This week, five of the portfolio holdings ranked in the Top 10: BKH, FMCB, MMM, NFG, and TDS.

| Ticker | Account Value |

| BKH | 1,883.52 |

| FMCB | 2,997.00 |

| MMM | 2,129.34 |

| NFG | 1,958.80 |

| TDS | 4,840.35 |

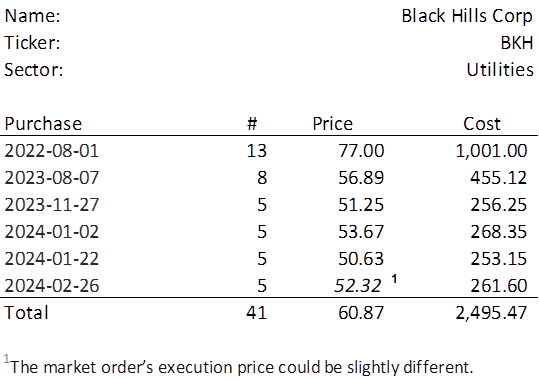

The lowest amount belongs to BKH which last traded at $52.32. Therefore, in order to invest a minimum of $250 in BKH, I need to purchase 5 shares on Monday. Below, is the purchase history and average cost calculation.

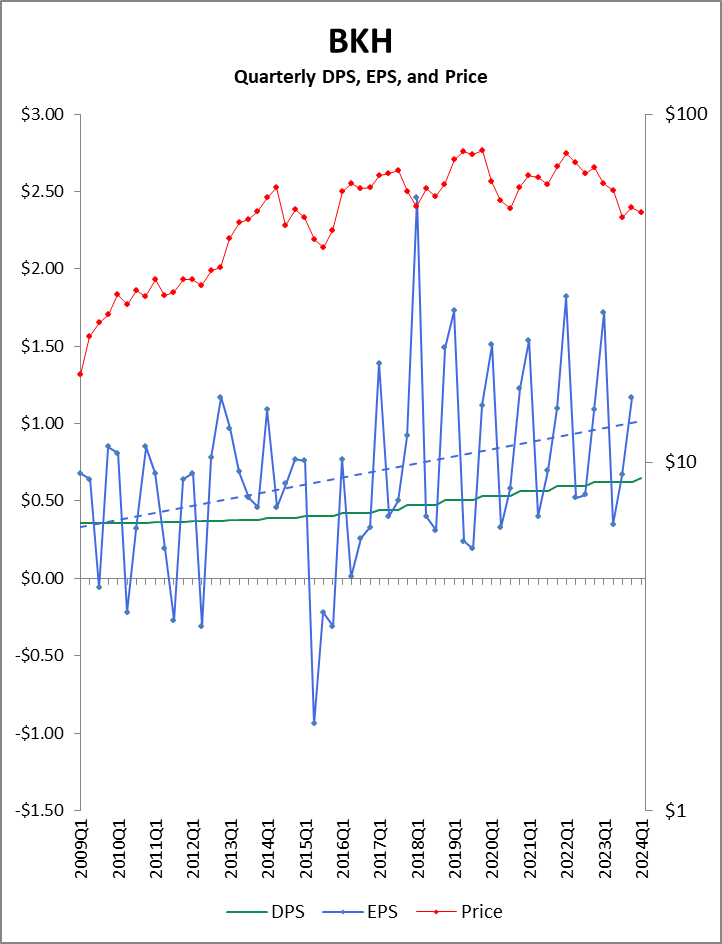

On February 7, 2024, BKH reported earnings for 2023Q4. The best news as far as I am concerned is that they are increasing their dividend after holding it steady for five straight quarters. That makes 2024 the 54th consecutive year of raising the dividend. BKH finished CY2023 with EPS of $3.91 and provided guidance of $3.80 to $4.00 for CY2024, the midpoint of which means we should expect earnings to stay flat for this year. Below is an updated chart that goes back to 2009 in order to put things in proper perspective. The stock price uses the axis on the right which is on a very undetailed log scale. Being able to tell the price of BKH from the graph is not as important as seeing that is hasn’t moved in a decade.

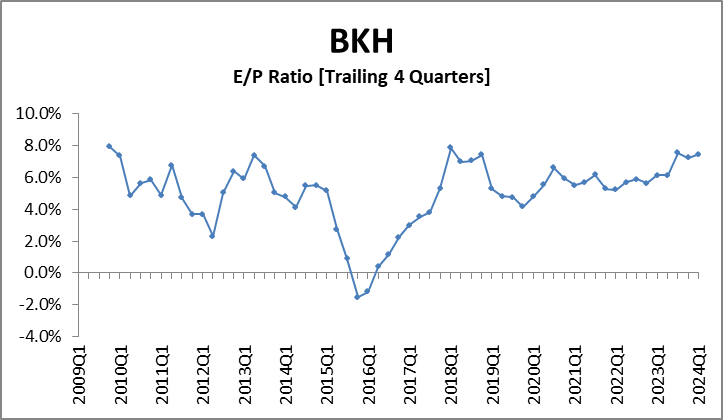

The following graph shows that it is a great time to invest in BKH; the earnings-to-price (E/P) ratio is at the high end of its trading range.

It would have been great if BKH hadn’t fallen precipitously since adding it to the portfolio. But because the earnings are still strong, the fair value of BKH is still north of $65. Monday’s purchase will bring the average cost of this position under $61. Eventually, this position will turn the corner and become profitable. And we’ll collect the dividend while we wait.