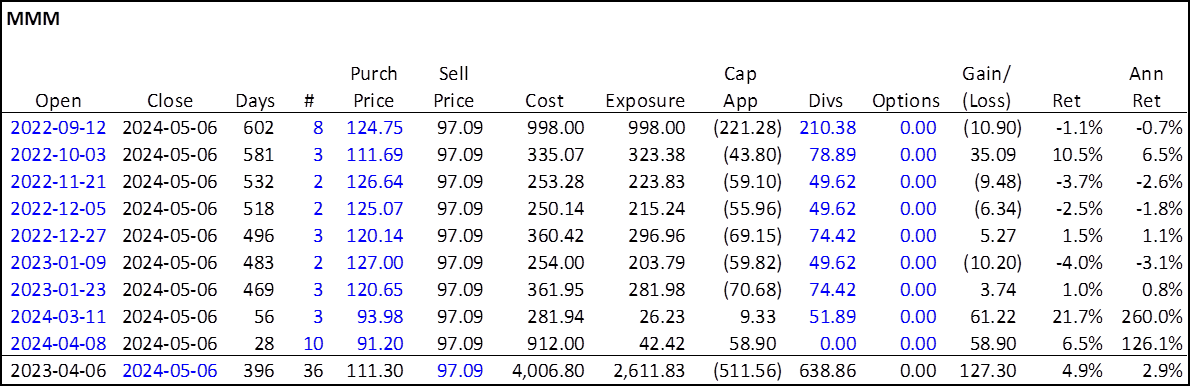

Royal Dividends has closed out its position in MMM. How did it go?

The position was open for a total of 602 days. A total of $4,006.80 was put at risk, but not all of it for the entire period. Dividends (including the large spin-off of SOLV) were enough to overcome the capital depreciation by a slight margin for a small $127.30 gain (ignoring the de minimis commission of $0.03 incurred upon selling).

I really wish MMM had not stated they will be reducing its dividend. It feels like unfinished business to let this one go just after it turned positive, but even I am not above the policy. However, even this small gain is illustrative of the return potential from averaging down when it makes sense to do so. Taking both the dividend paid and SOLV spin-off into account, MMM dropped about 4% over the 602 days. And yet, Royal Dividends still came out ahead.