Last week’s purchase of 1 share of FMCB for $980, requires that I abstain from the regular $250+ weekly investment for two consecutive weeks in order to maintain a $250+ per week average. This week will count as the first of those two weeks. However, there is $467.45 of accumulated dividends and option premiums available to be invested. The covered calls sold on TDS on Friday brought in enough premium to put the accumulation pool well above the $250 threshold. Why let that money burn a hole in ma pants?!

Read on to learn how this cold, hard cash will be deployed.

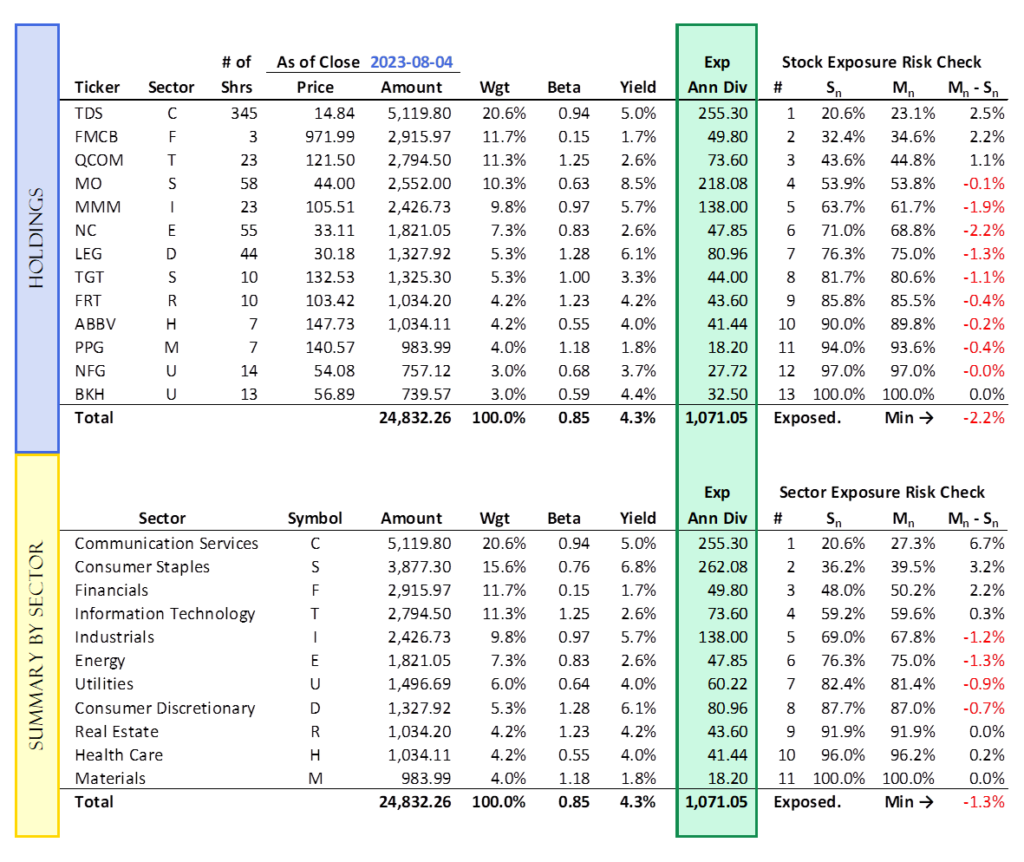

This week, five of the portfolio holdings ranked in the Top 10: BKH, FMCB, MMM, MO, and TGT.

| Ticker | Account Value |

| BKH | 739.57 |

| FMCB | 2,915.97 |

| MMM | 2,426.73 |

| MO | 2,552.00 |

| TGT | 1,325.30 |

The lowest amount belongs to BKH which last traded at $56.31. In order to invest as much of the $467.45 in accumulated dividends and option premium as possible, I will purchase 8 shares this Monday.

A Nice Problem to Have

The astute observer of the Portfolio page will notice that the recent performance of TDS must have been mind blowing. And it was. Discussion of TDS will follow in a separate post. However, it must be said now that TDS and perhaps one or two other positions has created overexposure in the Portfolio for the Ages, and it just so happens that the only eligible portfolio holding is BKH (the only holding below the last red number in the rightmost column of the first table).

The same individual may notice that if one were to invest in BKH, a member of the Utility sector, they would be adding to an existing overexposure from a sector perspective. Only stocks in the Real Estate, Health Care, and Materials sectors are technically eligible for additional investment. However, even if we weren’t abstaining from adding new funds this week, there were no Real Estate, Health Care, or Materials stocks in the Top Ten. I made the executive decision to increase the BKH position at this time with internal funds and I will revisit this issue in two weeks.

In the event the Top Ten two weeks from now features some companies from those sectors, I will likely add a new position to the portfolio. I may have to relax some criterion in building the Top Ten in order to increase the variety of sectors appearing in the Top Ten. There is also the option of keeping the criterion the same but extending the number to 15 or 20. However, if it comes to be that we add, say a stock from the Materials sector (which had zero presence in the Top 20 this week), it will likely still leave the portfolio overexposed from both a position and sector perspective, and that’s okay. I consider the sector test for exposure to be one of secondary importance and generally speaking, so long as the portfolio gradually becomes more balanced, I am satisfied. It is not always possible to pass the exposure checks from simply adding to an existing position or even adding a new position. However, if I cease adding to the most heavily weighted stocks and make a point to add funds and new positions to the least weighted sectors, when the expected future returns of doing so warrant it, the portfolio will eventually regain its balance.

Back in Black

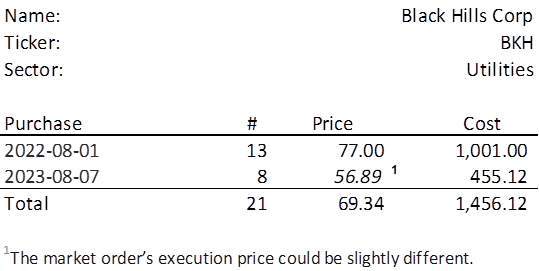

Hills, that is. BKH. It has been a year since we established a position in BKH. The price has dropped considerably since then, and it is a good time to add to the position. Below, is the purchase history and average cost calculation.