This is just a quick follow up to my last post wherein I provided some insight into what we could expect from today’s CPI report. My rather simple regression-derived estimate for the month over month change was spot on. My estimate for the annual change was high.

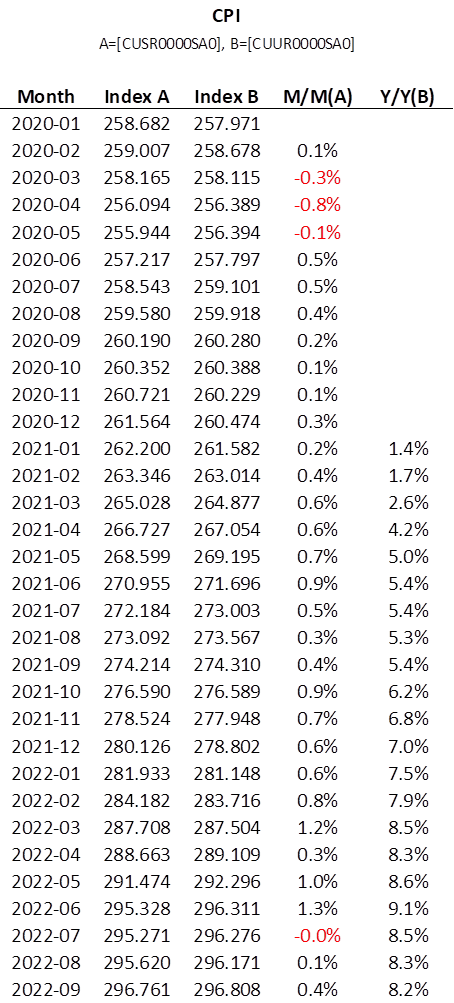

Here is the updated CPI table:

Only because the monthly change is based on seasonally adjusted numbers and the annual change is based on an unadjusted index, is it even possible for me to have had an accurate estimate of one, but not the other. Ultimately, I cannot be sure how the U.S. Bureau of Labor Statistics adjusts for seasonality. And frankly, I’m not all that interested.

The market tanked before market open as I guessed it would. However, it proceeded to climb for the rest of the day. I didn’t see that coming. Multitudes will try to explain this behavior or draw conclusions about whether we’ve hit a bottom or not. I wouldn’t bother. Quite often the market moves in such a way as to create the most doubt possible as to which direction it is heading in. The market fluctuates.

Stay tuned this weekend for my next investment.