This past weekend, using the Sure Analysis Research Database from Sure Dividend, I ranked stocks in preparation for my weekly investment of $250. I noticed that my universe from which I invest, the Empire, now numbered 71, one more than last week. After matching one list of tickers against another, I found a company with a 50-year streak of annual dividend increases, that had made it through my filters but had not yet appeared on Sure Dividend’s official list of Dividend Kings. I contacted Sure Dividend about the inconsistency and their founder and CEO Ben Reynolds, responded promptly. He agreed that this company should be added to the Dividend King list.

I wish this new Dividend King hailed from the Technology or Telecommunications sector, but it is a utility. Nevertheless, it is always a pleasure to see another company make this exclusive list.

All hail Middlesex Water Company!

Middlesex Water Company [MSEX]

Here’s the description from Yahoo! Finance:

Middlesex Water Company owns and operates regulated water utility and wastewater systems. It operates in two segments, Regulated and Non-Regulated. The Regulated segment collects, treats, and distributes water on a retail and wholesale basis to residential, commercial, industrial, and fire protection customers, as well as provides regulated wastewater systems in New Jersey and Delaware. The Non-Regulated segment provides non-regulated contract services for the operation and maintenance of municipal and private water and wastewater systems in New Jersey and Delaware. The company was incorporated in 1896 and is headquartered in Iselin, New Jersey.

Water, Water Everywhere

“Since 1912, Middlesex Water has demonstrated a consistent record of dividend growth. We are pleased, as we mark our 125th year, to attain a new milestone — our 50th consecutive year of dividend increases. Our teams remain committed to continually enhancing the quality of our operations, to growing and developing our talented workforce and to further driving shareholder value,” said President and Chief Executive Officer Dennis W. Doll.

Middlesex Water Company press release

So, let’s get this straight. Middlesex Water Company organized in 1897, began paying a dividend 15 years later. The dividend varied for the next 60 years, and then in 1972 they begin the dividend growth streak that persists to this day. That is very impressive, but they’re not alone.

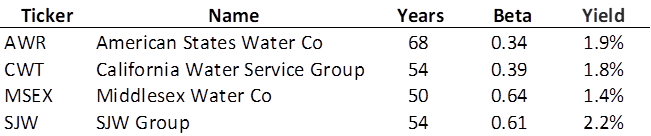

With the addition of MSEX, there are seven utilities in the current list of 46 Dividend Kings. MSEX is one of four water utilities.

All four stocks have been significantly less volatile than the S&P 500 Index over the last 5 years. MSEX is the only one who’s current dividend yield is lower than the S&P 500 Index.

Water utilities are very desirable to have in one’s portfolio. I don’t think it is hard to imagine why. Water is essential to life on this planet and there is a massive proportion of the world’s population that does not have consistent access to clean water. Water is always useful, always in demand. It should not come as a surprise that water utilities tend to be priced at a premium in the stock market. Even now, in this year-long bear market, the four companies above are all still a little too expensive. Rest assured, should one of the companies above drop to a point where they become irresistible, I won’t hesitate to put one in the Portfolio for the Ages. Maybe it will be Middlesex Water Company.