This week, five of the portfolio holdings ranked in the Top 10: FMCB, GRC, PPG, SJW, and TGT.

| Ticker | Account Value |

| FMCB | 2,880.30 |

| GRC | 1,631.62 |

| PPG | 2,370.82 |

| SJW | 2,533.13 |

| TGT | 2,723.04 |

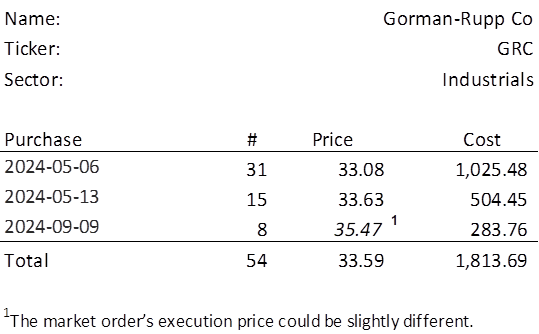

While there is no position-specific overweighting in the portfolio, there is an overweighting associated with the top 10 most heavily weighted sectors. This is an awkward way of saying Industrials are underweight and is the only sector eligible for additional investment at this time. However, since the lowest amount above belongs to GRC, which is the one industrial stock in the portfolio, the sector restriction does not affect this week’s investment. GRC last traded at $35.47. Therefore, in order to invest a minimum of $250 in GRC, I need to purchase 8 shares on Monday. Below, is the purchase history and average cost calculation.

GRC announced earnings on 2024-07-26, about six weeks after the last time I added to this position.

Let’s ignore the 2018Q4 special dividend of $2.00.

I am not going to waste your time on summarizing what must be another boring quarter from GRC. Do we really think this quarter was a trainwreck of performance except for a contribution from a wealthy benefactor that put their ‘earnings’ right on track with historical earnings?

Everything about GRC’s performance is boring. The earnings have a nearly imperceptible positive slope over the long haul. But! In May of 2022, GRC completed its acquisition of Fill-Rite (and Fill-Rite’s Sotera brand as well), the largest acquisition in its history. This dampened earnings in 2022 and took time to assimilate. If you mentally throw that year’s earnings out, it isn’t difficult to see an earnings slope more in line with the dividends. And that should make sense.

The truth is, Gorman-Rupp Company is a serious enterprise; their annual report is littered with pictures of pumps. This will never be a meme stock. No one is going to create a single-stock covered call ETF around GRC. So, let’s just sit back and let them sell their pumps and pump systems and pay their ever-increasing dividend, which they’ll likely raise next quarter. GRC is still a little undervalued and I’m happy to add to the position.