage segment transports and stores natural gas owned by its customers, whose gas primarily originates in the Appalachian region of the United States. The Gathering segment gathers, processes, and transports natural gas that is produced by Seneca in the Appalachian region of the United States.

National Fuel Gas is a diversified energy company, and this gives them a competitive advantage. Pipelines and utilities are regulated, stable businesses. And exploration adds the potential for higher growth. This diversification allows them to more easily weather the inevitable economic downturns than peers who are more narrowly focused on the cyclical, production end of the energy business.

The Details

Data as of 2022-08-20

| Name | National Fuel Gas Company |

| Ticker | NFG |

| Website | Investor Relations |

| Sector | Energy |

| Dividend Streak | 52 years |

| Last Price | $73.06 |

| Div Amt (quarterly) | $0.475 |

| Ann Dividend | $1.90 |

| Last Ann Div Inc | 2.8% |

| Dividend Yield | 2.6% |

| Payout Ratio (ttm) | 32.6% |

| Beta (5-yr, mon) | 0.70 |

| P/E Ratio (ttm) | 12.93 |

| Margin of Safety | 16.3% |

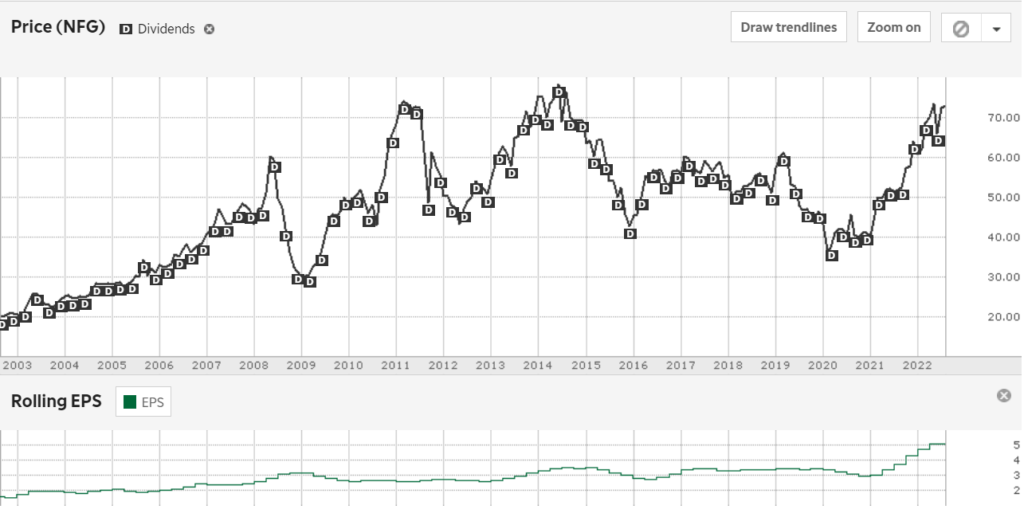

Arguments against purchasing NFG right now focus on the 13-year high price level of natural gas and NFG’s price sensitivity to it. Let’s get a bit more comfortable with these concerns. First, NFG is not overly sensitive. The price of natural gas dropped 42% in the final three weeks of June this year; NFG dropped only 11%. And let’s not forget, the S&P 500 declined 8.4% for the whole month of June. Second, though a reversion to the mean in the price of natural gas is likely, and would act as a headwind, NFG is trading well below their 10-year historical P/E Ratio of 16.2. This valuation level is bound to revert and act as a tailwind.

The fact of the matter is, NFG has flirted with $80 just a handful of times in its lifetime: mid 2011, mid 2014, and June 2022. Yet, earnings over the last twelve months have never been higher at $5.65, 60% more than CY 2014.

What really catches my eye though, are the dividends. NFG is set to pay increasing dividends for the foreseeable future, with a dividend payout ratio that is well under management’s target of 50%. It’s time to set up a market order to buy 14 shares of NFG this Monday.