This week, three of the portfolio holdings ranked in the Top 10, MMM, QCOM, and TDS.

| Ticker | Account Value |

| MMM | 2,413.00 |

| QCOM | 2,458.00 |

| TDS | 2,623.00 |

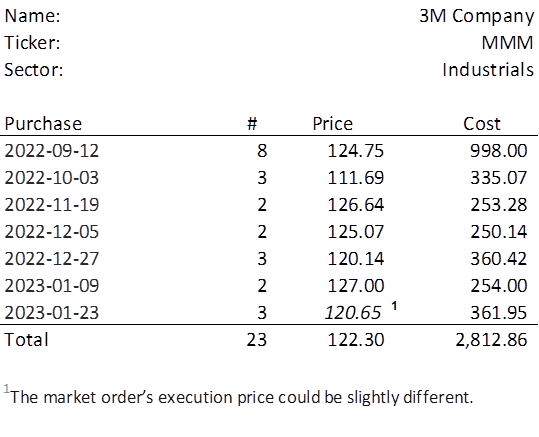

The lowest amount belongs to MMM. In order to invest a minimum of $250 in MMM, I need to purchase 3 shares this Monday. Read on to see the purchase history of this stock, the average cost calculation (subject to change), and the exposure risk checks.

Below, I present the purchase history and the average cost calculation assuming the price remains unchanged from the last trading day’s closing price.

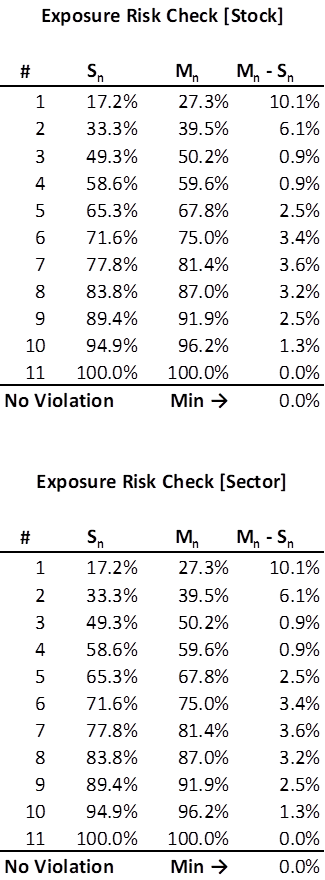

Though the anticipated weighting after the next purchase is well under the 27.3% cap for a single holding, I am keeping an eye on the three most heavily weighted stocks, which after this purchase will be within 1% of the 50.2% cap for a three-stock subset of the portfolio. As a reminder, I will not make a purchase that would create, or add to, an exposure risk violation from a stock or sector perspective.

Of course, the same concern exists in sector concentration as there is only one stock in each sector. That being said, there is no violation at this time.