This week, five of the portfolio holdings ranked in the Top Ten: BDX, GRC, PII, QCOM, and SJW.

| Ticker | Account Value |

| BDX | 2,025.36 |

| GRC | 3,279.65 |

| PII | 2,194.29 |

| QCOM | 3,215.63 |

| SJW | 3,479.49 |

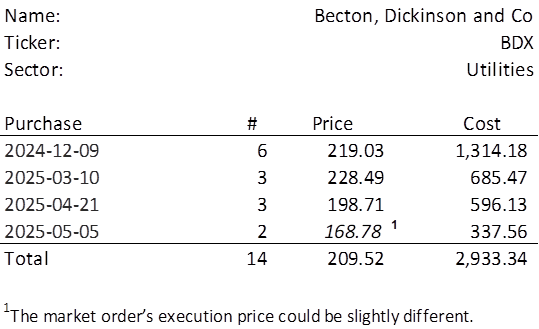

The lowest amount belongs to BDX which last traded at $168.78. Therefore, I will acquire 2 shares on Monday. Below, is the purchase history and average cost calculation.

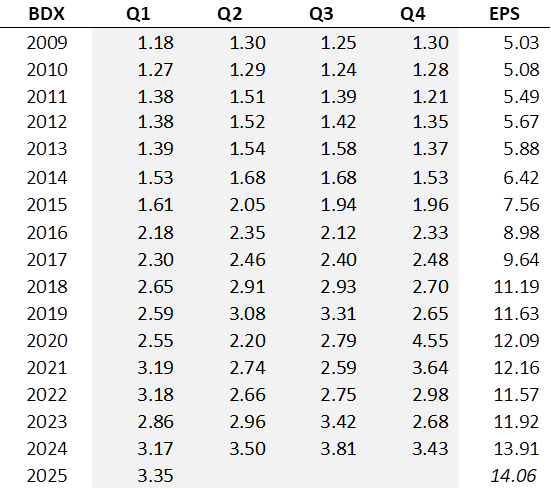

BDX announced FY2025Q2 [CY2025Q1] results on 2025-05-01. Despite beating analyst estimates for the sixth straight quarter with adjusted diluted EPS of $3.35 (vs the analyst estimate of $3.28), BDX sold off in dramatic fashion. BDX fell 20% in just two days and is now down 33% from the recent high of $251.99 achieved on 2025-02-03.

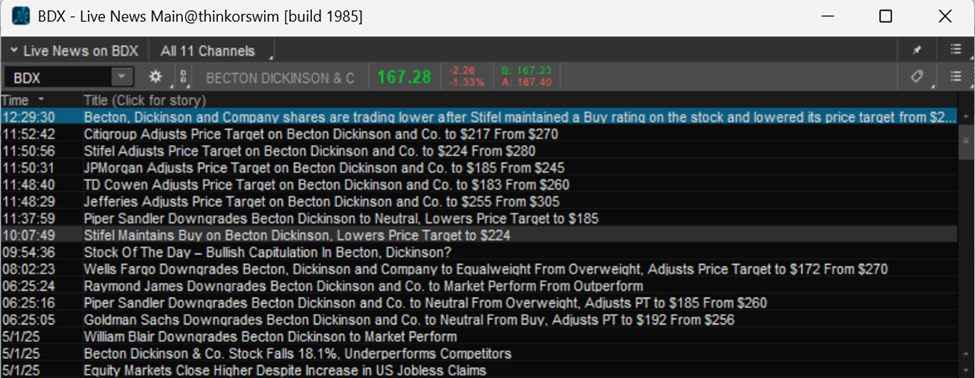

In addition, the analysts, the financial experts who follow BDX and the industry, wasted no time in discarding all the previous hard work and due diligence that went into their target price estimates established just 90 days before. At least ten different analysts downgraded or significantly lowered their target prices within a matter of hours.

Did they kill their 53-year dividend increase streak? No. Has there been an accounting violation? No. So, what happened? Well, BDX saw a smaller increase in revenue than they had expected. Oh, and they lowered their EPS guidance range by $0.25, with the expectation that tariffs will have an adverse impact. Is that $0.24 reduction 20% of the previous estimate? No, it is less than 2%.

If a stock drops 20% after announcing a < 2% reduction in expected EPS, it suggests that the stock was grossly overbought prior to the announcement. Well, if we lend any credibility to the analysts at all, their previous target prices were significantly above where BDX had been trading. This would have suggested that BDX was trading well under fair value before the guidance reduction.

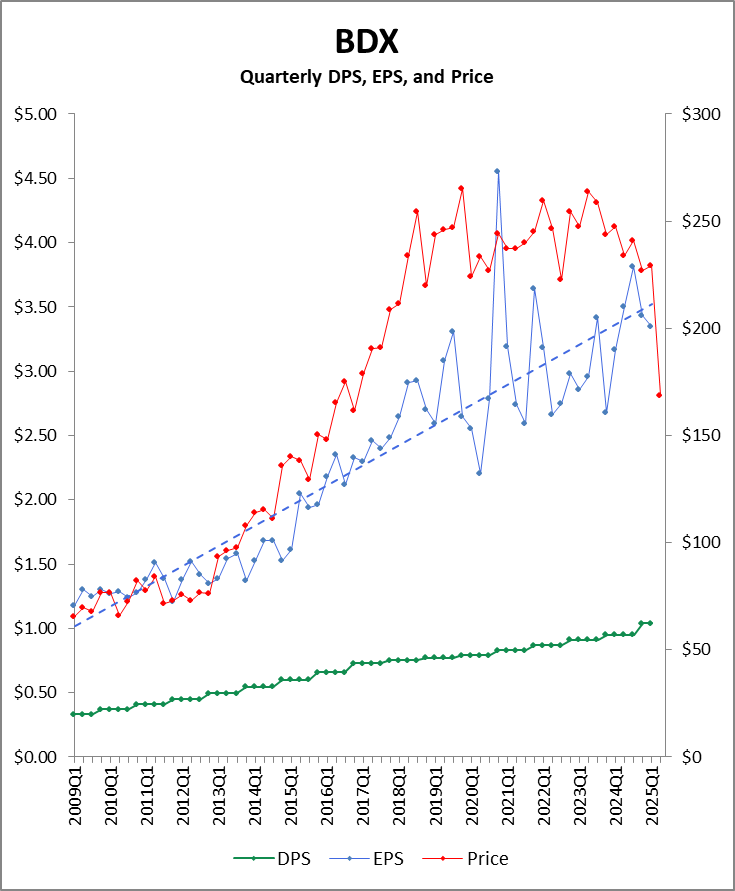

Let’s take a step back and look at the recent performance in the context of the past 16 years.

Observations

Stock Price

Below is the chart since 2024-12-09 when Royal Dividends initiated a position in BDX.

If we think of a stock price as the present value of all future cash flows, or perhaps for a Dividend King, as the present value of all future dividends (Dividend Discount Model) do we really believe that BDX is a fundamentally different company than it was just 4 or 5 months ago? Has their earnings potential fallen off a cliff?

Earnings

Magnitude/Trend

EPS has become more volatile over the last few years, but there is no arguing that there is a strong positive trend. Price is now trading at mid-2016 levels even though quarterly EPS in 2016 were at two-thirds the level of quarterly EPS today. At the low end of the FY guidance range BDX is trading at a P/E Ratio of (168.78/14.06) = 12.

Seasonality

There is virtually no seasonality to EPS. Q1 is historically a shade low, averaging about 24% of the full year amount, with the other quarters all slightly higher than 25%.

We do see however, that CY2025Q1 EPS of $3.35 is the best start to a calendar year ever. So there’s that. How about that reduced guidance for the year? Even the low end of the fiscal year range looks pretty good against previous calendar years. In fact, it is likely CY2025 will be their highest EPS ever.

Dividends

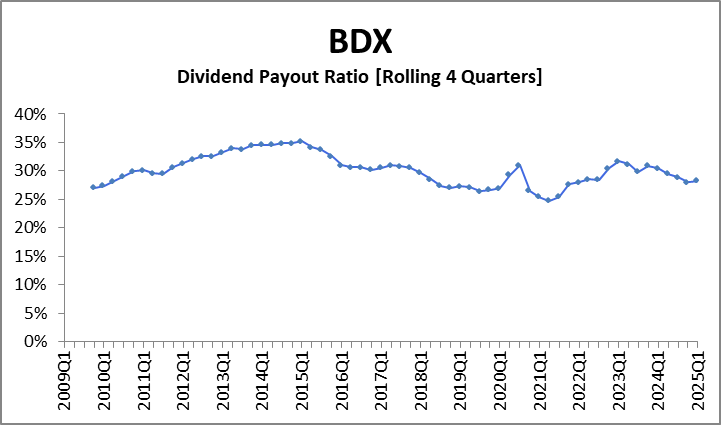

CY2025 dividends should be well covered with current payout levels hovering around 30% as has historically been the case.

Thoughts on Investment

Revenue growth is not where they want it to be (still a 4.5% increase over the prior year quarter), but they’re making up for it through a program aimed at improving all aspects of their operating structure they refer to as BD Excellence. BDX delivered adjusted gross margin of 54.9%, 190 basis points higher than the same quarter a year ago. In fact, that’s four consecutive quarters of strong gross margin expansion.

I mean, we’re absorbing 5% EPS growth headwinds, 2% tariff, 3% on the revenue and we’re still delivering 8% earnings growth. I think it’s the highest quality, highest leverage P&L and with the BD Excellence momentum going forward it should give confidence that, we’re able to deliver strong results even in an environment like that and compound earnings.

– Chris DelOrefice, Executive Vice President and Chief Financial Officer

That quote for the earnings call stood out to me. It tells me they’re using their scale and their management skills to maintain performance in the face of some recessionary adversity and are poised to return to stronger growth if and when markets improve.

Royal Dividends is happy to snag a couple of shares at this disconnected and depressed price level.