This week, four of the portfolio holdings ranked in the Top 10: BKH, FMCB, MMM, and PPG.

| Ticker | Account Value |

| BKH | 2,740.74 |

| FMCB | 2,940.00 |

| MMM | 2,366.78 |

| PPG | 2,641.76 |

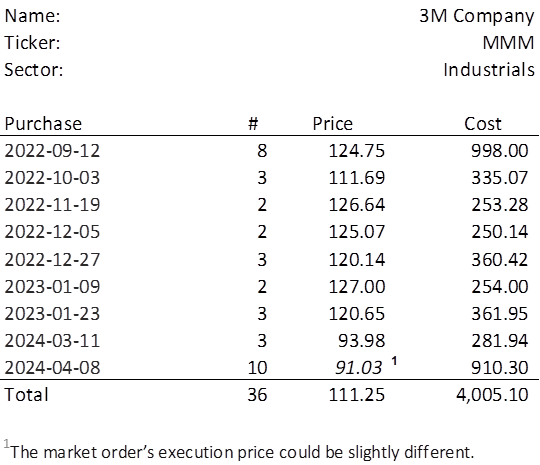

The lowest amount belongs to MMM which last traded at $91.03. Therefore, in order to invest a minimum of $250 in MMM, I need to purchase 3 shares on Monday. But that’s not all!

When uninvested income is above $250, it gets added to the investment of the week. And folks, there is $661.25 of uninvested income. Thus, I will be purchasing another 7 shares of MMM for a total of 10 shares. Given that two-thirds of the uninvested income arrived earlier this week as a result of MMM’s spin-off of SOLV, it seems appropriate to put that money right back into MMM. See the 2024-03-10 post for a slightly deeper dive into historical performance of MMM, but bear in mind the spin-off theoretically lowered MMM by $17.3875 per share. Below, is the purchase history and average cost calculation.