This week will count as the third of three ‘off’ weeks intended to restore the $250+ per week pace of investment due to the acquisition of SJW. However, there is over $250 ($520.59 to be exact) of uninvested income in the account and I am going to deploy it.

This week, five of the portfolio holdings ranked in the Top Ten: FMCB, GRC, MDT, PPG, and SJW.

| Ticker | Account Value |

| FMCB | 3,225.00 |

| GRC | 1,035.09 |

| MDT | 1,739.64 |

| PPG | 2,571.27 |

| SJW | 1,093.64 |

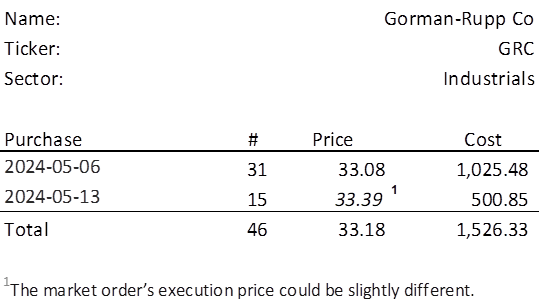

The lowest amount belongs to GRC. Not coincidentally, there is a sector imbalance in the portfolio and the only sector eligible for additional investment is Industrials, the sector to which GRC belongs. GRC last traded at $33.39. Therefore, being careful not to go over the $520.59 available, I will acquire 15 shares of GRC on Monday. Below, is the purchase history and average cost calculation.

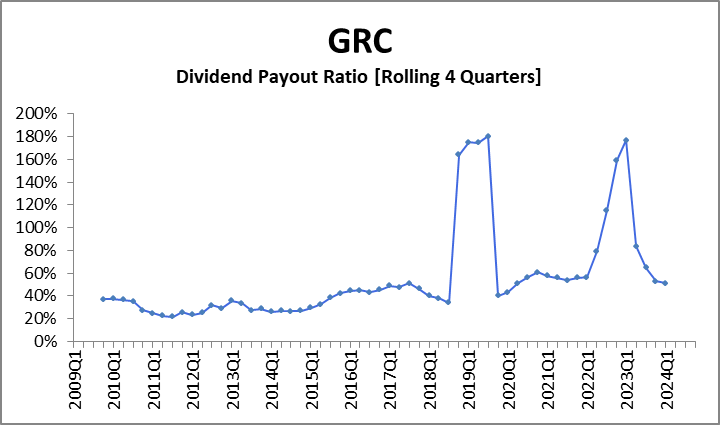

Below, I present some graphs that provide a glimpse at the last 15 years in GRC’s long history.

Earnings have been volatile and always positive save 2022Q2 when earnings came in at $(0.04). The trend has been positive but very, very slight over this extended period (dotted blue line).

Despite the volatility in earnings, a lower dividend yield has allowed the steady rise in that dividend to be well covered except for a couple of times in recent history.

2024Q4 EPS of $0.30 fell short of analyst estimates and disappointed myopic investors, but it is the best start to a year since 2018. Hopefully, earnings pick up from here and I will be keeping an eye on performance going forward.

Next week begins another set of three ‘off’ weeks to account for establishing a position in GRC.