Selling Shares of Versant Media Group [VSNT]

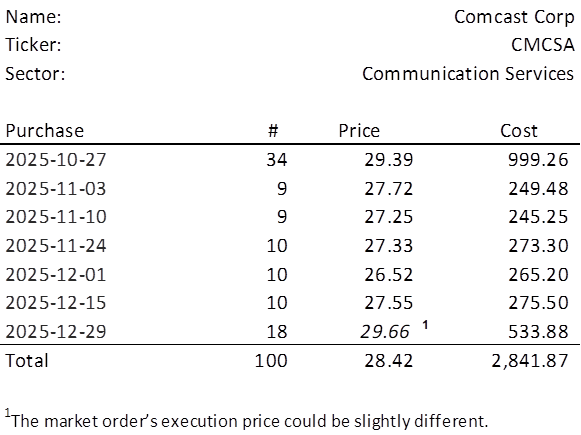

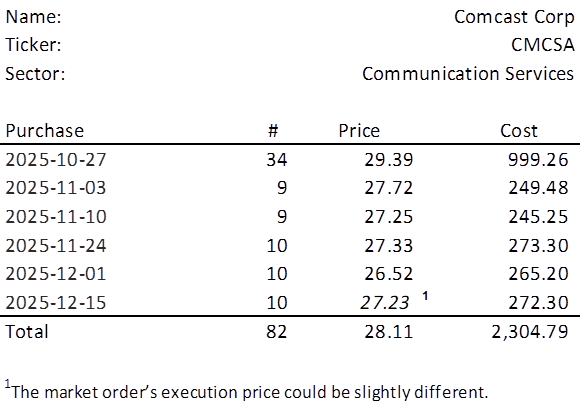

For every 25 shares of CMCSA held at the close of business on 2025-12-15, shareholders received 1 share of VSNT plus cash in lieu of any fractional shares after market close on 2026-01-02. The Royal Dividends portfolio received 4 shares and no cash1. Using a market order set up before market open, my shares sold for $45.17 per share. The $180.68 in proceeds will be treated as dividend income received from CMCSA for performance purposes.

…