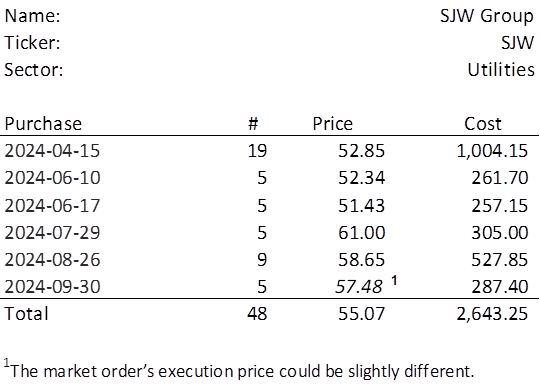

Dividend King of the Week [SJW][9]

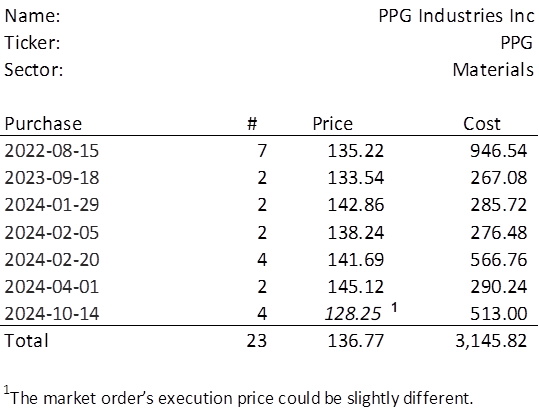

This week, four of the portfolio holdings ranked in the Top Ten: FMCB, PPG, QCOM, and SJW.

| Ticker | Account Value |

| FMCB | 3,270.00 |

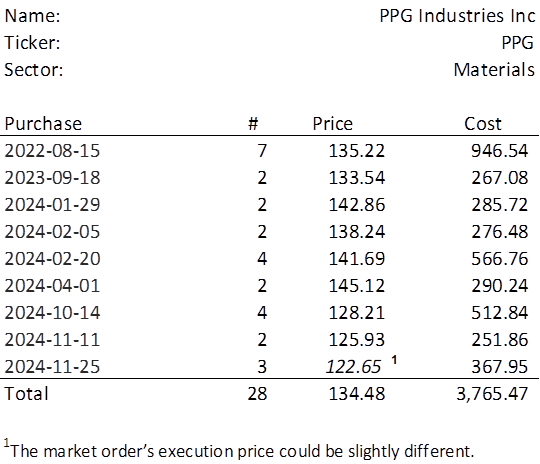

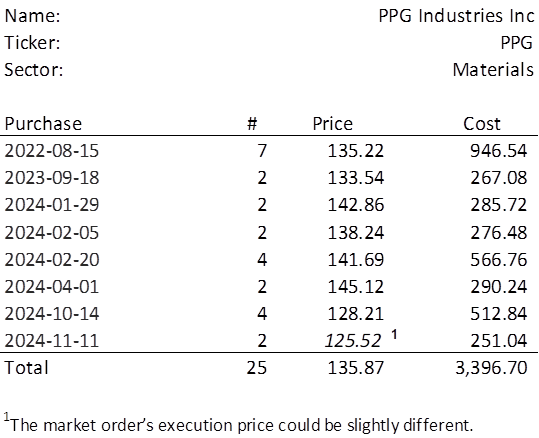

| PPG | 3,482.36 |

| QCOM | 3,646.19 |

| SJW | 3,231.76 |

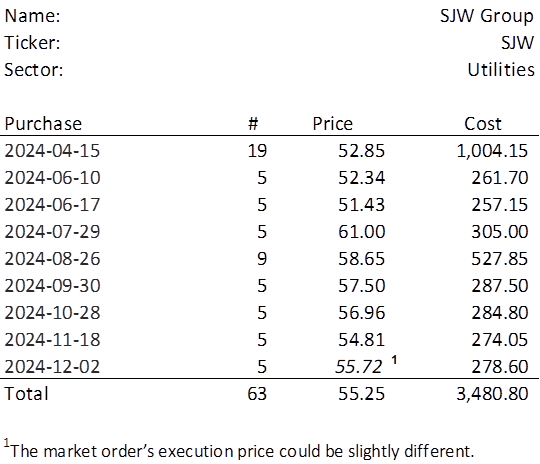

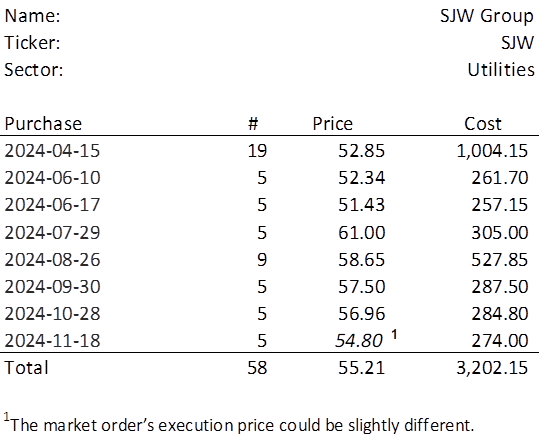

The lowest amount belongs to SJW which last traded at $55.72. Therefore, I will acquire 5 shares of SJW on Monday. Please see the post on 2024-11-16 for a high-level look at SJW’s performance over the last 16 years. Below, is the purchase history and average cost calculation.