Royal Dividends has closed out its position in TDS. How did it go?

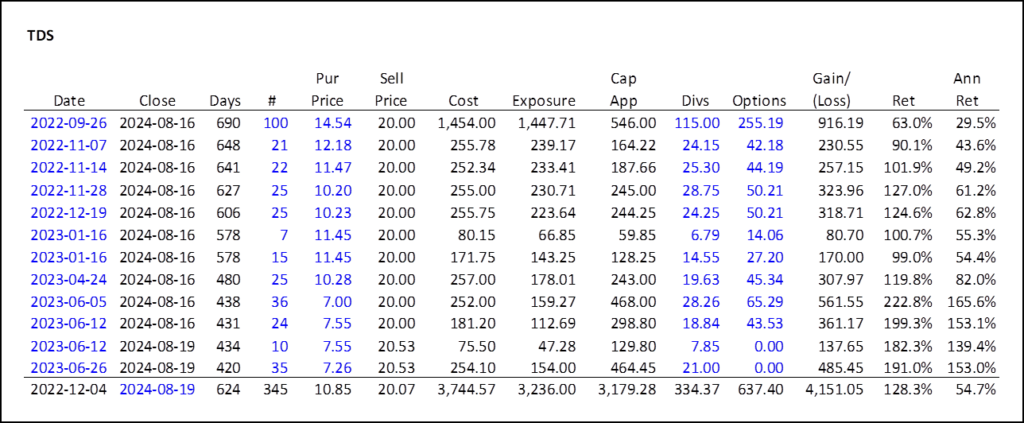

The position was open for a total of 693 days. A total of $3,744.57 was put at risk, but not all of it for the entire period. The total gain of $4,151.05, which excludes the de minimus closing commission of $0.04, was made up of capital appreciation (77%), call option premium (15%), and dividends (8%).

The overall trade illuminates two lucrative aspects of investing that I will use frequently at Royal Dividends in the Portfolio for the Ages:

- Averaging down when it makes sense to do so, and

- Writing covered call options to augment the dividend yield.

The latter can only be done when one owns at least 100 shares of a stock and so not every position is eligible. However, for those that are, selling covered calls is a great way to increase income, provide some downside protection, and name a price at which you’re willing to let the shares go. TDS was a perfect example of these two investment strategies. Had I never averaged down or sold covered calls, the gain would have been 100 x (20.53 – 14.54) + 115.00 = 714.00 in 693 days or 49.1% (23.4% annualized). In fact, the position was opened with the intention of buying enough shares to sell a covered call from the start. Had that not been the case, there would only have been 69 shares purchased (the usual $1,000 entry into a new position) and a total gain of just 69 x (20.53 – 14.54) + 79.53 = 492.84, with the same return percentages.

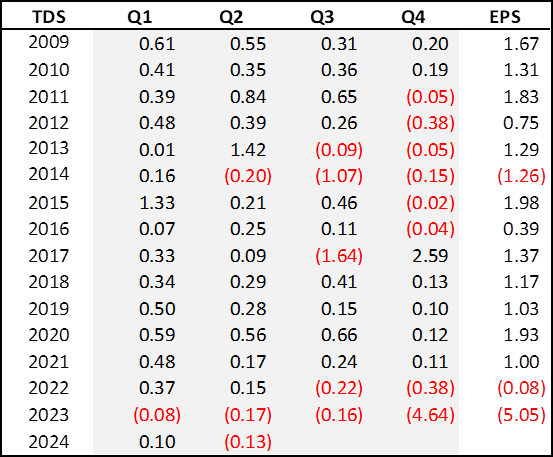

I would be remiss if I didn’t mention that TDS traded down to a low of $6.44 on 2023-06-02, a whopping 56% drawdown! There was anguish and rage in those days. In the end, Royal Dividends overcame the adversity on the floor and made significant money. And bear in mind, TDS themselves, only lost money over this time period. Seven of the last eight quarters have been a struggle to say the least.

There have been points in time over the last 3 months when this position had a slightly higher total return, and I had really hoped that the bulk of this position would get called away at the $25 strike that was once in place. Unfortunately, the broader market had a significant correction, and TDS showed a surprising amount of weakness.

I do think it is possible that TDS could approach $30 as their $4.4 billion sale of USCellular [USM] assets to T-Mobile [TMUS] becomes more certain. However, after several months, it has failed to get to within 80% of what I consider to be the true value of its shares given the price tag of the agreement. That, and the recent weakness during the pullback, tells me the market has doubts about the finalization of the sale. Perhaps governmental approval of the sale is uncertain. I just don’t want to be in this position if the sale, which could still be over a year out, doesn’t materialize.

‘The stone which the builders refused is become the head stone of the corner.’ – Psalm 118:22

TDS was a stock rejected by the market, but it has been the most important part of the foundation on which the Portfolio for the Ages has grown. The massive gain in this position has been remarkable and hopefully these gains will live on through Verizon Communications [VZ].

Royal Dividends will keep sifting through the stones the market has cast aside.