Dividend Stock of the Week [UHT]

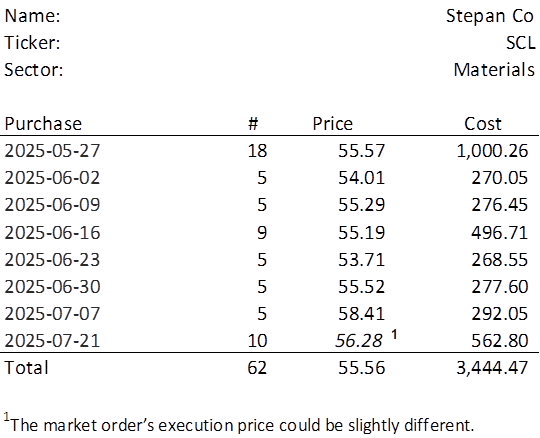

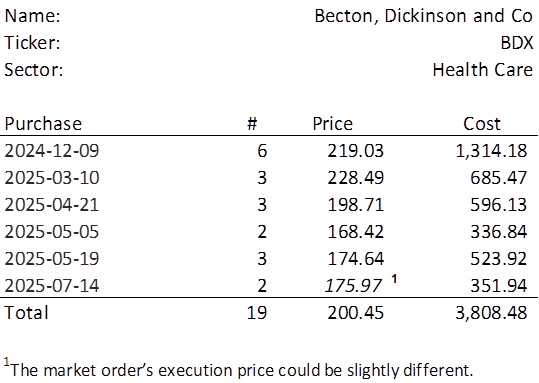

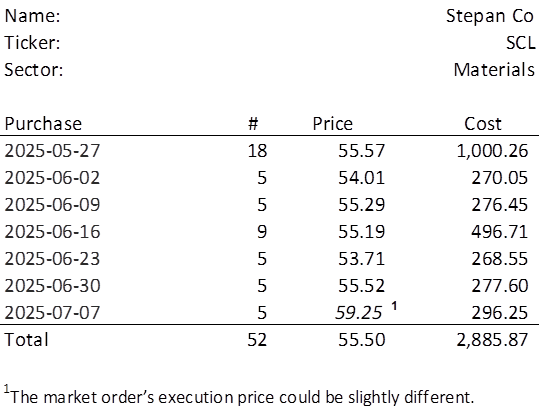

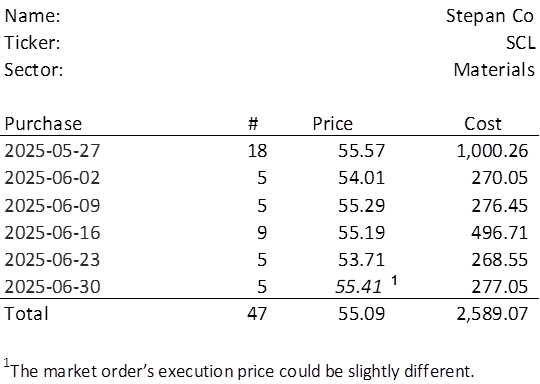

This week, six of the portfolio holdings ranked in the Top 10: BDX, FMCB, HTO, PPG, QCOM, and SCL.

| Ticker | Account Value |

| BDX | 3,521.08 |

| FMCB | 4,060.00 |

| HTO | 3,062.43 |

| PPG | 3,246.60 |

| QCOM | 3,643.20 |

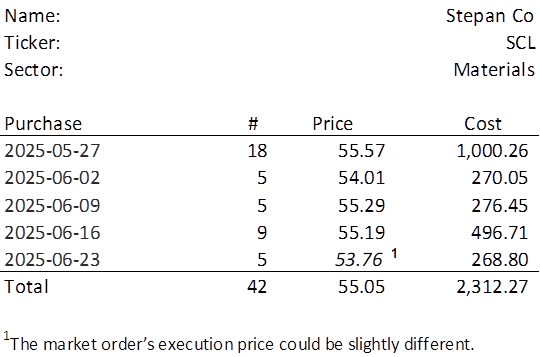

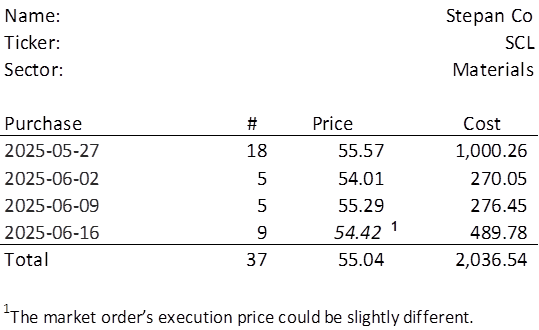

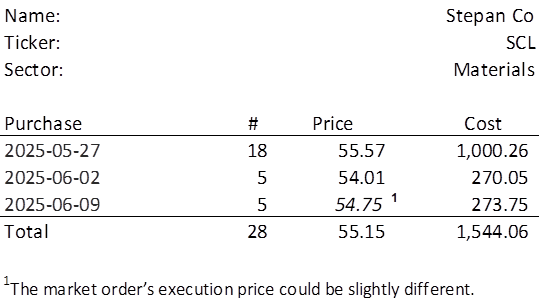

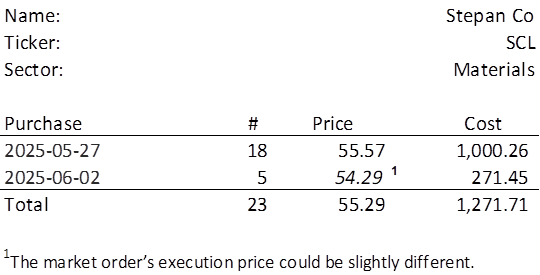

| SCL | 3,537.10 |

The lowest amount belongs to HTO. However, there exists a position and sector imbalance such that only FRT (position perspective) and Real Estate (sector perspective) are eligible for additional investment. Unfortunately, FRT nor any other Real Estate stock made the Top Ten. Upon relaxing the expected total return requirement from greater than 10% to greater than 9.3%, the first Real Estate stock makes an appearance at #24 in the expanded ranking. And it isn’t either of our current holdings, FRT or NNN.

It is time to add a new position to the Portfolio for the Ages!

…