On September 24, 2022, I wrote: TDS started in 1969 as the collection of ten rural phone companies in Wisconsin. In 5 years, they grew to 39 companies with operations in 17 states. That same year, they started paying a dividend and they have increased it annually until today. In mid-February of 2024, I expect they’ll announce a dividend increase that will be their 50th. At that point, just two annual increases from now, they’ll officially be called a Dividend King.

Here’s the problem. The Communication Services sector in general, and more specifically, the wireless telecommunication services industry, are highly competitive arenas. There is no guarantee that TDS gets to increase #50. After all, no other company from this sector ever has. Worse, TDS isn’t exactly thriving. But I think they’ll get there. More than that, I think they’re worthy of investment and right now seems like a great time.

I was right on all accounts.

All hail current Royal Dividends member, Telephone and Data Systems Inc!

Surviving Not Thriving

On February 16, 2024, TDS reported their earnings for 2023Q4 and announced an increase to their quarterly dividend. Given the news in the former, I was surprised at the absence of any fanfare in the latter. Not one word of this being the 50th consecutive year of raising the dividend. Not one word of TDS being the first company in the Communications Services sector to do so. Nothing in the conference call either.

The fourth quarter GAAP EPS of $(4.64) was the lowest ever and largely the result of a $547 million non-cash charge related to goodwill impairment within the TDS Telecom segment. Even when removing the impact of taking that charge, the EPS were $(0.11), respectively.

Six straight quarters of losses and two full calendar years is not how you want to achieve a milestone. This is not how you want to cross the finish line.

Because TDS is already in the portfolio, I will deviate from the typical ‘Coronation’ post. For starters, rest assured that the profile from TD Ameritrade remains unchanged from when I added it to the portfolio so there is no need to repeat it here.

The Details

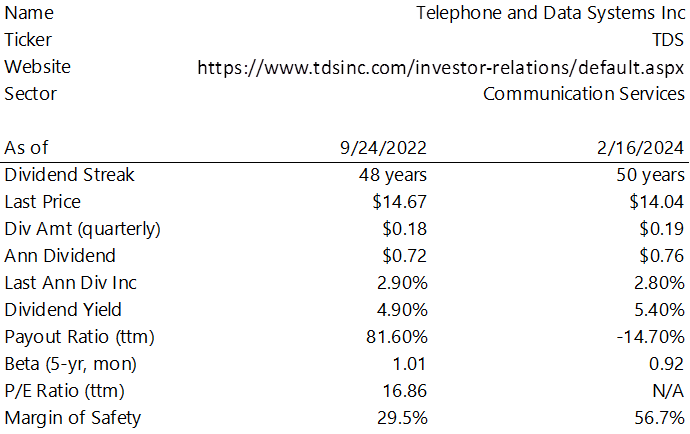

Here is a snapshot at two different points in time, now and when TDS was first added to the portfolio.

Performance

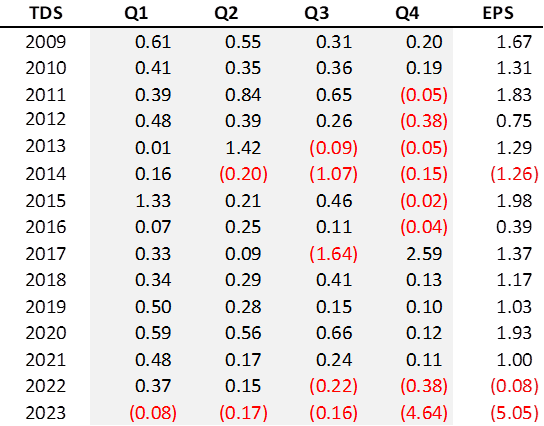

Below is a simple look at TDS over the past 15 years. It speaks for itself.

Now the stock plummeted 24% on Friday for two reasons:

- A large earnings disappointment

- Absolutely zero news on the discussions of ‘strategic alternatives’ regarding US Cellular [USM]. In fact, the topic was off limits during the question and answer portion of the conference call.

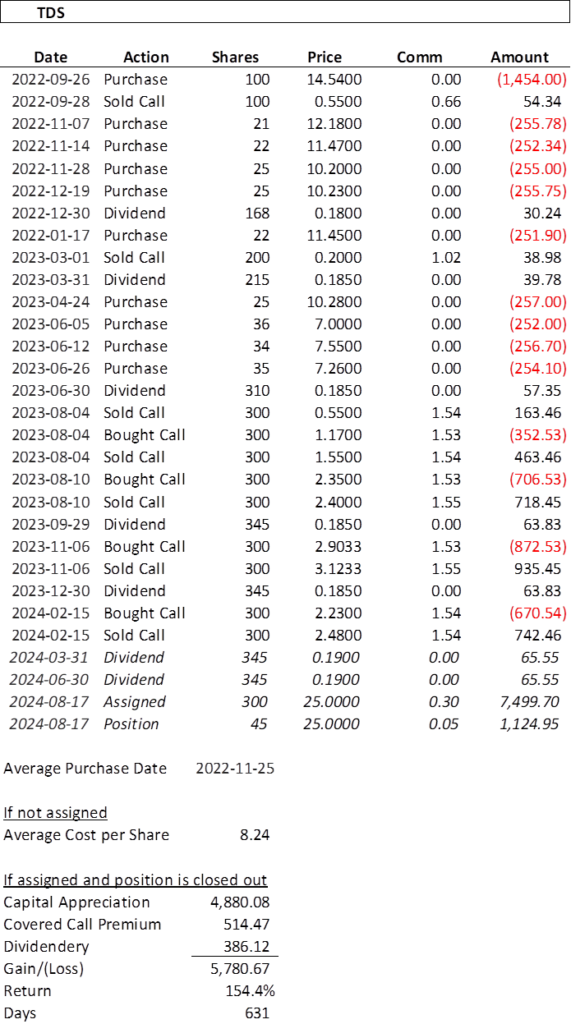

That being said, though TDS is clearly the worst performing business in the portfolio right now, it is still the best performing stock with a 50% return since the position was opened. That includes dividends received and the covered call option premiums.

A quick word on the covered call situation. On Thursday, I noted that the call and put options for all of the expiry dates were elevated. Ordinarily, an option 90 days away and 20% out of the money would have brought perhaps a fifth of what I was looking at. That told me there was an expectation in the market that the stock was going to have a big move in either direction. I looked at the at-the-money straddle prices (the sum of the call and put premiums for each of the $17.50 and $20.00 strikes and found that the market was expecting a move of as much as $7.00, in either direction, in just one day.

The irony is nothing changed and yet, the stock sold off, a lot. Sure, the impairment charge was a huge hit, but it is an accounting decision. A choice to officially recognize a now worthless asset as, well, worthless. They’re still in the same delicate situation where their business decisions to increase customer satisfaction and retention while expanding their footprint are still meeting their targets but coming with significant capital expenditure. Out of caution I rolled the May 17, $22.50 call up and out to August 16, $25.00. That is significantly higher than the current price of $14.04 and TDS will never hit that level unless there is an announcement of major importance before then.

What ‘strategic alternatives’ are being considered? Could TDS sell its 83% stake in USM? Might there be ongoing talks with another, larger telecom player? I’ve written about unlocking the value of TDS before, that it’s assets and customer base can be better leveraged by a larger company. I think something is in the works. The signs? First, goodwill assets of $547 million had been on the books for a few years. Taking it off the books all at once, in a quarter where there is nothing to offset it, feels like an attempt to clean up the balance sheet to make it more attractive. Second, a celebratory message about 50 years of dividend increases would be a sign of continued commitment as an ongoing concern. No indication that a significant milestone was reached says the opposite message.

Time will tell. In the meantime, TDS is trying to compete more effectively in the event a significant change doesn’t materialize. The signs? Well, aside from getting into the weeds with all of their targets of ARPU, tower rental revenue, etc. being met or surpassed, the adjusted, non-GAAP EPS of $(0.11) is the second straight quarter of improvement. It is also better than the fourth quarter EPS of $(0.38) from the prior year.